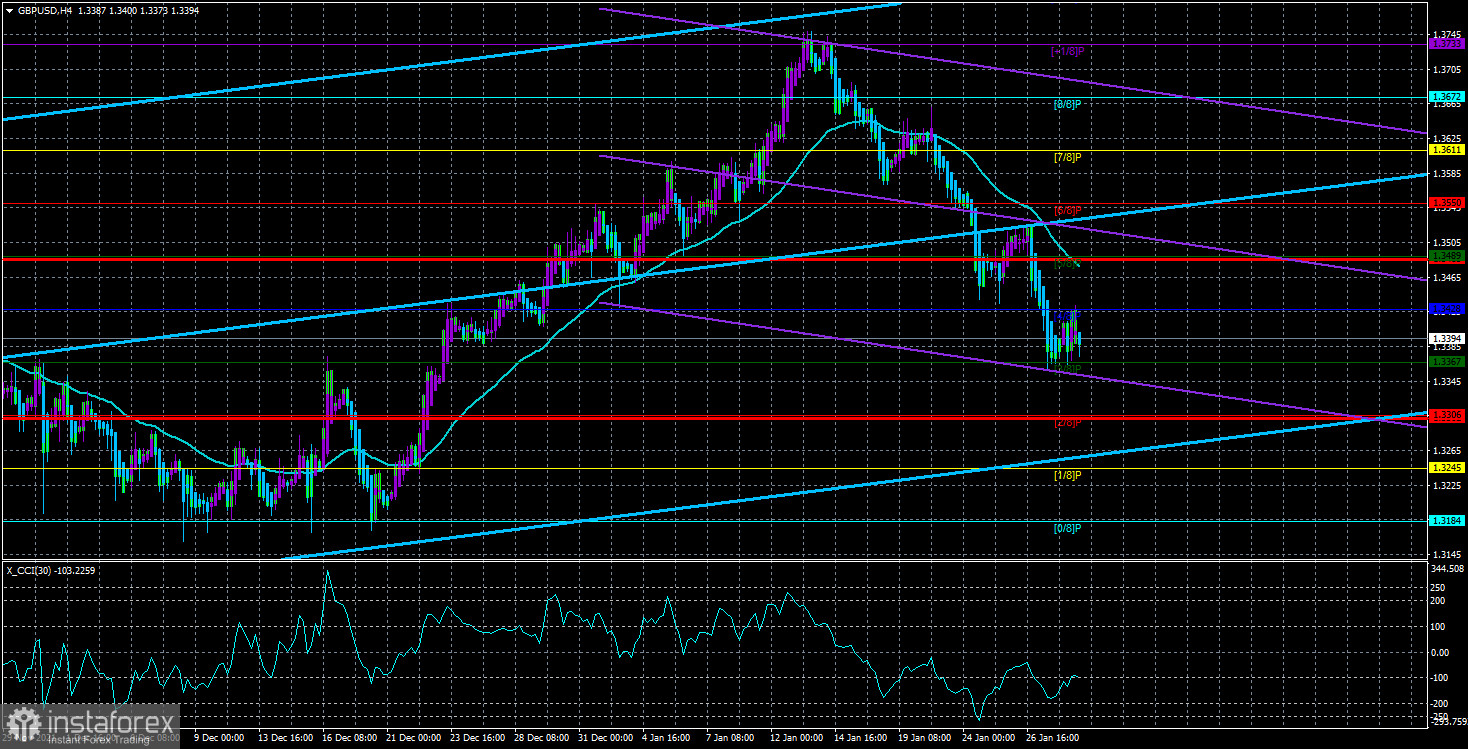

The GBP/USD currency pair on Friday, as well as the EUR/USD pair, simply stopped in its fall. Thus, the correction did not begin, and the price failed to gain a foothold above the nearest Murray level of "4/8" - 1.3428. On the one hand, this indicates the strength of bears who do not even want to take profits on short positions opened over the past two weeks, and on the other hand, this should not mislead traders. After all, the correction can begin on Monday and Tuesday. The meeting of the Bank of England is scheduled for Thursday, February 3, and most forecasts say that the British regulator will raise the key rate again. Such a decision is simply bound to provoke the growth of the British currency. Thus, in one form or another, we should see an upward correction this week. Moreover, if the European currency can continue to fall in price for most of 2022, then the probability of a fall in the British pound over the same period is much lower. First, the Bank of England, unlike the ECB, has already started raising the rate. Second, over the past year, the pound has fallen in price much weaker against the dollar than the euro currency. We have already said that the overall correction against the 2020 trend for the pound was only 38.2%, and for the euro – almost 70%. Moreover, over the past couple of months, the pound has shown an increase of 550 points, and the euro currency has painfully doubled by 300. Thus, the euro currency itself may continue to keep heading south, and the pound will either fall much more slowly or will not depreciate at all against the US currency. A lot of things this week will depend on the Bank of England.

Goldman Sachs believes that BA has also taken a course to tighten policy.

