Since in today's previous reviews of the euro/dollar and pound/dollar pairs, it was stated in sufficient detail about yesterday's results of the two-day Fed meeting and the press conference of the head of this department, Jerome Powell, I see no point in repeating myself. I suggest that you focus your attention on the technical picture of AUD/USD and look for the most acceptable options for opening positions on this trading instrument.

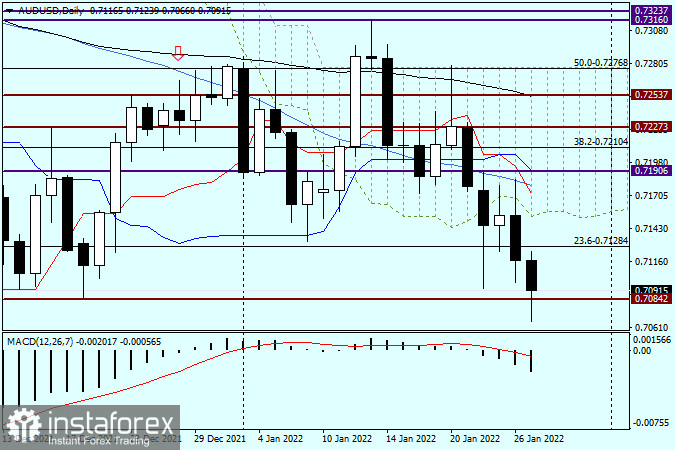

Daily

After such a speech, which Jerome Powell noted yesterday during his press conference, the pair had no choice but to choose a path in the south direction. The initial attempts to strengthen yesterday were limited to 50 by a simple moving average, from which the depreciation began. However, it should be noted that even on such tough statements by the head of the Fed, the exchange rate did not reach one of the key support levels of 0.7084, and Wednesday's session ended at 0.7116. However, today the market continued to win back the results of the Fed meeting that ended yesterday, and the pair has already tested the strength of this level of support. At the time of writing, there is not much to brag about the bears on "Aussie". From the level of 0.7084, there was a rather weak rebound upwards, and at the moment the AUD/USD pair is trading near the important technical mark of 0.7100.

The main question now is - how long will the market playback yesterday's events related to the Fed, and how long will the US dollar continue to receive support from the openly "hawkish" statements of Jerome Powell? If the pressure on the pair continues and today's trading closes below the support level of 0.7084, the road to lower prices will open, where the next target may be the landmark psychological, historical, and technical level of 0.7000. As I assumed earlier, it is here that the fate of the future direction of the AUD/USD currency pair will be decided. If today's candle eventually has a long lower shadow and a small black, and even more so the former (bullish) body, this can be perceived as a reversal signal for movement in the north direction.

H1

On the hourly chart of AUD/USD, there are attempts to correct after a rather impressive decline shown the day before. If this happens and the pair rises to the price range of 0.7135-0.7170 and bearish reversal patterns of candle analysis begin to appear here, this will be an excellent opportunity to open short positions on AUD/USD. After yesterday's pronounced tone of the Fed, purchases are now considered irrelevant and quite risky. To open them, the corresponding candlestick signals should appear on the daily, four-hour, or hourly charts. So at this point, I consider sales to be a priority positioning, but not at the very bottom of the market, but after minor corrective pullbacks up.