Despite the stubborn optimism of bitcoin supporters, the main cryptocurrency fell by more than 20% in January. At such times, despite the many signs that give hope for a recovery, it is worth remembering that the market can remain irrational longer than traders are solvent.

"Red" January

Data from the network analytics resource Coinglass shows that January 2022 was the least profitable since the last Bitcoin halving. Investors, however, are still waiting for a "return to the top."

Contrary to almost all expectations, the dynamics of BTC this month remained unsatisfactory, although hopes for a reversal flashed with every consolidation.

If we estimate the position of bitcoin near $37,000, then the January fall is just over 20%.

At the same time, historical data shows that January, on the contrary, was often a "green" month for bitcoins. For example, in 2021, the main cryptocurrency grew by more than 21%.

In previous years, November and December were also quite good, unlike 2021. This is a painful realization for crypto bulls, but in the last two months of 2020, Bitcoin has gained 43% and 47%, respectively.

Looking back, the last "red" January for Bitcoin was in 2018. It was a retreat time after the first all-time high of $20,000.

And although the halving, during which the block reward is halved, usually led to an increase in the price, this time the pattern did not work.

Assessing the chances of Bitcoin growth in February

Is there a chance for BTCUSD to recover from losses in February? Last year, the BTCUSD exchange rate rose by almost 37% in four weeks of February. But then the sensational institutional implementation gave impetus to the main cryptocurrency: Microstrategy and Tesla started buying bitcoin. But a serious February fall last occurred in February 2014. In 2018, by contrast, bitcoin barely moved.

Unusual price action since November has left analysts scratching their heads as to whether bitcoin is in a bullish or bearish market right now.

And while some are calling for an end to panic selling, retail investors are leaving the market, and whales continue to actively replenish their stocks on price pullbacks.

Exit for traders - small dashes

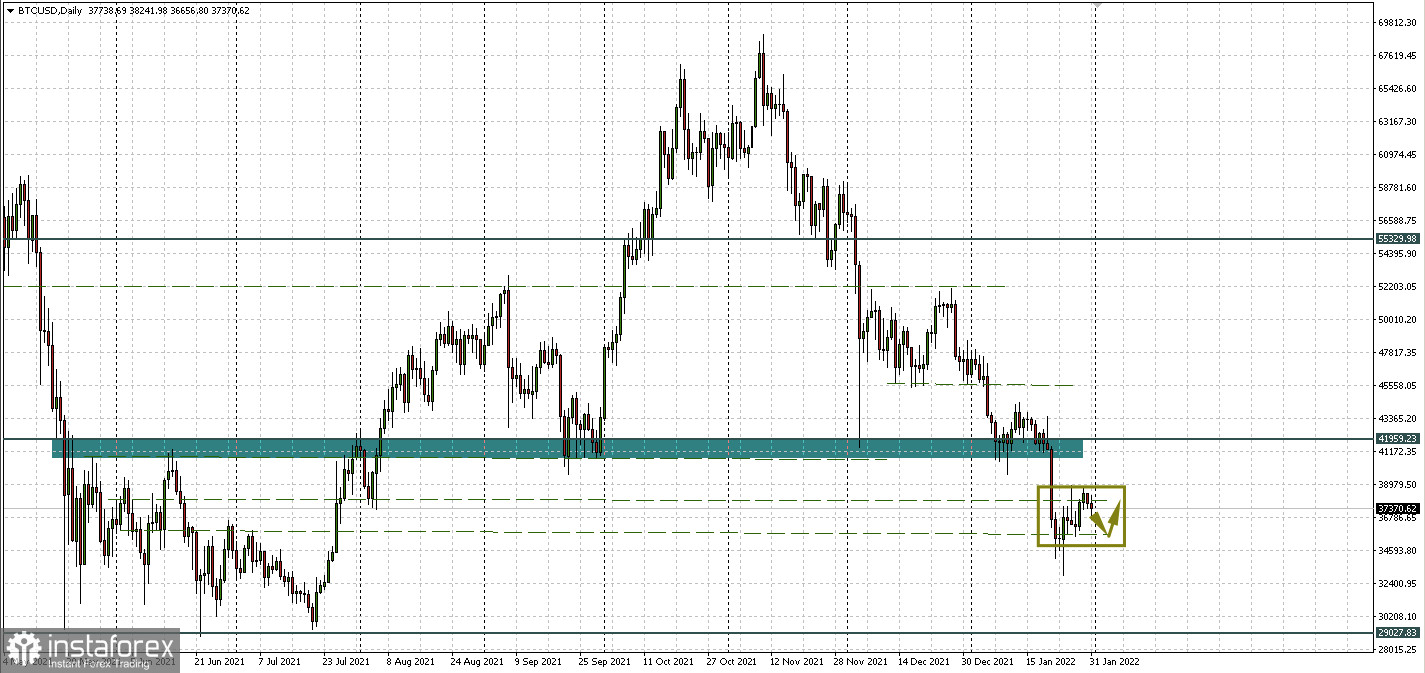

However, in the midst of this uncertainty, the only thing left for retail traders is to move in small dashes based on technical analysis. But the technical picture now looks the same. The price is still in the narrow consolidation range 35,915.72 - 37,903.51 after two unsuccessful attempts to get out of it up.

In such a situation, the safest, in my opinion, would be to wait for an obvious exit from this corridor up or down. And then, according to the situation, buy in anticipation of a return to $40,000 per coin, or sell, focusing on support at $29,000 per bitcoin.