The EUR/USD currency pair was trading as volatile as possible on Monday. Although only one relatively important report was published during the day (we will talk about it later), the European currency grew all day as if the ECB had raised the key rate. Nevertheless, the trend remains downward, as the pair continues to be located below the moving average line. Therefore, the downward movement can resume at any moment. Moreover, the week has not started well for the European currency. The report on the GDP of the European Union for the fourth quarter with very weak forecasts, in reality, turned out to be even worse. Further, during the week, the most important reports are more likely to provoke a new fall in the euro and a rise in the dollar than vice versa. For example, European inflation is likely to slow down in January. And this, in turn, will further reduce the likelihood of tightening the ECB's monetary policy in 2022. The meeting of the European regulator is unlikely to give at least one "hawkish" thesis. And the Nonfarm report in the US on Friday has such a low forecast that it will not be difficult to exceed it, which means the dollar will be able to get market support. Thus, at first glance, all four of the most important reports this week will be in favor of the US currency. Of course, in reality, everything may not be so rosy.

The European economy lags far behind the American one, which is confirmed by the GDP reports.

Over the past few days, the United States and the European Union have published GDP data for the fourth quarter. And these data make it possible to understand in what light both economies are now. If the growth of 5.5% q/q was predicted in the United States, and the actual value turned out to be higher, then in the European Union growth was predicted at around 0.4%, and the actual value turned out to be lower. This is all you need to know now about the American and European economies. What other questions can there be after such eloquent data regarding the ECB and the Fed? Naturally, the Federal Reserve will "extinguish" its growing inflation by any means, but in the European Union, it may begin to slow down, so any tightening of monetary policy simply loses all meaning, given the "whole" +0.3% of GDP in the fourth quarter. At the same time, it should be understood that this situation is not smoothed out by the "coronavirus", since both the States and the EU had an equally difficult pandemic situation this winter. Thus, the US dollar turns out to be another factor of its growth in 2022. We have already said earlier that the factor of repeated tightening of the Fed's monetary policy can support the dollar for a long time. However, every day there are more and more such factors. The European economy lags in terms of GDP, lags in terms of wage growth, and lags far behind in terms of unemployment. That is, we are not talking about any indicator, which is worse in the European Union than in the United States. We are talking about all indicators.

As for other topics, there are a few of them now. Since Donald Trump left his post in the United States, there has been much less news from the White House, and all of them, as they say, "essentially" and do not particularly affect the movement of the US dollar. There is a lull in the European Union now. There is no news from Ursula von der Leyen, there is no news from Christine Lagarde, there are no burning topics. And such a situation again works against the euro currency, since it does not even have theoretical grounds and factors to strengthen at least a little. The only factor in its favor is the factor that the dollar cannot rise in price forever. And it has been growing for 13 months. Sooner or later, the trend will have to end. But that's what technical indicators are for, to determine reversals. So far, there is no question of any reversal of the trend. A couple of weeks ago, the pair could gain a foothold above the Ichimoku cloud on the 24-hour TF but did not do so.

