To open long positions on GBP/USD, you need:

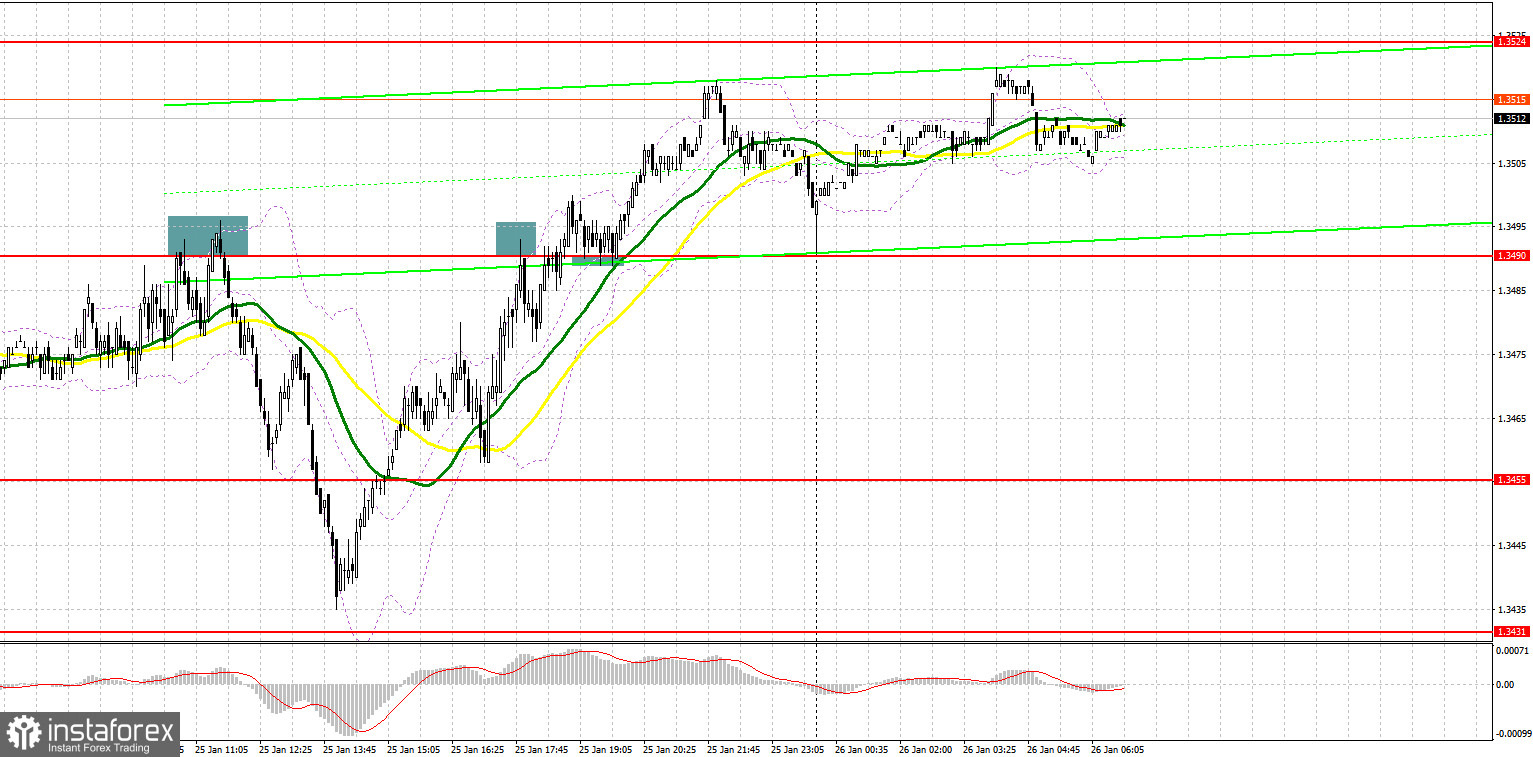

Yesterday, several good signals were formed to enter the market. Let's take a look at the 5-minute chart and figure out the entry points. In my morning forecast, I paid attention to the 1.3490 level and recommended making decisions from it. The bulls failed to offer anything above the 1.3490 level and several unsuccessful attempts to consolidate above this range led to forming excellent sell signals. As a result, the drop was more than 50 points. In the afternoon, after the GBP/USD returned to the level of 1.3490, the bears again tried to protect it, forming a false breakout there. However, the pair did not significantly fall. After settling above 1.3490 and a top-down test, a buy signal was formed, as a result of which the pound rose by 30 points.

