The British pound has become one of the main beneficiaries of the Christmas and New Year rally on American stock markets. Paired with expectations of an increase in the REPO rate in February, inflated speculative sterling shorts, and the worst day of the US dollar in 6 weeks after the release of disappointing US employment statistics for December, this allowed the GBPUSD bulls to return the pair's quotes to the area of 2-month highs.

Employment growth outside the US agricultural sector by 199 thousand with a forecast of +422 thousand, it would seem, put an end to the Fed's desire to raise rates in March. This circumstance theoretically should have drowned the American dollar. It quickly surfaced concerning the euro, yen, and other currencies whose central issuing banks are not set up for monetary restriction.

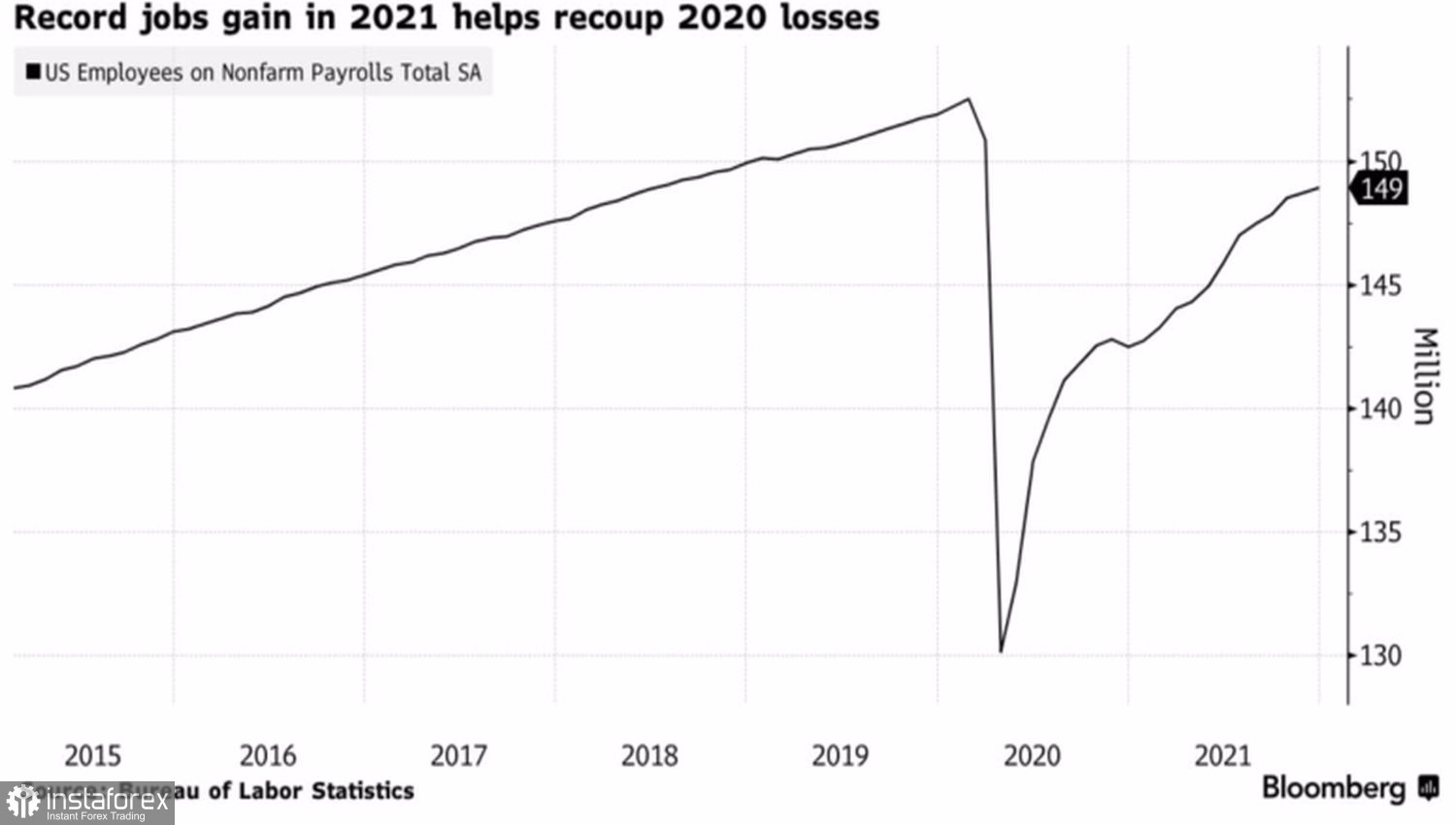

Despite the modest December figures, employment in 2021 grew at a record pace. The indicator has added 6.4 million people, and although the country still lacks 3.6 million to the pre-pandemic level, few doubt that the States will return to it in 2022. In addition, according to the results of the last month of the year, unemployment fell from 4.2% to 3.9%, and the average salary jumped by 4.7%, which is a strong argument in favor of further acceleration of inflation.

Dynamics of American employment

In January, statistics on non-farm payrolls may be even worse due to the spread of a new strain of COVID-19, but Omicron is a temporary phenomenon. As if since February, employment has not started to grow again at a rate exceeding 500 thousand. This is understood not only by FOMC officials, but also by the futures market, which estimates the chances of raising the federal funds rate in February at 90%, and gives a 90% probability of another increase in borrowing costs by 25 bps in June. Goldman Sachs believes that the Fed will tighten monetary policy at 4 meetings in 2022.