Although the BA rate hike in December came as a surprise, forecasts suggest that the rate will be raised again at the February meeting. And analysts at Goldman Sachs bank believe that the rate will be raised in March as well as in May. Thus, by May of this year, the Bank of England can bring the key rate to 1%. The Goldman Sachs report says that the regulator is serious about the level of inflation that should be in the country, and is ready to demonstrate all commitment to 2%. Their colleagues from Saxo Bank also believe that in 2022, most of the world's central banks will be busy raising rates. Of course, we are not talking about the ECB now. Thus, there may not be a gap between the Fed and BA rates. Or it will be extremely small. And if so, then there may not be a strong fall in the pound sterling in 2022.

However, Boris Johnson can always "hurry up". The British Prime Minister continues to get into scandals with enviable regularity, which sooner or later will "come back to him." And, most likely, they will be auctioned not only to him but also to the entire Conservative Party. There is already talk of a change of the Conservative leader, as not only Johnson's political ratings are falling, but also the entire ruling party. Everything may end up with the fact that the Conservatives may suffer a crushing defeat in the next parliamentary elections, which, of course, they would like to avoid. However, the by-elections to the British parliament in North Shropshire showed the victory not of the Conservatives, or even of the Labor Party, but the Social Democrats. This is in a region where only conservatives have won for 200 years. For many, the result of the by-election was a "wake-up call" and a signal that Johnson is unlikely to sit in his place until the end of the term. It is unknown how the Scotland Yard investigation into Boris Johnson's "coronavirus parties" will end. If he is found guilty (which is unlikely), it may force the opposition to put even more pressure on the Prime Minister with calls to resign, calling on public opinion to help.

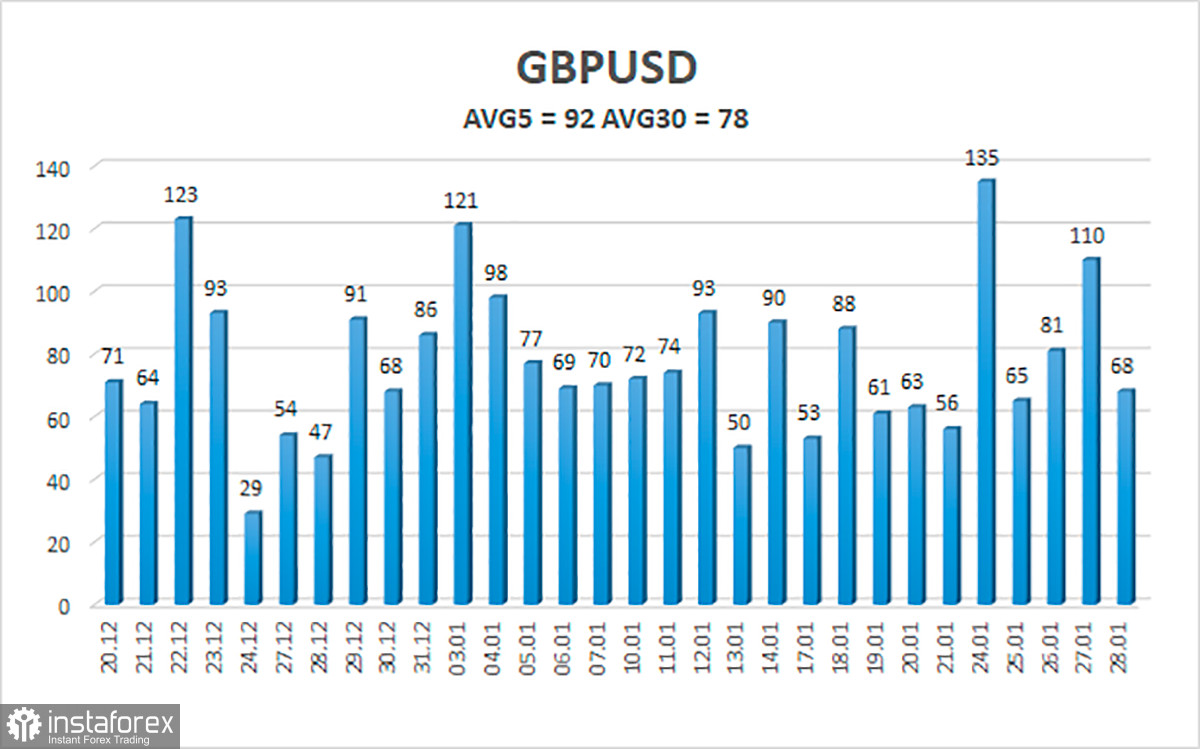

The average volatility of the GBP/USD pair is currently 92 points per day. For the pound/dollar pair, this value is "average". On Monday, January 31, thus, we expect movement inside the channel, limited by the levels of 1.3302 and 1.3485. The reversal of the Heiken Ashi indicator downwards signals a possible resumption of the downtrend.

Nearest support levels:

S1 – 1.3367

S2 – 1.3306

S3 – 1.3245

Nearest resistance levels:

R1 – 1.3428

R2 – 1.3489

R3 – 1.3550

Trading recommendations:

The GBP/USD pair continues its downward movement on the 4-hour timeframe. Thus, at this time, it is recommended to stay in sell orders with targets of 1.3306 and 1.3280 until the price is fixed above 1.3428. It is recommended to consider long positions if the pair is fixed above the moving average line, with targets of 1.3550 and 1.3611, and keep them open until the Heiken Ashi indicator turns down.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.