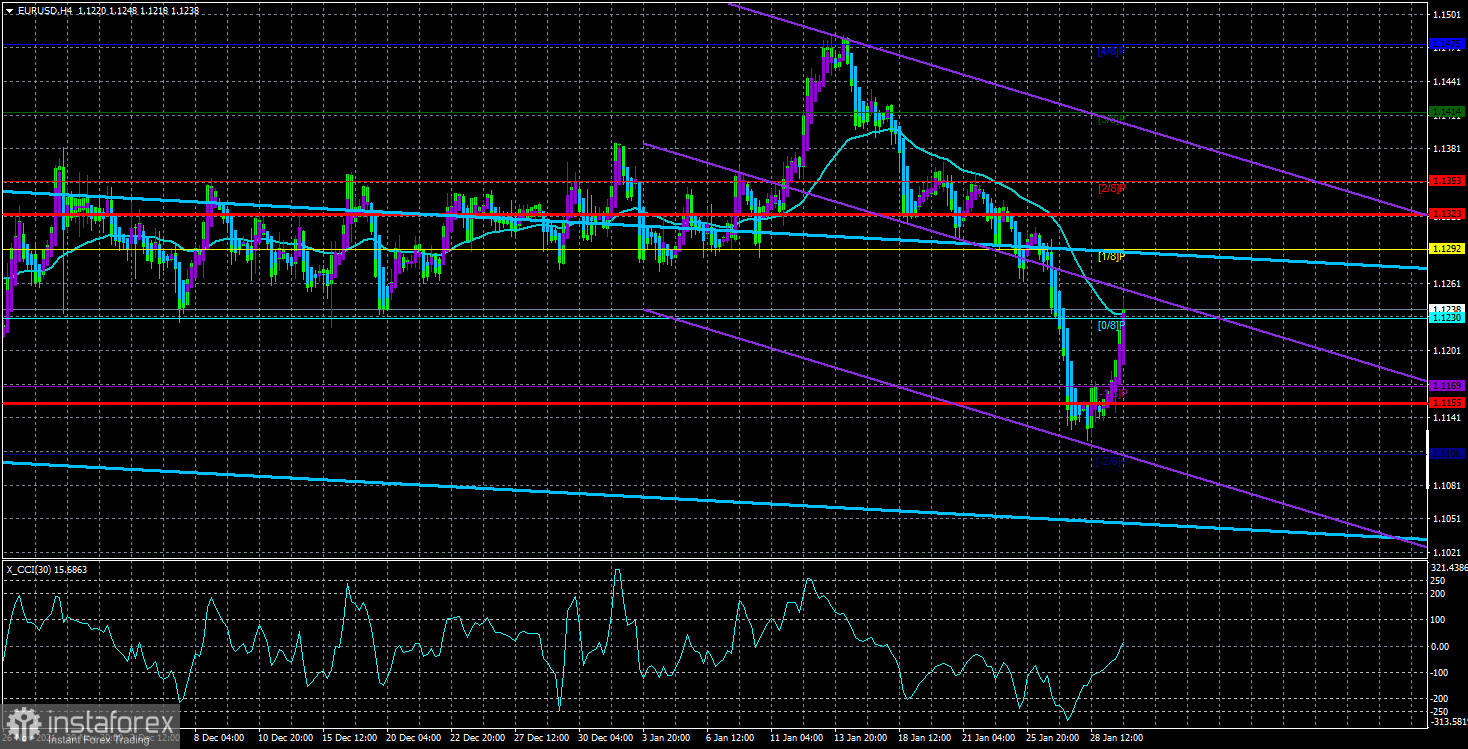

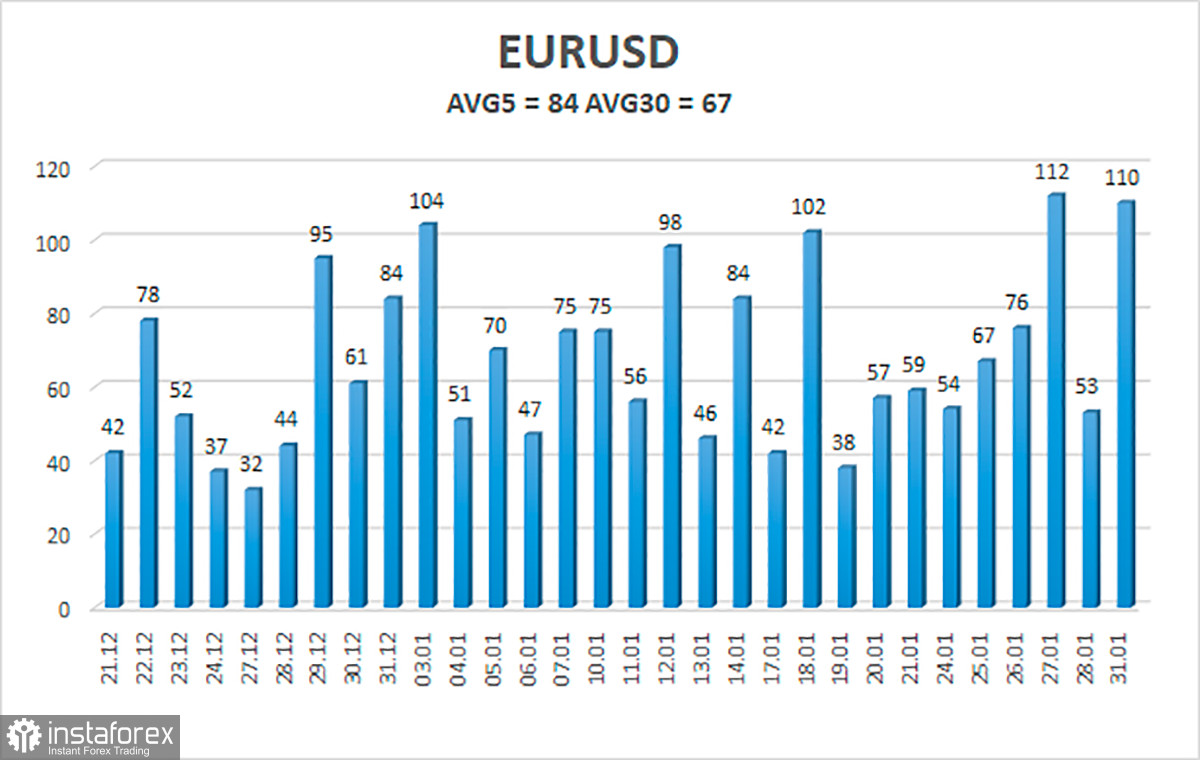

The volatility of the euro/dollar currency pair as of February 1 is 84 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1155 and 1.1323. The reversal of the Heiken Ashi indicator downwards signals the resumption of the downward movement.

Nearest support levels:

S1 – 1.1169

S2 – 1.1108

Nearest resistance levels:

R1 – 1.1230

R2 – 1.1292

R3 – 1.1353

Trading recommendations:

The EUR/USD pair adjusted to the moving average line. Thus, now we should consider options for new shorts with targets of 1.1169 and 1.1155 in the event of a price rebound from the moving average. Long positions should be opened no earlier than the price-fixing above the moving average line with targets of 1.1292 and 1.1323.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.