The euro/dollar pair consolidated near the 11th level. Bears failed to push the pair to the boundaries of the 10th level. Bulls are unable to push the pair to the 1.1200 mark within a corrective pullback. As a result, the pair is trading flat in anticipation of new drivers. Notably, the first week of February is likely to be volatile. The ECB will hold its monetary policy meeting. The US will reveal its labor market data- the Nonfarm Payrolls report. Apart from that, traders will also digest EU inflation data.

Today, EU GDP figures are due. According to preliminary data, in the fourth quarter of last year, the European economy expanded by 0.4% on a quarterly basis and by 4.7% on an annual basis. In the third quarter, the indicator came out at the level of 2.2% and 3.9%, respectively. Apart from that, Germany will publish its inflation data. The core indicators are expected to slow down. Thus, the consumer price index is projected to reach -0.4% in monthly terms versus the previous reading of 0.3%. In annual terms, analysts forecast the reading to amount to 4.7% versus the previous figure of 5.3%). The harmonized index of consumer prices is likely to demonstrate the same dynamic. If Germany's inflation report is weak, bulls may lose steam. They will be extremely worried about the results of the eurozone inflation report, which is on tap on Wednesday.

On Tuesday, February Germany will unveil its labor market data. The unemployment rate is expected to increase slightly to 5.4%. The economy is forecast to add +8,000. The indicator itself is not significant. However, if Germany's inflation report is disappointing, then a decline in the labor market may adversely affect the trajectory of the pair. During the US session on Tuesday, the ISM manufacturing index will be published, which is projected to show a slight drop to 57.4 from 58.7.

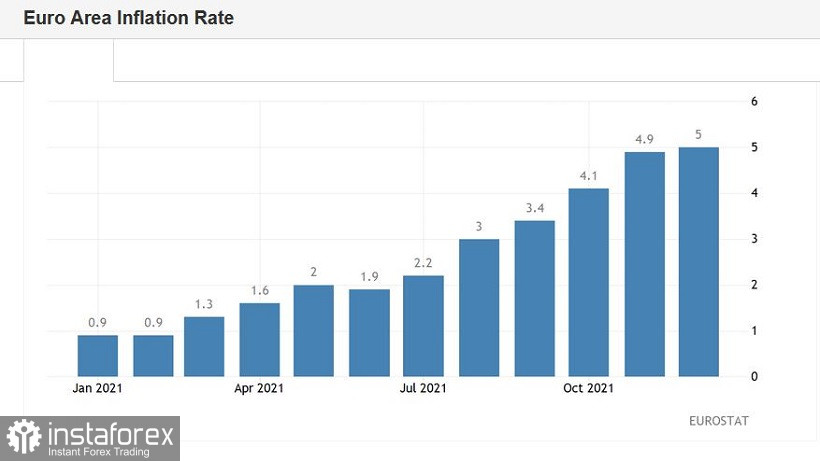

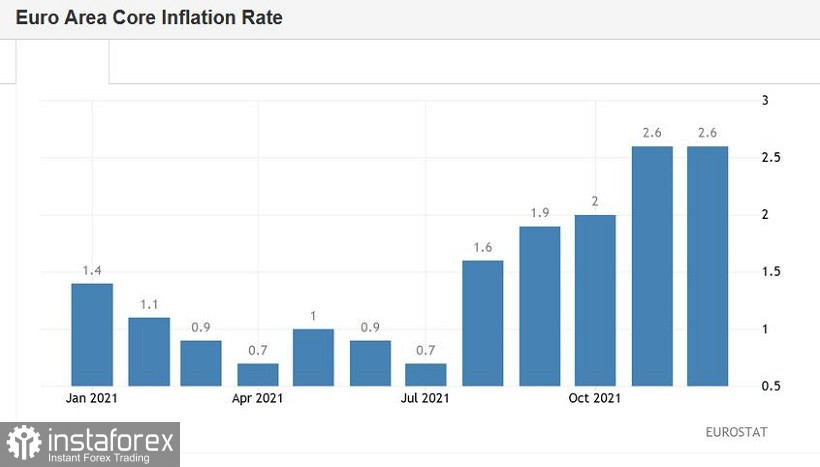

Traders will also take notice of Pan-European inflation data, which will be published on Wednesday, February 2. According to forecasts, the consumer price index may reach 4.4% in January. This will mean that inflation in the eurozone countries will slow down for the first time after a 12-month rise. As for core inflation, it is likely to come out at around 1.8% despite the fact that in December and November it stayed around 2.6%. If the figures are in line with forecasts, bears will exert pressure on the euro. Many ECB policymakers take a dovish position on the prospects of monetary policy. In their opinion, the strong increase in inflation is temporary. Five (out of 25) members of the Governing Council disagree with this position. They believe that inflation will continue to rise steadily. Therefore, the European Central Bank should revise its approach to monetary policy. Inflation figures for January will show which sentiment prevails: the hawkish or the dovish one.

