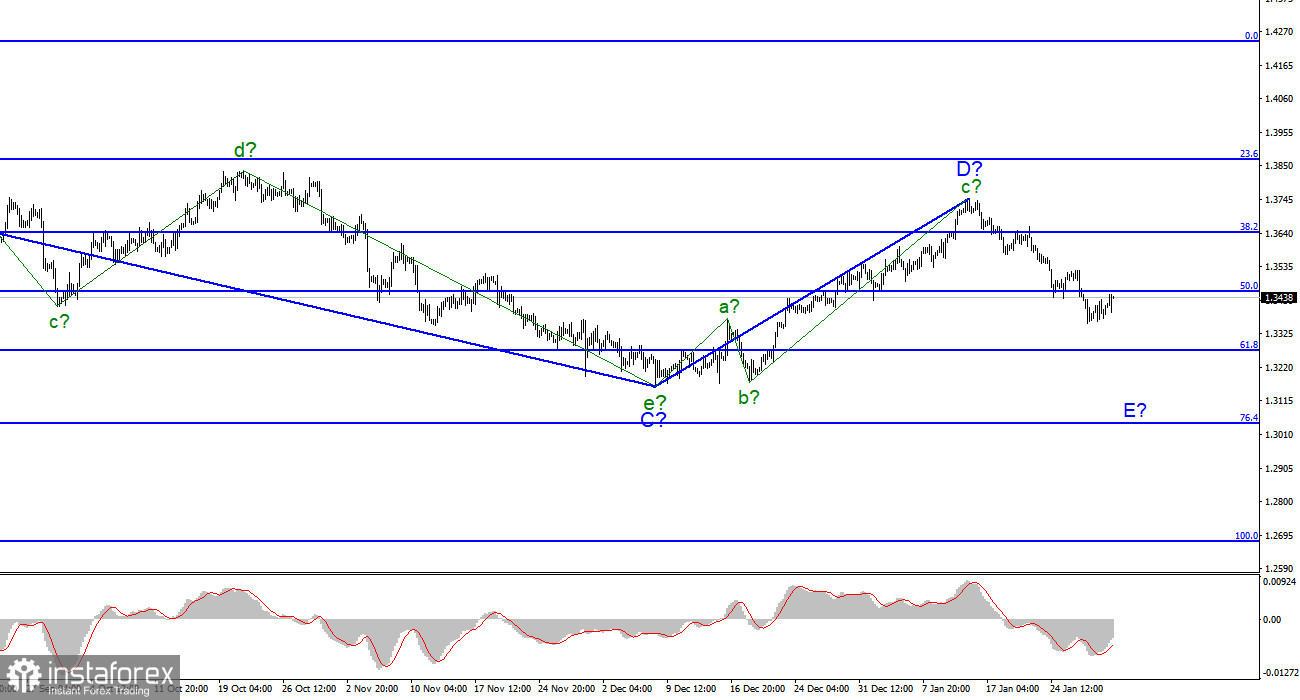

For the pound/dollar instrument, the wave markup continues to look convincing. In the last few weeks, the instrument has been at the stage of building an upward wave, which is currently interpreted as wave D of the downward trend segment. However, if the current wave markup is correct, then this wave has completed its construction and the construction of wave E has begun. Thus, the entire downward section of the trend may take on an even more extended form. Wave D has taken a clear three-wave form and its internal wave marking does not cause any questions now. A successful attempt to break through the 50.0% Fibonacci level, which corresponds to 1.3458, indicates the readiness of the markets for new sales of the British. Correction waves are practically not visible inside the supposed wave E, which leads to the conclusion that its possible very extended appearance. Both the euro and the pound may significantly sink in price in the coming months since the wave marking allows for continued decline for both instruments.

The British can expect growth if the Bank of England raises the rate.

The exchange rate of the pound/dollar instrument increased by 50 basis points during January 31, but during the day, it managed to go down by 50 basis points too. Today, the information background was absent for the British and Americans, but it does not matter. The market needed at least one day to consolidate and prepare for an extremely important week. Although all the most important events are scheduled for its end - Thursday and Friday. It is on these days that the results of the Bank of England meeting will be announced, as well as the Nonfarm Payrolls report in the USA will be released. Let me remind you that now the wave marking suggests a further decline in the quotes of the British. However, if the Bank of England rate is raised on Thursday (and the probability of this is very high), the market will not be able to continue selling the pound sterling. That is, there will be an increase that will fit into the current wave markup only as a corrective wave in the composition of E. However, the decline of the instrument may resume on Friday, as the Nonfarm Payrolls report is highly likely to be strong. This is indicated by the usual probability theory, since the last two months, the report was worse than market expectations. Thus, the news background this week can seriously affect the movement of the instrument, but if there are no surprises, then everything should move forward in accordance with the wave pattern that is available now. Until Thursday, the instrument may move horizontally, as there will be little news in the coming days.

General conclusions.

The wave pattern of the pound/dollar instrument assumes the construction of an assumed wave E. A successful attempt to break through the 1.3458 mark allowed us to continue selling the instrument with targets located near the estimated 1.3271 mark, which corresponds to 61.8% Fibonacci. You can also sell on the MACD signal "down". I am not considering alternative options right now, since there is no reason for this. The wave E can get a clear five-wave structure.

On the higher scale, wave D also looks complete, but the entire downward section of the trend does not. Therefore, in the coming weeks, I expect the instrument to continue to decline with targets below the low of wave C. Wave D turned out to be a three-wave one, so I cannot interpret it as wave 1 of a new upward trend section.