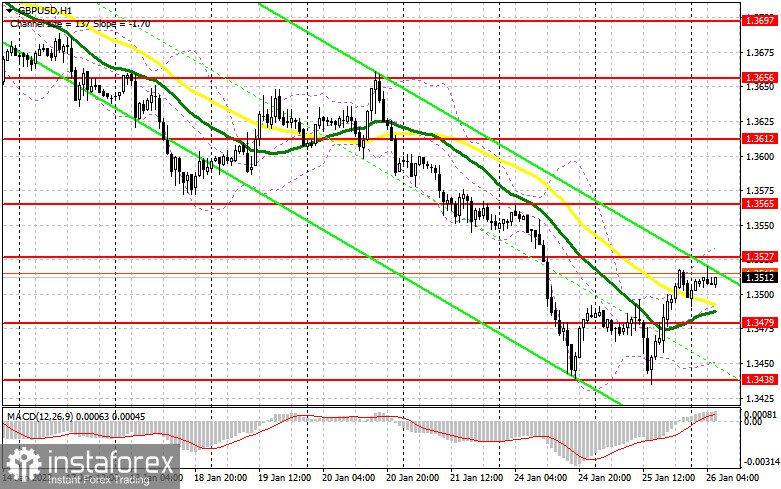

The market situation has changed in favor of the bulls and it seems that they are ready to build a larger upward correction after a prolonged downward trend observed since January 12. The only "but" is today's Federal Reserve meeting. Given that there are no fundamental statistics anymore, most likely the entire focus will shift to the Fed's monetary policy decisions. Therefore, it is worth assuming that volatility in the first half of the day will be at a fairly low level. An important task for today is to protect the support of 1.3479, on which the moving averages are located, playing on the bulls' side. Having missed this area again, you can say goodbye to the pound's growth in the short term. A false breakout at 1.3479 creates the first buy signal with the prospect of recovery to the area of 1.3527, on which the bulls will clearly place a certain emphasis today. Only a breakthrough and a test of this level from top to bottom will provide another entry point into long positions while aiming to return to the 1.3565 high. A more difficult task will be the test of the 1.3612 area, where I recommend taking profits. A sharp jump to this level can occur only after the publication of the results of the Fed meeting.

In case GBP/USD falls during the European session and there is a lack of activity at 1.3479, and judging by how the markets are afraid of the US central bank's decisions on monetary policy, it is better not to rush with purchases of risky assets. I advise you to wait for the test of the next major level of 1.3438 and only the formation of a false breakout there will provide an entry point to long positions. You can buy the pound immediately on a rebound from 1.3409, or even lower - from the 1.3389 low, counting on a correction of 20-25 points within the day.

To open short positions on GBP/USD, you need:

Yesterday, the bears did everything possible to maintain the downtrend, but large purchases in the area of 1.3438 turned everything upside down. The primary task for today is to protect the 1.3527 level, above which it is impossible to release the pair in any way. There is a fairly large number of stop orders, the triggering of which will lead to an instant jump of the pound to the upside. Forming a false breakout at 1.3527 creates the first entry point into short positions, followed by a decline to the area of 1.3479, for which you will have to fight very hard. Only a more aggressive policy from the Fed can help with the breakdown of this key area. The 1.3479 test from the bottom up will give an additional entry point into short positions in the expectation of a further decline in GBP/USD by 1.3438 and 1.3409, where I recommend taking profits. If the pair grows during the European session and bears are weak at 1.3527, it is best to postpone short positions until the next major resistance at 1.3565. I also advise you to open short positions there only in case of a false breakout. You can sell GBP/USD immediately for a rebound from 1.3612, or even higher - from this month's high in the area of 1.3656, counting on the pair's rebound down by 20-25 points within the day.

I recommend for review:

According to the Commitment of Traders (COT) report from January 18, traders increased long positions and cut on short positions. It means that the sterling retains the speculative interest after the Bank of England raised the key policy rate at the end of the last year. Currently, traders have high expectations that the regulator could increase interest rates again by 0.25% at the nearest policy meeting. Such expectations are bullish for the pound sterling.

At the same time, the fundamental picture contains some factors that cap the pound's upside potential. First, soaring inflation that has been raging for almost half a year negates strong employment in the UK. Despite high wages and a decline in the jobless rate, rampant inflation erases households' incomes. Besides, elevates energy prices and costly services make a dent in the people's well-being so that living standards are currently below the ones during the COVID pandemic. By and large, the outlook for the pound is bright. Moreover, the ongoing downward correction makes it more attractive. The Bank of England's intention to continue rate hikes this year will push the pound to new highs.

This week, traders are anticipating the crucial event: the FOMC policy meeting. The policymakers are widely expected to clear up the timeline for monetary tightening. Some analysts assume that the US central bank could decide in favor of raising interest rates at this policy meeting in January without delaying this question until March. The rate-setting committee is likely to announce tapering the Fed's balance sheet.

The COT report from January 18 reads that the number of non-commercial positions rose from 30,506 to 39,760 whereas the number of short non-commercial positions decreased from 59,672 to 40,007. This leads to a change in negative non-commercial net positions from -29,166 to -247. GBP/USD closed at 1.3647, higher than 1.3570 a week ago.

Indicator signals:

Trading is conducted above the 30 and 50 moving averages, which indicates an attempt by bulls to turn the market to their side.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

In case of growth, the upper limit of the indicator around 1.3530 will act as resistance. In case of a decline, the lower limit of the indicator around 1.3440 will act as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.