The FOMC meeting ended and, as many expected, the US stock market experienced extreme volatility along with the gold market.

What was unexpected was the statement released by the Federal Reserve and the way gold reacted to new monetary policy changes. Clearly, traders paid no attention to market consensus. It was expected that interest rates would remain at the same level, and the Federal Reserve would complete the process of reducing asset purchases in March and announce the first rate hike immediately after the end of the QE program. The latest FOMC statement came almost entirely in line with economists' expectations. The regulator kept interest rates unchanged, close to zero. Although no exact date was given, Chairman Powell hinted that the central bank would raise interest rates soon. Many analysts saw it as a sign that the first rate hike would take place already in March. As for the new information in the statement, it was about the regulator's plans to reduce its balance sheet. When the statement was released, gold was stable. As soon as Chairman Powell's press conference started, the precious metal faced serious bearish pressure and plunged to the low of $1,814.10. Silver also traded lower after the FOMC meeting:

What was unexpected was the statement released by the Federal Reserve and the way gold reacted to new monetary policy changes. Clearly, traders paid no attention to market consensus. It was expected that interest rates would remain at the same level, and the Federal Reserve would complete the process of reducing asset purchases in March and announce the first rate hike immediately after the end of the QE program. The latest FOMC statement came almost entirely in line with economists' expectations. The regulator kept interest rates unchanged, close to zero. Although no exact date was given, Chairman Powell hinted that the central bank would raise interest rates soon. Many analysts saw it as a sign that the first rate hike would take place already in March. As for the new information in the statement, it was about the regulator's plans to reduce its balance sheet. When the statement was released, gold was stable. As soon as Chairman Powell's press conference started, the precious metal faced serious bearish pressure and plunged to the low of $1,814.10. Silver also traded lower after the FOMC meeting:

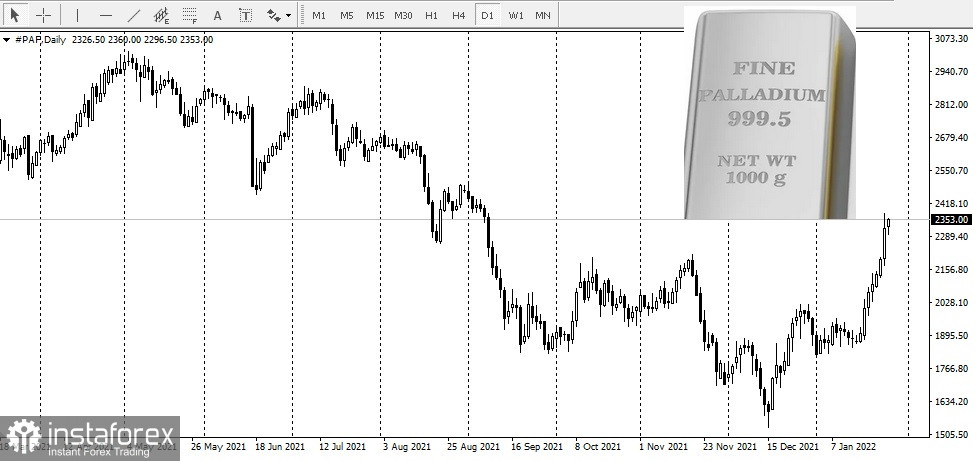

Nevertheless, there were precious metals that continued to add gains, although they should have reacted to the outcome of the meeting in an opposite way. Palladium gained $34.50, up by 6.15%:

Nevertheless, there were precious metals that continued to add gains, although they should have reacted to the outcome of the meeting in an opposite way. Palladium gained $34.50, up by 6.15%:

Platinum climbed $5.70, or 0.56%:

Platinum climbed $5.70, or 0.56%:

Palladium is mainly mined in Russia. A large percentage of platinum is also mined there. According to Provident Metals, palladium is mined all over the world, but the vast majority comes from only two countries - Russia and South Africa. Together, they account for 93% of annual palladium production, with 40% mined in Russia. Although, the United States and Canada mine palladium, their percentage is tiny compared to Russia. Escalating Russia-Ukraine tensions are fueling fears of a shortage of palladium needed by industrial consumers around the world. Platinum is also mined in Russia but the country is just a minor player when it comes to global production. Meanwhile, South Africa is the major supplier of platinum.

Palladium is mainly mined in Russia. A large percentage of platinum is also mined there. According to Provident Metals, palladium is mined all over the world, but the vast majority comes from only two countries - Russia and South Africa. Together, they account for 93% of annual palladium production, with 40% mined in Russia. Although, the United States and Canada mine palladium, their percentage is tiny compared to Russia. Escalating Russia-Ukraine tensions are fueling fears of a shortage of palladium needed by industrial consumers around the world. Platinum is also mined in Russia but the country is just a minor player when it comes to global production. Meanwhile, South Africa is the major supplier of platinum.