The main news from the world of cryptocurrencies:

The NEAR Protocol team has introduced a new staking mechanism that allows validators to pay delegates a reward in several different tokens.

The initiative was launched jointly with the developers of the Aurora second-level solution. NEAR Protocol believes that the new farming model will allow validators to attract more capital and delegates, and ecosystem projects to participate in ensuring network security. This, in turn, will increase the decentralization of the blockchain.

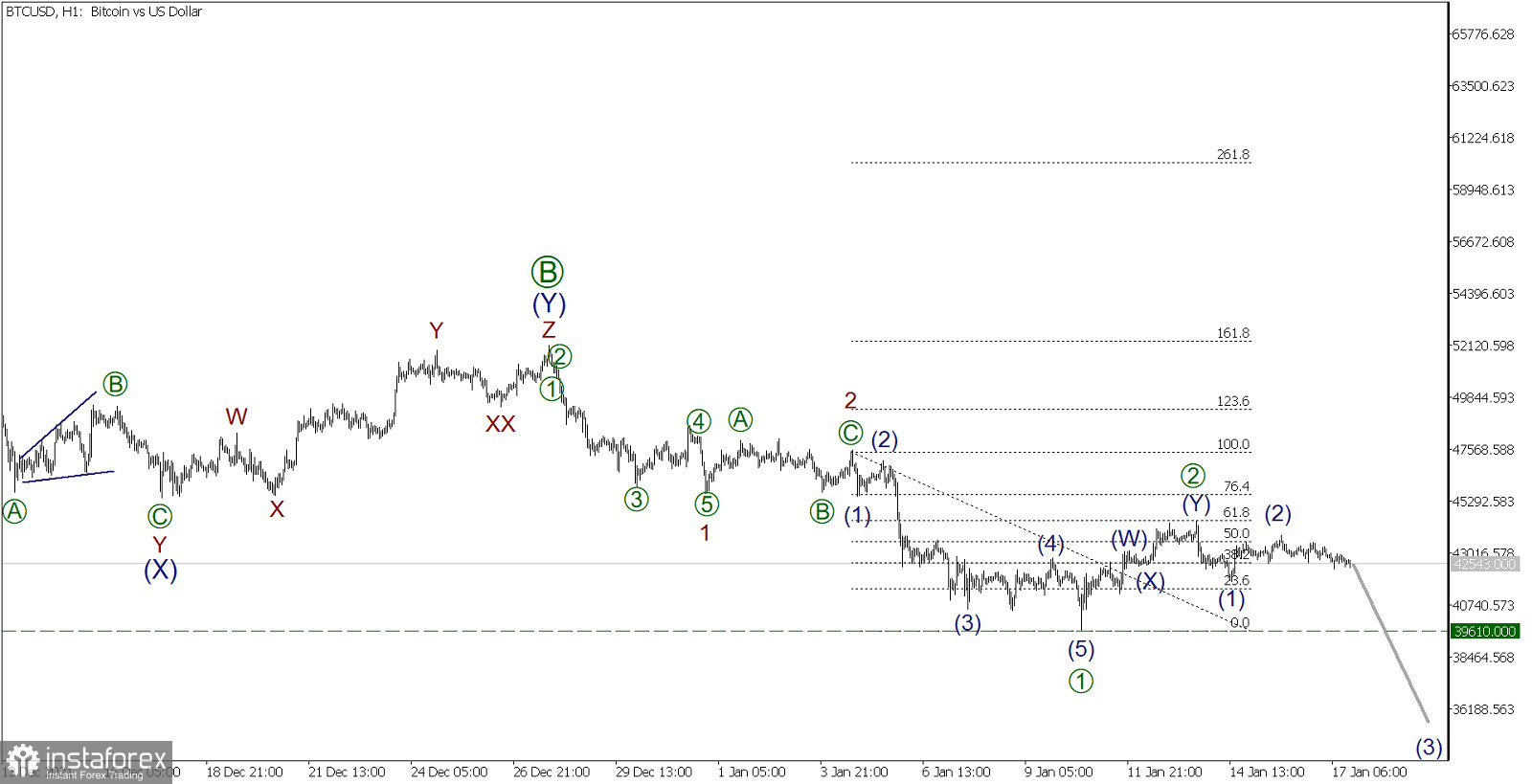

We continue to consider Bitcoin from the point of view of Elliott theory on an hourly timeframe.

BTCUSD H1:

Judging by the downward impulse movement of the market, it can be assumed that the BTCUSD cryptocurrency pair is developing the initial part of a bearish wave, which is likely to take the form of a simple 5-wave pulse.

To date, subwaves 1 and 2, momentum and correction have been fully completed. Now we see the formation of the initial part of the third wave.

It is likely that at the level of 39610.00, the first sub-wave was completed, which took the form of an impulse (1)-(2)-(3)-(4)-(5). Most likely, the correction wave has also come to an end, taking the form of a double zigzag (W)-(X)-(Y). At the moment, it is 61.8% of the Fibonacci polyline of the momentum, and this is a frequently encountered coefficient.

Thus, in the coming trading days, we can expect a drop in Bitcoin and the construction of a new impulse wave consisting of sub-waves (1)-(2)-(3)-(4)-(5), the price in which will fall significantly below the previous low of 39610.00, marked by the wave.

In the current situation, it is possible to consider opening sales transactions to take profit at the specified level.