The US dollar still managed to slightly strengthen its position despite the fact that it was a holiday in the United States yesterday. However, the scale of growth was largely purely symbolic. And if it weren't for the absence of American traders, then the US dollar's growth could have been much more evident. Last week, the US currency weakened considerably, and almost all of this decline was contrary to the published statistics. That is, it was completely unreasonable, and the correction is something extremely necessary and logical. Apparently, the scale of the US dollar's growth today will continue to be insignificant, although it may be a little more than yesterday. Today's macroeconomic calendar is completely empty despite a full-time working day in the US.

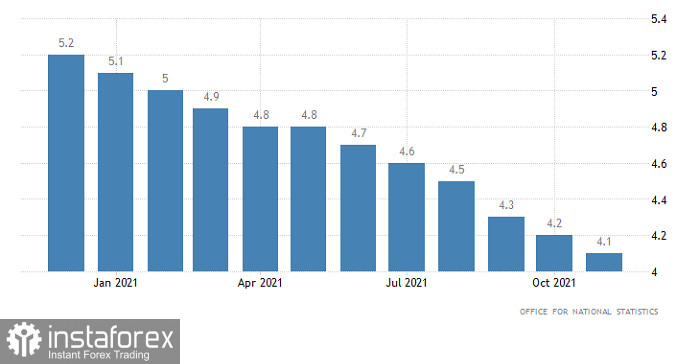

At the same time, the pound initially had much more reasons to weaken today. The forecasts for the UK labor market should have remained as it is. No matter what one may say, the unemployment rate should have remained the same. However, it dropped from 4.2% to 4.1%. This did not lead to the noticeable growth of the pound. Meanwhile, wages' growth rate has slowed from 4.3% to 3.8%, while employment increased by only 60 thousand with a forecast of 115 thousand.

Nevertheless, the main thing here is the dynamics of average wages. Taking into account inflation, we are talking about a decrease in real incomes. So it's not surprising that retail sales reports are only disappointing. However, the data themselves were largely ignored, which indicates that market activity will begin only with the opening of the US trading session.

Unemployment rate (UK):

The EUR/USD pair entered the stage of a technical correction after a sharp growth, which led to a reversal towards the previously broken level of 1.1400. Now, there is variable turbulence along the control level, trying to prolong the corrective move. Therefore, keeping the price below the level of 1.1380 is likely to lead to a move towards 1.1350. Otherwise, the stagnation within 1.1400 will remain.

The GBP/USD pair slowed down its inertial course around the level of 1.3750, where stagnation occurred followed by a pullback. The pound's overbought status is still felt in the market, so the current pullback is still relevant, at least to the level of 1.3600.