Well, it's time to consider another interesting and much-loved AUD/USD currency pair. A lot has already been written about the upcoming announcement of the results of the US Federal Reserve System (FRS) meeting starting today in previous today's articles, therefore, for this trading instrument, we will immediately proceed to consider the technical picture, and, using the recent opening of current trading, we will immediately start with the weekly timeframe.

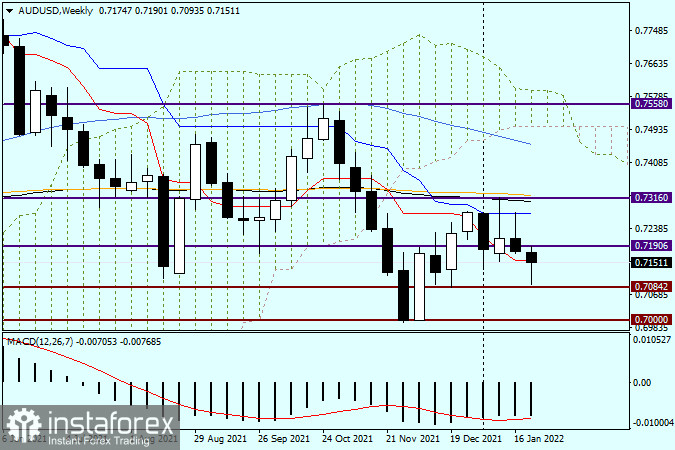

Weekly

Following the results of trading last week, the pair showed a downward trend. This is not surprising, since, at the auction on January 17-21, the US dollar strengthened across a wide range of the market. As you can see, the bulls' attempts to "Aussie" to take the course of trading under their control failed after the quotes met with the blue line of the Ichimoku indicator Kijun. In my personal opinion, the pair was not destined to break through the sellers' resistance at 0.7316, since 89 and 200 exponential moving averages were grouped near this level, which could provide serious resistance to growth attempts. The fact that the exchange rate has not reached the designated level once again indicates the current weakness of the bulls in AUD/USD. A vivid confirmation of this was the stop below 0.7316, as well as the fact that the further path in the north direction was blocked by the Kijun line, which runs below. The beginning of trading of the current five-day period was again left behind by the bears, but the long lower shadow of the weekly candle signals a fierce struggle between the warring parties.

A little before reaching the strong technical level of 0.7085, the players on the rate increase at the time of writing this article are very actively reducing the losses incurred earlier. However, a lot will be decided tomorrow evening, when the Fed will announce its decision on interest rates, after which Federal Reserve Chairman Jerome Powell will give a press conference. Few people have any doubts that the federal funds rate will remain in the range of 0.00-0.25%, but the tone of Powell's speech can become a real driver for the US currency and all pairs with the US dollar. The weekly chart shows that for a clear indication of bearish sentiment, a true breakdown of the key 0.7000 support level at this stage of time is necessary. Let me remind you that this round mark is considered an extremely important psychological, historical and technical level. But bulls on the instrument to control the course of trading on AUD/USD simply need to break through the 0.7316 mark, as well as 89 with 200 exponents, and with the mandatory closing of the week above.

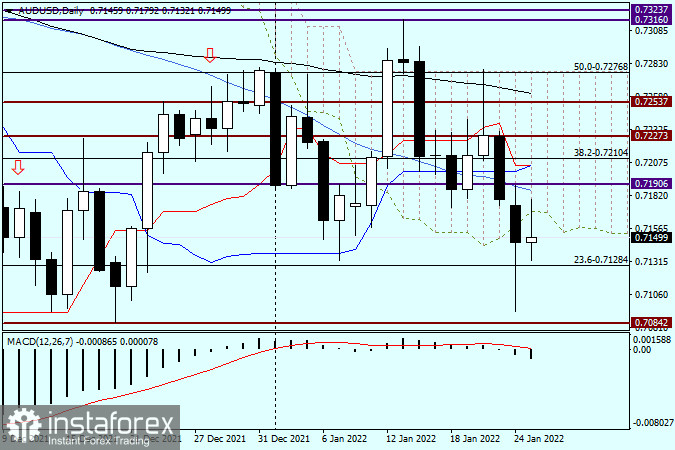

Daily

On the daily price chart, the pair fell from the Ichimoku indicator cloud yesterday, however, looking at the very long lower shadow of the candle, there is a high probability of the quote returning to the cloud limits. In fact, at the time of the completion of the article, such attempts have already taken place, but so far have been unsuccessful. Nevertheless, I would venture to assume that tomorrow's Powell rhetoric tomorrow may not suit market participants with its harsh tone, and the "American" may fall under a wave of sales. Nevertheless, the reverse scenario cannot be ruled out in any way. Since we take into account exclusively technical aspects in this article, I consider the most likely scenario to be a downward one. I recommend trying to sell AUD/USD after short-term rises to 0.7200, 0.7212, and possibly higher, towards the strong and important technical level of 0.7300.