Such a schedule creates prerequisites for an early return of investors to the US dollar after its sell-off, due to data on the US labor market for December. Moreover, Jerome Powell's speech to Congress may turn out to be "hawkish", and the release of data on consumer prices will show a rise in inflation above 7% for the first time since 1982.

Against the very background, the stability of the pound freezes praise. GBPUSD bulls were supported at the turn of 2021-2022 by an increase in global risk appetite, a decrease in fears about Omicron and hopes that the Bank of England will raise the repo rate before the Federal Reserve. In February. In such conditions, the slowdown in business activity in the service sector to a 10-year low did not frighten sterling fans. Britain's GDP, for sure, will continue to show ragged dynamics, accelerating in November by 0.5% and shrinking in December by 0.8%. This opinion is expressed by Capital Economics.

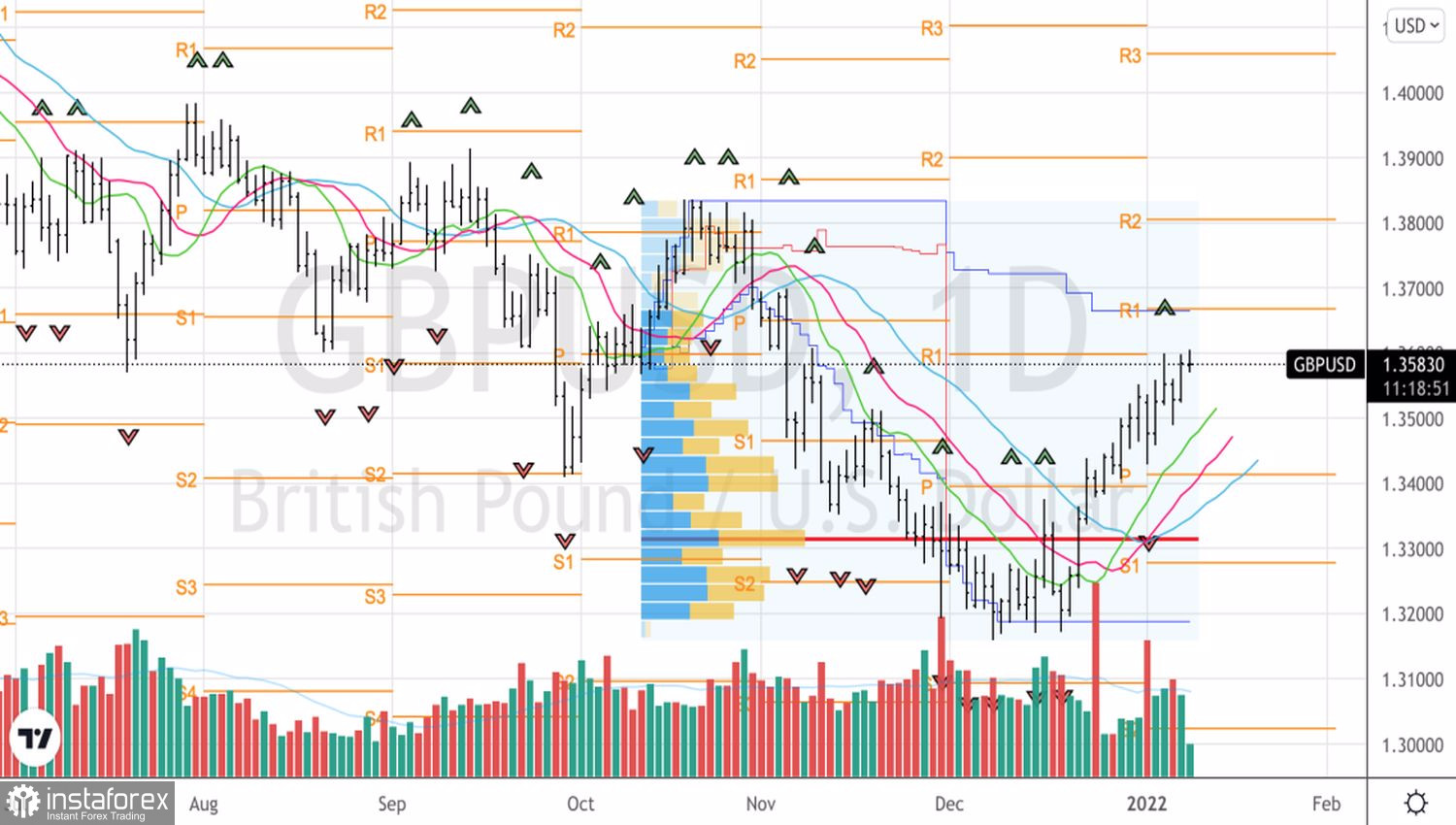

Technically, the presence of GBPUSD quotes above the fair value and above the moving averages indicates the stability of the upward trend. The strategy of buying the pair on a decline followed by a rebound from support at 1.3465 gave its result. A confident breakout of resistance at 1.36 or pullbacks to the EMA will allow you to increase the longs.

GBPUSD, the daily chart