Yesterday's volatility in the stock market once again proves the tense state traders are in, worrying about the more active actions of the Federal Reserve System regarding the future monetary policy. Today, stock index futures were almost unchanged at the beginning of trading. The Dow Jones Industrial Average gained 74 points or 0.2%, and the S&P 500 rose 0.4%. Nasdaq 100 futures jumped 0.6%.

As for bond yields, they are also quite mixed: short-term Treasury bonds have risen, but yields on longer securities have slightly decreased. Benchmark 10-year Treasury bonds fell to 1.76% after rising 1.8%.

As for yesterday's close, the Nasdaq closed in positive territory on Monday after a sell-off in the previous week caused by rising bond yields and concerns about the upcoming actions of the Federal Reserve System. The index closed at +0.05%, losing 2.7% at the moment. Meanwhile, the Dow Jones index, after falling by more than 500 points, eventually closed at -162 points, or 0.4%, while the S&P 500 dropped 0.1%.

Yesterday, many experts noted the need to buy cheaper technology sectors and shares of these companies. The emphasis was placed on the fact that investors will be able to cope with both the higher yield of the bond market and the new strain of the omicron coronavirus. It is noted that the reduction of long positions in risky assets in response to the protocol of the Federal Reserve System is exaggerated, which is confirmed by yesterday's market fluctuations. Many economists continue to expect that the tightening of policy by the central bank is likely to be gradual, which will help buyers of risky assets to cope with problems, especially since everything is happening in conditions of a strong cyclical economic recovery.

However, some believe that this year the stock market is likely to face a correction – the Fed's actions last week could be its beginning. A lot now depends on how the reporting season for the 4th quarter of this year will go and what indicators the companies will provide. The reporting season will be in full swing by the end of this week.

This is a very important week for economic data, and we are now talking about the US inflation report, which is expected tomorrow. Its performance will have a serious impact on stock indexes. In the meantime, today we need to pay attention to the confirmation hearings of the head of the Federal Reserve System Jerome Powell. Kansas City Fed President Esther George will also deliver a speech on economic policy, as will St. Louis Fed President James Bullard.

Clarida everything

Today, it also became known that the vice-chairman of the Federal Reserve Richard Clarida will resign two weeks before the expiration of his term of office after new revelations about his stock trading. Clarida, 64, will leave the Fed's Board of Governors on January 14, before his term as governor expires on January 31.

As for the premarket, the Illumina papers showed pretty good growth. The growth was already more than 4% after the genome sequencing company published forecasts for 2022, which turned out to be much higher than consensus.

Shares of energy companies also rose due to the rise in the price of oil. Marathon Oil securities rose 1.5%, and Juniper Networks shares rose 2.7%.

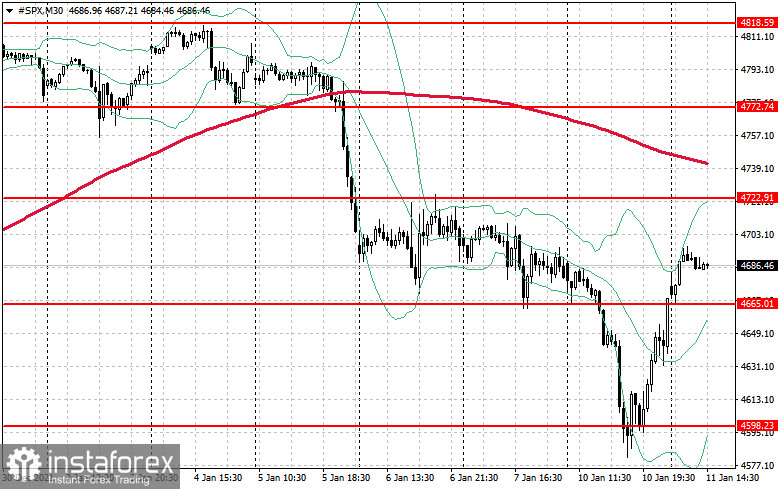

As for the technical picture of the S&P 500

Yesterday, the bulls defended the levels and now they need to focus on protecting the support of $ 4,665. If you move below this level again, buyers will have really serious problems. A break in this range will dump the trading instrument in the area of $ 4,598 and $ 4,551. Buyers need to win back the fall of last week, and given that inflation data in the US are waiting for us very soon, it will be quite problematic to do this. Only a break of $ 4,722 will return the trading instrument to a larger resistance of $ 4,772.