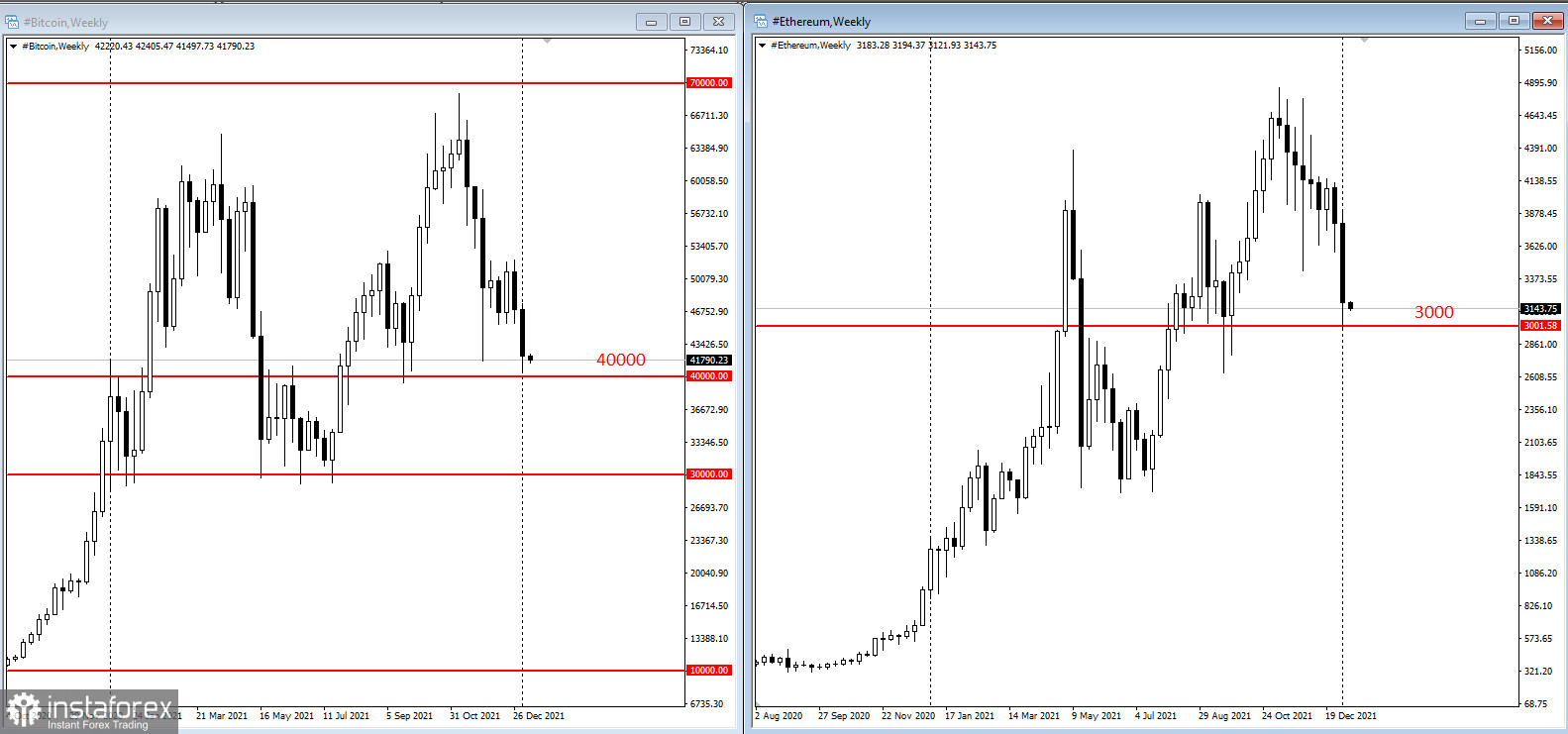

Bitcoin continued its decline as the most speculative assets continue to suffer the most and some of them disappear from global markets. The leading digital asset approached $40,000 for the first time since late September. It lost about 42% from its high reached just three months ago. At the same time, Ethereum also dropped.

The volatility happens due to the Federal Reserve preparing to curb spiking inflation by reducing its stimulus program. Minutes of the December meeting, released on Wednesday, noted earlier and faster-than-expected rate hikes, as well as potential balance sheet depletion. These actions may deprive the system of liquidity, which could make traders refrain from fast-growing and speculative assets.

"If the Fed is going to be more aggressive, risk assets, including cryptos, are more vulnerable," Matt Maley, chief market strategist for Miller Tabak + Co said.

Bloomberg Intelligence's Mike McGlone said $40,000 is an important technical support level for the digital token. Cryptocurrencies are a good indicator of the current decline in risk appetite, but the expert predicts that bitcoin will eventually come out ahead as the world becomes increasingly digital and the coin becomes benchmark collateral.

The Covid-19 pandemic helped Bitcoin become even more popular as institutions and retail investors became involved in the cryptocurrency market and its projects. Nowadays, the Fed has become more hawkish, and riskier assets such as stocks and digital assets suffer the most.

"It is heart-pounding, nerve-racking for any investor that's looking at it, especially if they come from a traditional equity market," Eric Ervin, chief executive officer at Blockforce Capital, said.

Indeed, Bitcoin and other cryptocurrencies are infamous for their volatility and have been known to post huge up or downswings, sometimes in a matter of minutes.

Weekend trading was able to increase volatility, and this was due to several factors, thinner trading volumes and a market structure that consists of hundreds of disconnected exchanges that in effect are their islands of liquidity. In early December, Bitcoin reported an abrupt crash over the weekend, when it lost 21% at its worst.

Bitwise CIO Matt Hougan said it makes sense to see prices fall as the Fed begins to be more aggressive with its withdrawal of stimulus. The recession could last a bit because there are no obvious short-term catalysts to help turn things around. "The fundamentals of crypto are stronger than ever, even as prices falter. In the long run, the fundamentals will win," he added.