The EUR/USD currency pair stopped falling on Friday but did not start an upward correction. Over the past week, the quotes of the European currency have fallen below the Murray level of "-1/8" - 1.1169 and remain there at this time. Thus, so far, after falling by 350 points, the pair have not even found the strength for a small increase. However, we have already said earlier that the growth to 1.1475 was groundless from the point of view of fundamental factors and we believe that it was just "acceleration" before a new attempt to overcome the level of 1.1230, which was eventually overcome last week. Therefore, in the coming weeks, according to the "Linear Regression Channels" trading system, the pair's decline may continue. Of course, an upward correction to the moving is possible, but so far the bulls are absent from the market again. There will be quite a lot of macroeconomic statistics in the new week. Both in the European Union and America. There will also be an ECB meeting. However, the markets may ignore most of the reports again, and there is not much to expect from the ECB meeting in the current circumstances. We believe that the key report of the week will be NonFarm Payrolls in the USA, but it will be released only on Friday. And until Friday, you also need to trade somehow and rely on something when making trading decisions.

The European economy lags far behind the American one, and the ECB lags far behind the Fed.

Over the past two decades, the European Central Bank has often raised or lowered rates immediately after the Fed. This is where the judgment came from that the Fed first decides to change the course of monetary policy, and only then – all the others. Therefore, we were quite surprised when the Bank of England was the first to raise its rate in December and may repeat it this week. However, the ECB, which previously did exactly that, this time does not intend to follow the American Central Bank, as Christine Lagarde openly stated last week. Experts note that inflation in the European Union may indeed begin to slow down "by itself", as Christine Lagarde expects. Unlike the American economy, the European one is not overheated and does not require "cooling". Inflation is only 5% and may fall to 4.5% y/y by the end of January. In this case, first, there will be no need to cancel monetary stimulus as soon as possible, and second, raising the rate loses all meaning. That is why the ECB is in no hurry with any tightening. If inflation declines by itself, it is possible that it will fall below 2% again. And in this case, the economy will again have to be dispersed, but not slowed down by tightening monetary policy. Most experts agree that the ECB will start raising rates no earlier than the spring of 2023 when the Fed will have already completed its rate hike cycle. Thus, at the beginning of next year, we can see the ratio in rates approximately the following: 2.5% (Fed) - 0.5% (ECB). Naturally, the factor of the gap between the rates will not support the US currency forever. We do not believe that the euro/dollar pair is capable of going below parity. Moreover, many experts also note that the Fed may raise the rate until it returns inflation to 2%. And when the goal is achieved, he may even hold several rounds of rate cuts to stimulate the economy a little again, which may slow down by then. It is also noted that the purchase of bonds in the EU will continue at least until the end of 2022 (under the APP program). The PEPP program should be completed as planned in March of this year. Thus, if we take into account only 2022, then in it the advantage should remain on the side of the dollar. But again, this does not mean that only the US dollar will grow during the year. Recall that the US currency has been growing for most of 2021.

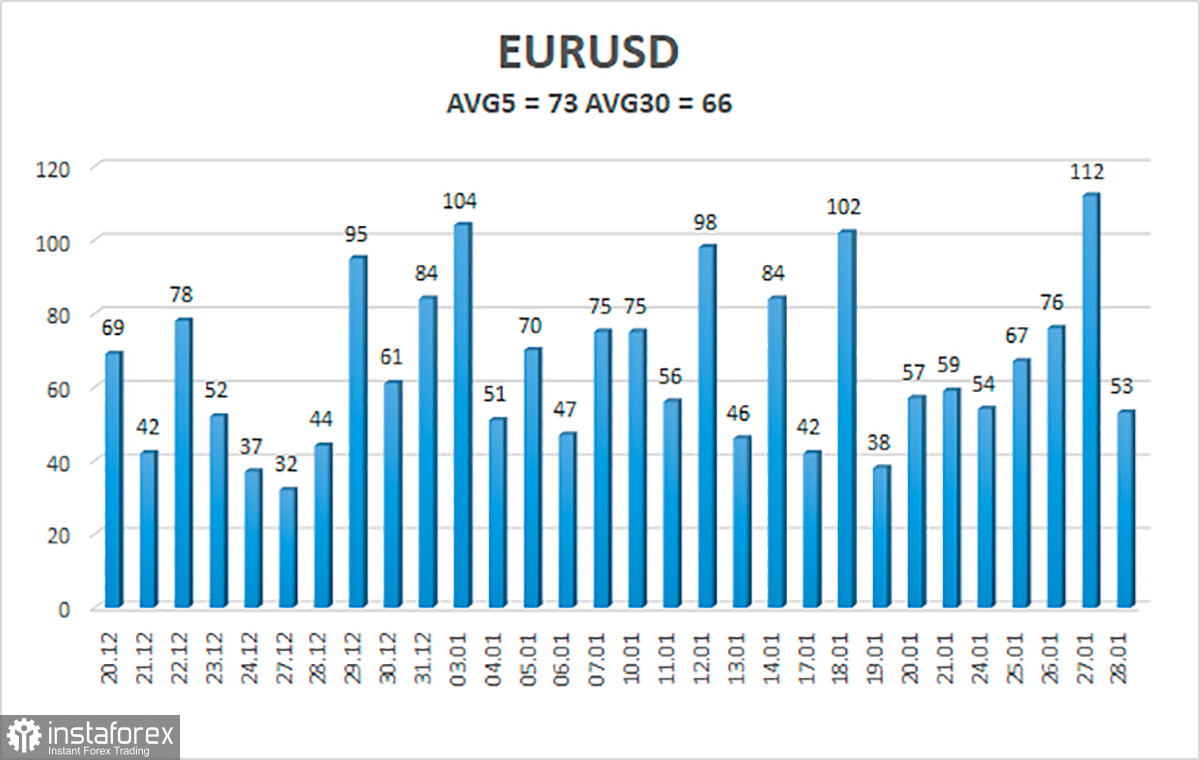

The volatility of the euro/dollar currency pair as of January 31 is 73 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1074 and 1.1220. The reversal of the Heiken Ashi indicator downwards signals the resumption of the downward movement.

Nearest support levels:

S1 – 1.1108

Nearest resistance levels:

R1 – 1.1169

R2 – 1.1230

R3 – 1.1292

Trading recommendations:

The EUR/USD pair continues a strong downward movement but may begin a correction. Thus, now it is necessary to stay in short positions with targets of 1.1108 and 1.1065 until the price fixes above the level of 1.1169. Long positions should be opened no earlier than the price-fixing above the moving average line with a target of 1.1292.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.