To open long positions on EUR/USD, you need:

Last Friday there were some great signals to enter the market. Let's look at the 5-minute chart and figure out what happened. In my morning forecast, I paid attention to the level of 1.1118 and advised you to make decisions on entering the market. The low activity from the bulls during the first half of the day, even against the background of contradictory statistics on the eurozone, led to an update of the local low, but unfortunately, we did not reach the level of 1.1118. It was not possible to get an entry point into long positions, respectively. The afternoon was much more interesting. Three false breakout in the area of 1.1167 during one session led, respectively, to good points of entry into the market in short positions. Each time the movements were 20-25 points.

Data on the US economy, as well as on the incomes and expenses of Americans forced us to close long positions on the dollar at the end of the week, as the reports failed to surprise traders, completely coinciding with the forecasts of economists. Today, a rather interesting series of data on the eurozone is expected, which may lead to a surge in volatility in the first half of the day.

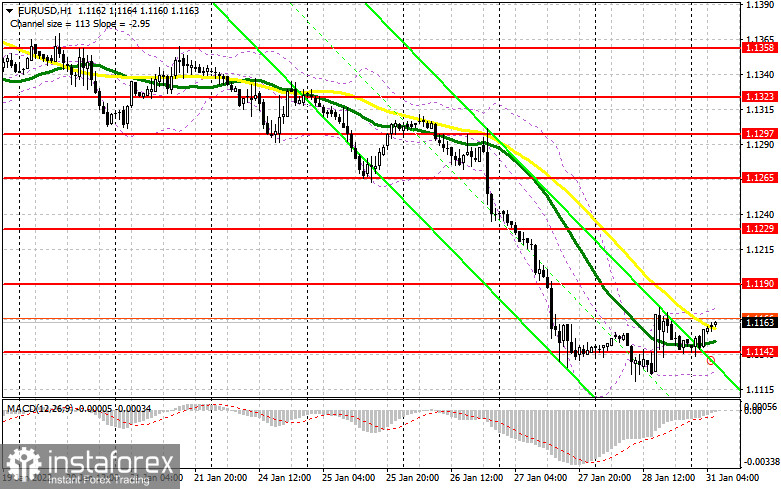

The bulls' main task is to protect the support of 1.1142, since it is quite possible that an upward correction for the euro will be formed from this level, which we have been asking for for quite a long time. Given that the European Central Bank will hold a meeting this week– it is quite possible that demand for the euro will return. Forming a false breakout at 1.1142, in addition to the first signal to buy the euro, will also be evidence of an attempt to find the low in hopes of completing a short-term downward trend. An equally important task for euro bulls is to regain control of the 1.1190 resistance. A breakthrough and a reverse test from the top down of this range, together with strong data on Italian and eurozone GDP, will lead to another buy signal and open up the possibility of recovery to the area: 1.1229. A more distant target will be the level of 1.1265, but it is possible to count on updating this range only after strong statistics on the inflationary jump in Germany in January this year. I also recommend taking profits there.

If the pair declines during the European session and there is no bullish activity at 1.1142, the pressure on the euro may seriously increase. In this case, it is best to postpone long positions until the next monthly low of 1.1100. However, I advise you to open long positions there when forming a false breakout. You can buy the euro immediately for a rebound from the level of 1.1034 with the goal of an upward correction of 20-25 points within the day. A lot will depend on the release of data on the American economy, so the focus is likely to shift to the afternoon.

To open short positions on EUR/USD, you need:

Bears continue to control the market, however, after Friday's US data, the pressure on risky assets decreased slightly. The beginning of the week promises to be on the bulls' side, as many traders are counting on a more aggressive policy of the ECB. Therefore, bears need to do their best not to miss the initiative. An important task for the first half of the day is to protect the resistance of 1.1190. In case of rather weak data on eurozone GDP, which may be significantly worse than economists' forecasts in the fourth quarter of 2021, it will be difficult for bulls to offer something to cross this level. Forming a false breakout at 1.1190 will return pressure on the pair and create the first entry point into short positions with the goal of further pulling EUR/USD to the area of 1.1142.

A breakthrough and a bottom-up test of this range will provide another signal to open short positions with the prospect of falling to large lows: 1.1100 and 1.1034. The 1.0994 area will be a more distant target, but it will be available only in case we receive very strong data on the American economy. I recommend taking profits there. In case the euro grows and the bears are not active at 1.1190, it is best not to rush with short positions. The optimal scenario will be short positions when forming a false breakout in the area of 1.1229. You can sell EUR/USD immediately for a rebound from 1.1265, or even higher - around 1.1297 with the goal of a downward correction of 15-20 points.

I recommend for review:

The Commitment of Traders (COT) report for January 18 revealed that long positions had increased while short ones decreased, leading to an increase in the positive delta. Generally speaking, the euro is still in demand despite the expected changes in the monetary policy of the Federal Reserve. The deeper the correction, the higher the demand. The Federal Reserve will announce its policy decision today. Some traders expect the central bank to raise the interest rate already in January. A shrink in the regulator's balance sheet will also be announced. A lot now depends on Chairman Powell's rhetoric. If he expresses concerns about US inflation, demand for the US dollar will most likely only increase. As many as 4 rate hikes are expected this year. Some major market players suggest there will be even 5 of them. The ECB is planning to end its PEPP already in March. At the same time, the regulator is not ready to take further actions aimed at tightening its policy, which limits the upward potential of risky assets. The COT report revealed an increase in long non-commercial positions to 211,901 from 204,361 and a fall in short non-commercial positions to 187,317 versus 198,356. Traders continue to increase long positions on EUR/USD, hoping for an uptrend. The positive non-commercial net position rose to 24,584 from 6,005. The weekly closing price grew to 1.1410 versus 1.1330 a week earlier.

Indicator signals:

Trading is conducted around the 30 and 50 day moving averages, which indicates a likely pause with a further bear market for the euro.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

Crossing the lower limit of the indicator in the area of 1.1130 will lead to a fall in the euro. A breakthrough of the upper limit of the indicator in the area of 1.1170 will lead to a correction of the pair.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.