In yesterday's materials, three main currency pairs were considered.

I think it would be unfair to ignore the fourth one, so today we will consider the USD/CHF trading instrument, where we will focus on the technical picture for this currency pair.

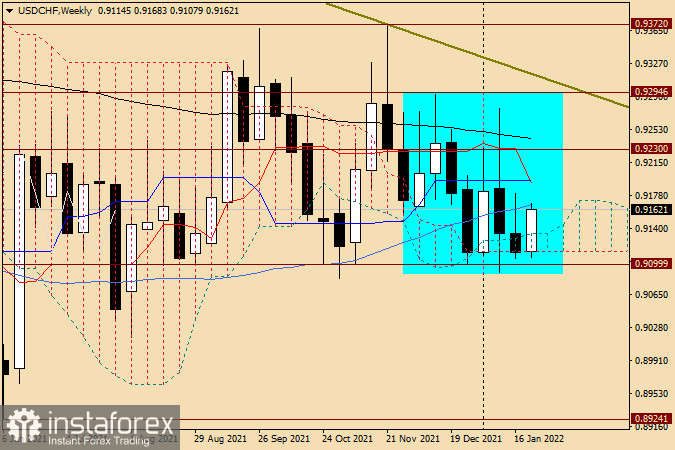

Weekly

So, following the results of trading on January 17-21, the Swiss franc, as well as the Japanese yen, strengthened its position against the US dollar. However, there is no need to talk about a complete clarification of the situation regarding further price movement at this stage of time. As you can see, the USD/CHF pair is stuck in a cluster of indicators. These are both borders of the Ichimoku 50 indicator, a simple moving average, under which two consecutive trading weeks have closed, as well as the red Tenkan line and the blue Kijun, which converged under the iconic technical level of 0.9200. Crowning this pyramid of indicators is the black 89 exponential moving average, which runs at 0.9242. Thus, the task of USD/CHF bulls looks much more difficult than their counterparts. To indicate their claims over the control of the pair, in addition to the listed indicators, it is necessary to break through another landmark technical mark of 0.9300, as well as the olive resistance line drawn at points 1.0022-0.9372. The primary task of the players to lower the rate is to bring the quote down from the Ichimoku indicator cloud, followed by a decline to the most important psychological, historical and technical level of 0.9000.

I believe that the prospects of this currency pair will depend on the bears' ability to truly breakthrough this round mark. Naturally, much will depend on the most important event of this trading week. Let me remind you that tomorrow evening the US Federal Reserve System (FRS) will announce its decision on the interest rate, but the main thing, in my personal opinion, will be the rhetoric of Fed Chairman Jerome Powell's speech at a traditional press conference. If Powell adds or at least retains the earlier "hawkish" notes, buyers of the US currency will not have much reason to worry. If there is at least some softer rhetoric, the "American" risks falling under a wave of sales across the entire spectrum of the market, including about the Swiss franc. So, judging by the weekly timeframe, sales look technically reasonable after the rise of USD/CHF in the price zone 0.9165-0.9200. There are fewer reasons to open purchases, but we will try to find them in a smaller time interval.

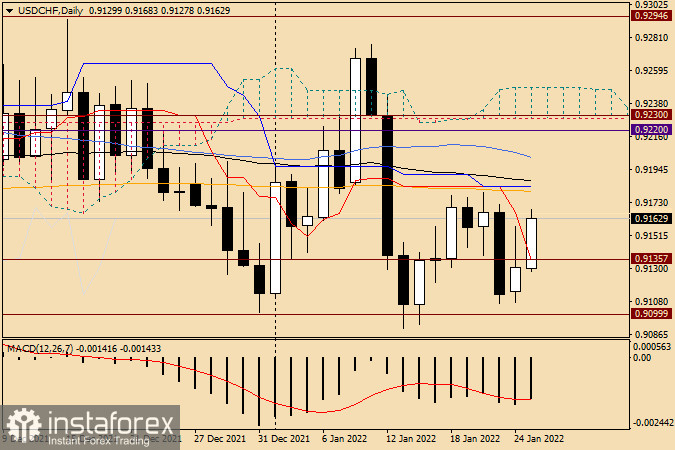

Daily

Everything is very difficult for USD/CHF bulls. Quite strong indicators hung over the pair: Tenkan, 200 EMA, Kijun, 89 EMA, and 50 simple moving average. There will be nothing unusual if the listed movings or Tenkan with Kijun will provide very strong resistance to the pair and will not let it go up. At least, even in this timeframe, the technical picture is more inclined to search for sales after rising to the same price area of 0.9265-0.9200. Once again, I would like to draw your attention to the fact that this forecast does not provide for the reaction of market participants to tomorrow's decisions and comments of the Fed representatives.