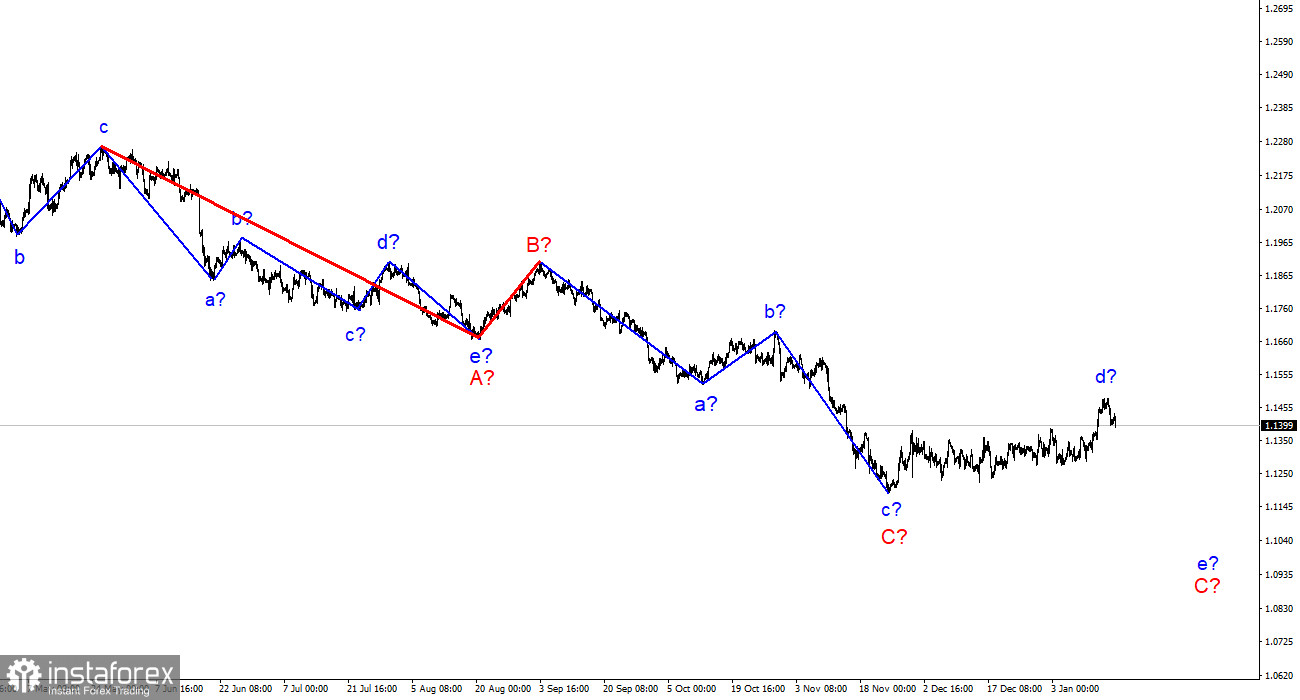

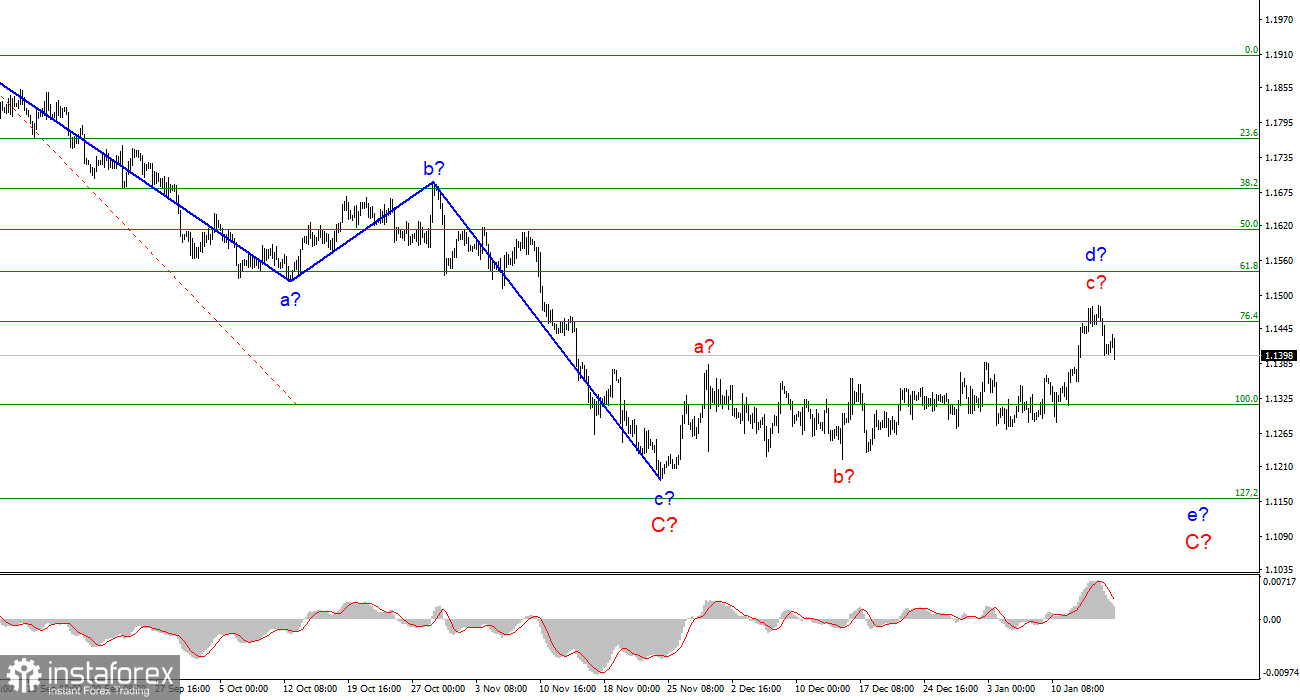

The wave marking of the 4-hour chart for the euro/dollar instrument still does not change. Over the past few working days, the quotes of the instrument have been rising and have broken through the previous peak of the expected wave d. Thus, wave d turned out to be more extended than I originally expected. However, this change does not change the essence of the wave markup. I still believe that the current wave is corrective, not impulsive, as evidenced by its complex internal wave structure. Therefore, it cannot be wave 1 of a new upward trend segment. If so, the decline in quotes will resume within the framework of the expected wave e-C and Friday's departure of quotes from the reached highs may indirectly indicate the beginning of the construction of a new downward wave. At the same time, a further increase in the quotes of the European currency may lead to the need to make adjustments to the current wave markup, since wave d will turn out in this case to be the longest wave in the composition of the downward trend section. An unsuccessful attempt to break through the 1.1455 mark also indicates that the market is not ready for further purchases of the instrument.

American inflation continues to accelerate.

The euro/dollar instrument rolled up slightly on Monday, after which it fell by 45 basis points. Now I can say that the internal wave structure of the supposed wave c-d looks very convincing, despite its complexity. Thus, even without taking into account the news background, I believe that the decline of the instrument will continue. In the first three days of the new week, the news background, by the way, will be absent. There are no important events planned for these days in the Eurozone and the USA. The market will