Notably, on February 3, the European Central Bank will announce its decision on monetary policy, summing up the results of the meeting. Judging by the December meeting minutes, some ECB officials cautiously talked about monetary policy tightening. Hawks warned about rising inflation in the long term. Thus, the central bank will have to act appropriately. As one of the speakers noted, the regulator should be ready to tighten or ease policy if necessary. The protocol published at the beginning of this year helped the euro to rise versus the greenback for several weeks. After the publication of the document, there were even assumptions that the ECB may raise the interest rate at the end of 2022. The results of the January meeting will clarify the situation. The ECB may provide hints at the possibility of such a scenario, which is bullish for the euro. The regulator may also dispel such rumors, which will affect the single currency. The ECB's decision will largely depend on the results of the inflation report for January. Therefore, traders may price in the dovish rhetoric of the regulator if the consumer price index turns out to be in the red zone.

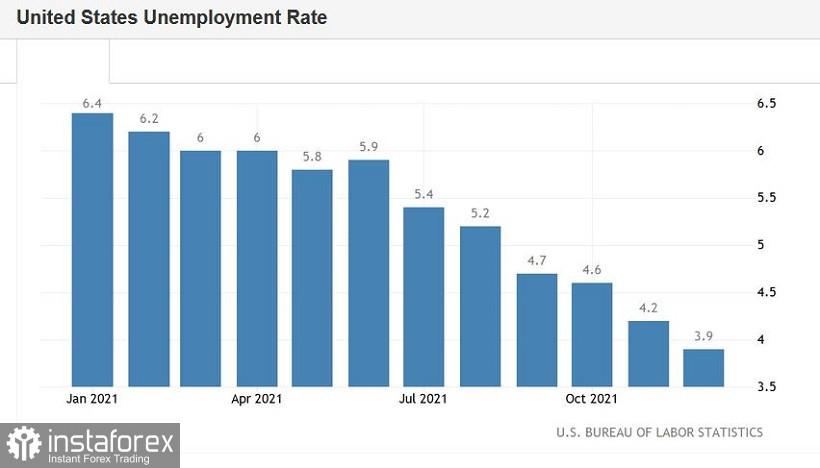

After a volatile Thursday, Friday will also bring sharp flections. On February 4, the Us will unveil the Nonfarm Payrolls report. This data is of high importance as it serves as a barometer of the labor market state. According to the January estimate, the US unemployment rate in December fell to 3.9%. This is the best result since March 2020. On the other hand, a weak increase in the number of people employed in the non-agricultural sector was recorded in December. This indicator increased by only 199,000 versus the forecast reading of 410,000. The economy added 211,000 jobs in the private sector versus the forecast reading of 365,000 and in the manufacturing sector, there was a 26,000 rise compared to the reading of 35,000 a month earlier. The average hourly wage advanced to 4.7% in annual terms and to 0.6% on a monthly basis. Both figures came out in the green zone, exceeding the forecast.

According to preliminary forecasts, the unemployment rate in January dropped to 3.8%. The economy added only 166,00 jobs. The average hourly wage is expected to climb to 5.2%. In this case, the indicator will reach almost the yearly high. The reading hit this level in February 2021. If the above indicators are in line with the forecasts, the US dollar is likely to rise higher. Traders will certainly focus on a drop in unemployment and an increase in wages.

The medium-term trajectory of the euro/dollar pair will mainly depend on inflation figures, the ECB's rhetoric on monetary policy, and the US Nonfarm Payrolls report. In my opinion, the European Central Bank will dispel rumors of the possibility of a hawkish stance this week, especially if the eurozone CPI shows a slowdown. The NFP report may bolster the US dollar's growth if the reading coincides with the forecast.

Judging by the current fundamental factors, it is recommended to open short positions at corrective pullbacks. The support level is located at the psychologically important level of 1.1100, which corresponds to the lower line of the Bollinger Bands indicator on the W1 chart.