In today's review of the USD/CAD currency pair, we will casually go through yesterday's macroeconomic statistics from the United States of America, once again recalling the most important event of this week, after which we will consider the technical picture of USD/CAD. So, yesterday's data from the US on the index of manufacturing activity from the Federal Reserve Bank of Richmond came out quite weak, at the level of 8. For comparison, the previous indicator was at around 16, so, you know, the difference in the downward direction is significant. But the more important American indicator, which is considered an indicator of consumer confidence, came out better than the forecast value of 111.8 and amounted to 113.8. But that's all, because at 19:00 London time, the Fed will announce its decision on the main interest rate, and half an hour after that, the press conference of the re-elected chairman of the Federal Reserve Jerome Powell will begin. It is safe to assume that this landmark event will have a significant impact on the course of trading on all dollar pairs, including USD/CAD. By the way, the bank will publish its decision on the main interest rate today at 15:00 London time. No changes are expected here, and it is likely to remain at 0.25%. In the meantime, let's look at the current alignment of forces on the charts of the "Canadian".

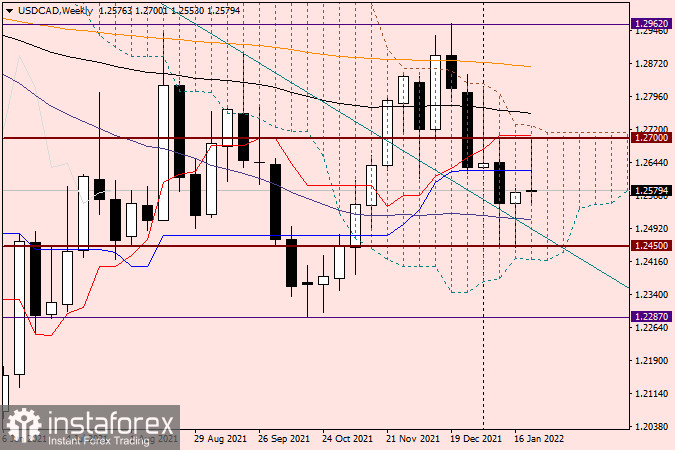

Weekly

Looking at the weekly timeframe, several technical points catch your eye at once. First, the pair has been trading within the Ichimoku indicator cloud for a long time, which in itself is a zone of uncertainty. Second, I would like to draw attention to the long shadows of the last three candles. By the way, the current one already has a rather impressive upper shadow at the time of writing, but this is an intermediate result, and it can still be changed. And finally, I will highlight the 1.2700-1.2450 range in which the trades of the last three weeks have been held. At the same time, the upward exit from the designated range, in addition to the strong technical mark of 1.2700, is also covered by the red Tenkan line, as well as the upper boundary of the Ichimoku indicator cloud. However, in fairness, it should be noted that the lower boundary of the cloud also passes under 1.2450. Based on the above, we can conclude that the medium-term prospects of USD/CAD will or may depend on which way the pair will exit from the weekly Ichimoku indicator cloud.

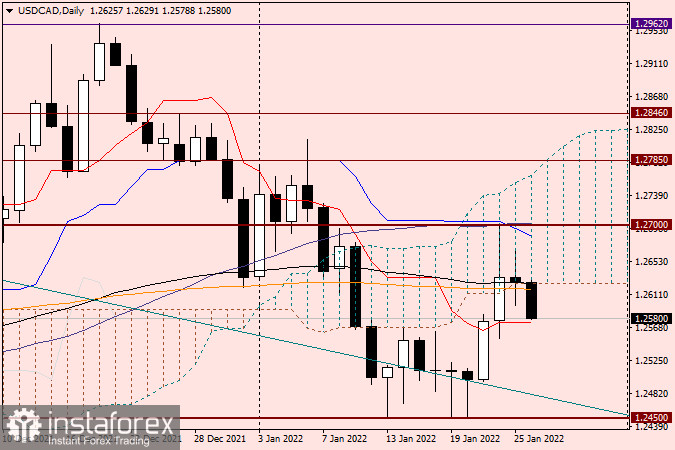

Daily

A slightly different picture is observed on the daily chart of the USD/CAD currency pair. There has already been a downward exit from the Ichimoku indicator cloud, after which the pair, it would seem, has confidently gained a foothold under its lower border. But it was not there. Bulls on the instrument have made serious efforts to return the quote to the limits of the cloud. The last two candles, although yesterday's one can be considered as such with a big stretch, closed within the cloud. However, today's candle has a rather big bearish (black) body and is trading under the lower border of the cloud. However, it should be noted once again that today is a special day, and in the evening after or at the Fed, much (if not everything) may change. And yet, taking into account these two charts, I consider sales to be technically the main trading idea, which is more appropriate to open after the USD/CAD pair rises into a strong price resistance zone of 1.2685-1.2700. It is riskier and at less favorable prices, you can try to open short positions, if there are corresponding candle signals at lower time intervals from 1.2640.