be left to its own devices and will make decisions based on its reflections and wave markup. It should also be recognized that on Friday the market reaction to economic reports from America was ambiguous. American statistics turned out to be weak, but at the same time, the demand for the dollar was growing. In such conditions, I believe that the wave marking remains in the first place in importance. Only the next important events, such as meetings of the ECB or the Fed, can change the mood of the market. However, there is still a lot of time before these events. Nevertheless, the news background may still support the demand for the dollar now. Last week, Jerome Powell, Patrick Harker, James Bullard, Raphael Bostic, Mary Daly, and other FOMC members made hawkish comments. From my point of view, such a serious focus on several increases in the key rate in 2022 may continue to increase demand for the US currency. After all, in the European Union, Christine Lagarde said that she does not expect a rate increase in the coming year. This means that the gap between the Fed and ECB rates may seriously increase over this and next year. At the moment, the deposit rate in the European Union is negative, and the loan rate is zero. By the end of the year, the Fed may increase its rate to 1.00-1.25%. And this is a huge difference.

General conclusions.

Based on the analysis, I conclude that the construction of the ascending wave d can be completed. If this assumption is correct, then now it is possible to sell the instrument based on the construction of the wave e-C with targets located near the calculated marks of 1.1315 and 1.1154, which equates to 100.0% and 127.2% by Fibonacci. A successful attempt to break through the 1.1455 mark will indicate an even greater complication of the upward wave and cancel the sales option.