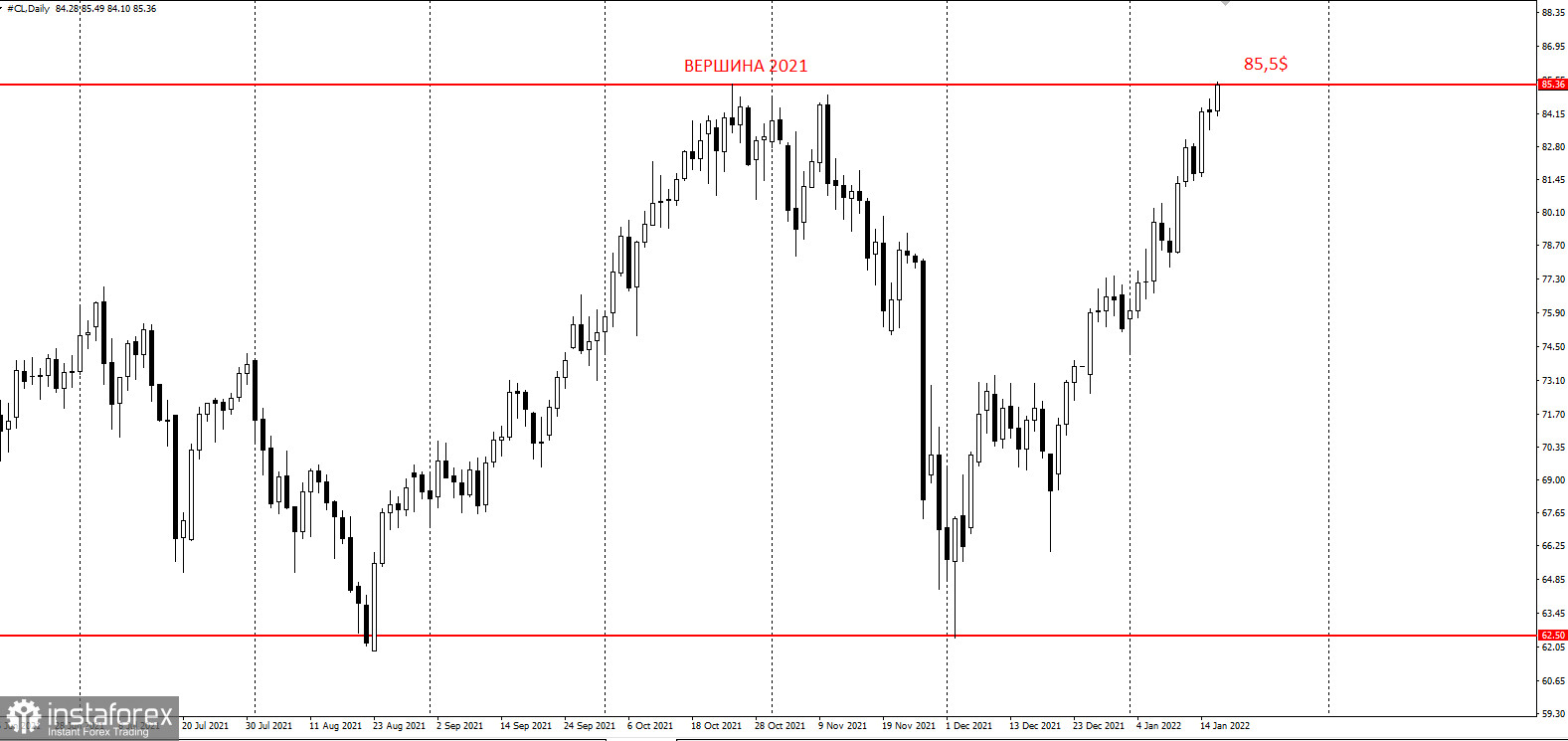

Today, WTI crude oil reached $85.5 during the Asian session, topping last year's high.

Crude oil prices have gained 10% since the beginning of the year and could rise even higher, Mike Muller, head of Asia for Vitol Group said.

In an interview with Bloomberg, Muller stated that these prices were justified. Although natural gas prices have climbed enough to cause some industrial users to cut back on consumption, the oil market hadn't reached that point, he added.

The situation with gas prices "serves to remind us that people will abstain from buying expensive energy at some point," Muller said. "The question is at what point that affects the oil market."

Crude oil prices have posted a fourth-straight gain last week - the longest rising streak since October. Demand for oil continues to recover as concerns over Omicron ease.

China's decision to release oil from its strategic reserves did not prevent the rally. Last week Brent crude reached its 2-month high.

"People looking at the big picture realize that global supply versus demand situation is very tight and that's giving the market a solid boost," said Phil Flynn, senior analyst at Price Futures Group.

According to Vitol's Mike Muller, the White House could probably release more oil from its Strategic Petroleum Reserve than the 50 million barrels it announced in November.

There is increased appetite for future oil supply in the run-up to spring and summer, which is otherwise known as the driving season in the Northern Hemisphere. There is also an element of anticipation of even tighter supply.

In the meantime, Libya's crude oil production has rebounded to 1.2 million barrels daily, according to the country's oil minister, Mohammed Oun.

Libya's crude oil output was back to normal after a series of outages and its biggest field in the country, El Sharara, was producing at near maximum capacity of 300,000 barrels per day, Oun told Bloomberg.

In early January, Libya's National Oil Corporation shut down a key pipeline for repairs. The shutdown led to a 200,000-bpd decline in production.