Analysis of trades and tips for trading the pound sterling

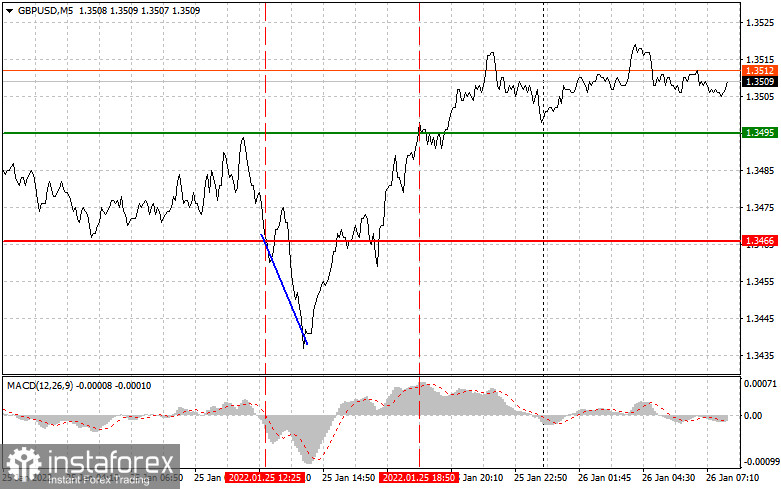

The pound/dollar pair made an attempt to test the 1.3466 level in the middle of the day. At that moment, the MACD indicator had just begun its downward movement from the zero level. According to yesterday's forecast, one should have opened short positions. As a result, the pair fell by more than 30 pips but it did not approach the target level. In the afternoon, the price tested the 1.3495 level. At that time, the MACD indicator climbed quite high into the overbought area, which limited the upward potential. So, there was no entry point into long positions.

Yesterday, the UK revealed the Confederation of British Industry's order book balance. However, this data is of little importance to traders. So, they ignored this report. It also did not help the pound sterling rise higher in the first half of the day. However, bulls held the pair from breaking monthly lows. The consumer confidence indicator in the United States unexpectedly declined, which led to a trend reversal during the US session. Thus, the pound sterling recouped all losses by the close of the day.

The economic calendar for the UK is absolutely empty today. This is why bulls may try to continue yesterday's upward correction aimed at breaking the highs. In the afternoon, before the FOMC meeting, speculators will assess the reports on the balance of trade in goods as well as wholesale and retail trade. An increase in new home sales in the primary market may trigger a spike in volatility provided that data exceeds considerably economists' forecasts. However, traders will focus their attention on the results of the FOMC meeting, which will be unveiled later today. If Fed Chairman Jerome Powell confirms hawkish expectations, speculators will open long positions on the US dollar, getting rid of the GBP/USD pair.

Signals to open long positions

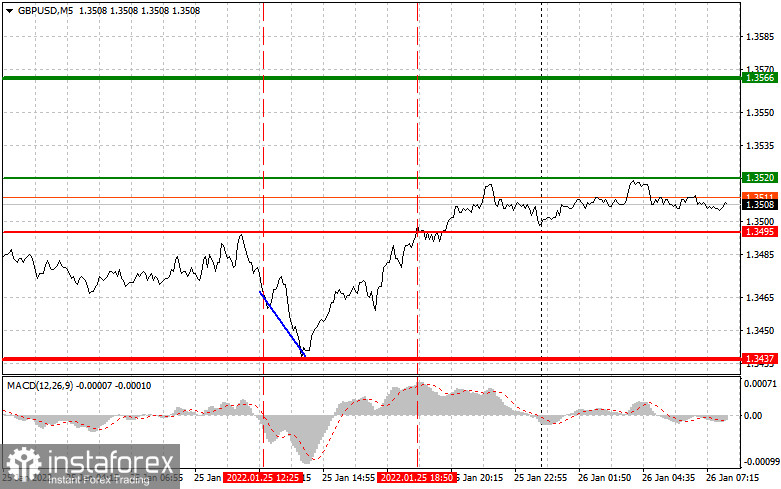

Scenario No.1: it is recommended to open long positions today when the pair reaches the entry point around 1.3520 (green line on the chart), aiming at the level of 1.3566 (thicker green line on the chart). It is better to close long positions near the 1.3566 level and open short ones, bearing in mind a 15-20 pip correction in the opposite direction from the level. The pound sterling is likely toad gains only in the first half of the day. During the US session, market participants will be anticipating the results of the Fed meeting. Important! Before opening long positions, make sure that the MACD indicator is above the zero mark and it has just begun to move up from it.

Scenario No. 2: it is also possible to buy the pound sterling today if the price hits 1.3495. At that moment, the MACD indicator should be in the oversold area, which will limit the downward potential of the pair. It may also trigger an upward reversal. The British currency could grow to the opposite levels of 1.3520 and 1.3566.

Signals to open short positions

Scenario No.1: it is recommended to sell the pound sterling today only after it approaches the level of 1.3495 (the red line on the chart). It may accelerate a decline. The target level of bears will be 1.3437. I would advise to close short positions near this level and immediately open long ones, bearing in mind a 15-20 pip correction in the opposite direction from the level. The pound sterling will face strong pressure ahead of the FOMC meeting. The US dollar is sure to strengthen only if the fed decides to tighten monetary policy. Important! Before selling, make sure that the MACD indicator is below the zero mark and it has just begun to decline from it.

Scenario №2: it is also possible to sell the pound sterling today if the price reaches 1.3520. At that moment, the MACD indicator should be in the overbought area, which will limit the upward potential of the pair. It may also trigger a bearish reversal. So, the pair is likely to decrease to the opposite levels of 1.3495 and 1.3437.

Description of the chart:

The thin green line is the entry point to open long positions on a trading instrument.

The thick green line is the estimated price where you can place a take-profit order or lock in profits by yourself as the price is unlikely to rise above this level.

The thin red line is the entry point to open short positions on a trading instrument.

The thick red line is the estimated price where you can place a take-profit order or lock in profits by yourself as the price is unlikely to decline below this level.

The MACD indicator. When entering the market, it is important to pay attention to overbought and oversold zones.

Important. Novice traders need to make very careful decisions on entering the market. Before the release of important fundamental reports, it is best to stay out of the market to avoid losses due to sharp fluctuations. If you decide to trade during the news release, then you should always place stop-loss orders to minimize losses. Without placing stop-loss orders, you may lose the entire deposit very quickly, especially if you do not use money management but trade in large volumes.

Remember that for successful trading it is necessary to have a clear trading plan, following the example of the one I presented above. Relying on spontaneous decision making based on the current market situation is a losing strategy of an intraday trader.