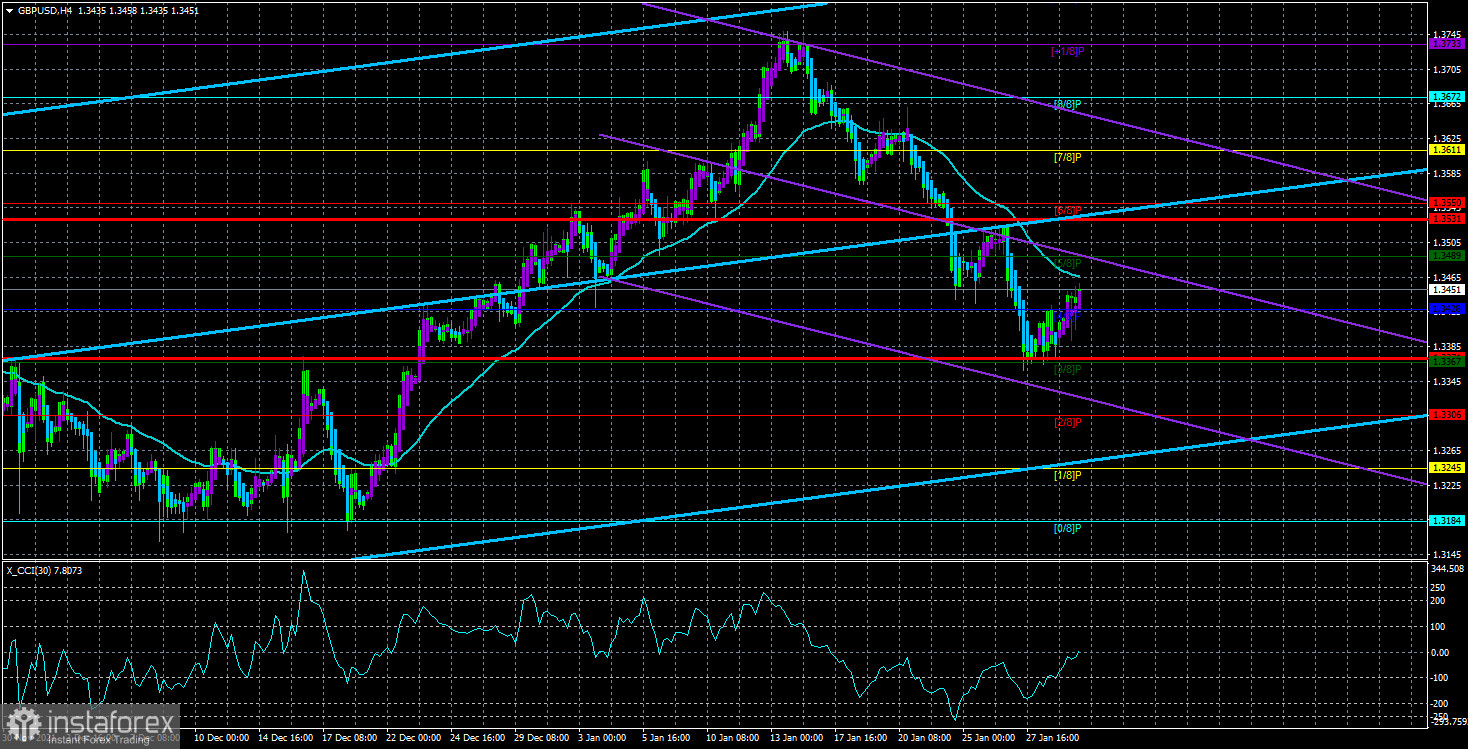

The GBP/USD currency pair on Monday also tried to adjust against a fairly strong fall over the past two weeks, but without much success. Also, as in the case of the euro currency, an unambiguous downward trend has developed on the 4-hour timeframe. The price is located below the moving average line, and the lower channel of the linear regression is directed downwards. However, the difference is that this week the British currency may receive serious support thanks to the Bank of England. We are talking about the fact that BA may raise the key rate this week, and Andrew Bailey will confirm the regulator's intentions to raise the rate this year to 1%. Of course, Mr. Bailey can also easily refute this assumption. But everything goes to the fact that it will be confirmed. Thus, when paired with the British pound, the dollar does not have such an unconditional advantage as when paired with the euro currency. Consequently, its further growth is far from obvious and will largely depend on what decisions BA will make this Thursday. After the results of the meeting of the British regulator become known, it will be possible to conclude the movement of the pair in the medium term. But until Thursday, the growth of the British currency has no specific fundamental and technical grounds.

Boris Johnson is flying to Kyiv for talks.

Boris Johnson has been a key figure in the UK over the past few weeks. Those who do not regularly read our reviews may think, what is strange or interesting here? After all, Johnson is the head of state. However, this news was not related to important internal and external political decisions. This news was related to scandals in the British government. Yesterday, it became known that Boris Johnson cancels his visit to Japan and urgently flies to Kyiv to discuss the situation that has developed in Eastern Ukraine. According to Johnson, Russia is preparing for an invasion of Ukraine and everything can end in a bloody war. Of course, all participants in the dialogue hope that all differences will be resolved peacefully. And all market participants hope for this. However, for Boris Johnson, escalating the situation in Ukraine can be a great way to divert the attention of the electorate from the scandals he has gotten into lately. Recall that in the UK, Scotland Yard has launched an official investigation of "coronavirus parties", which Boris Johnson calls "working meetings" and generally pretends that he did not know that meeting with colleagues and drinking wine is prohibited in "lockdown". The opposition and public opinion are putting pressure on Johnson, his political ratings and the ratings of his party are steadily falling. Therefore, the topic of the conflict in Eastern Ukraine can successfully divert everyone's attention from this unprofitable issue for Johnson.

For the British pound, this news still does not mean anything catastrophic. He is much more interested in the upcoming meeting of the Bank of England. However, in the long term, Britain may once again find itself in a political crisis. And these are serious problems for the economy, which has not yet fully recovered after Brexit and the pandemic. Recall that last year the country faced a "fuel crisis", a "logistical crisis" and may now "get into" a "political crisis" as well. However, so far everything is not so bad, and the pound has a chance to resume growth in the next week or two. The main thing is for the Bank of England to raise the rate on Thursday. In this case, we are waiting for a correlation between the euro/dollar and pound/dollar pairs.

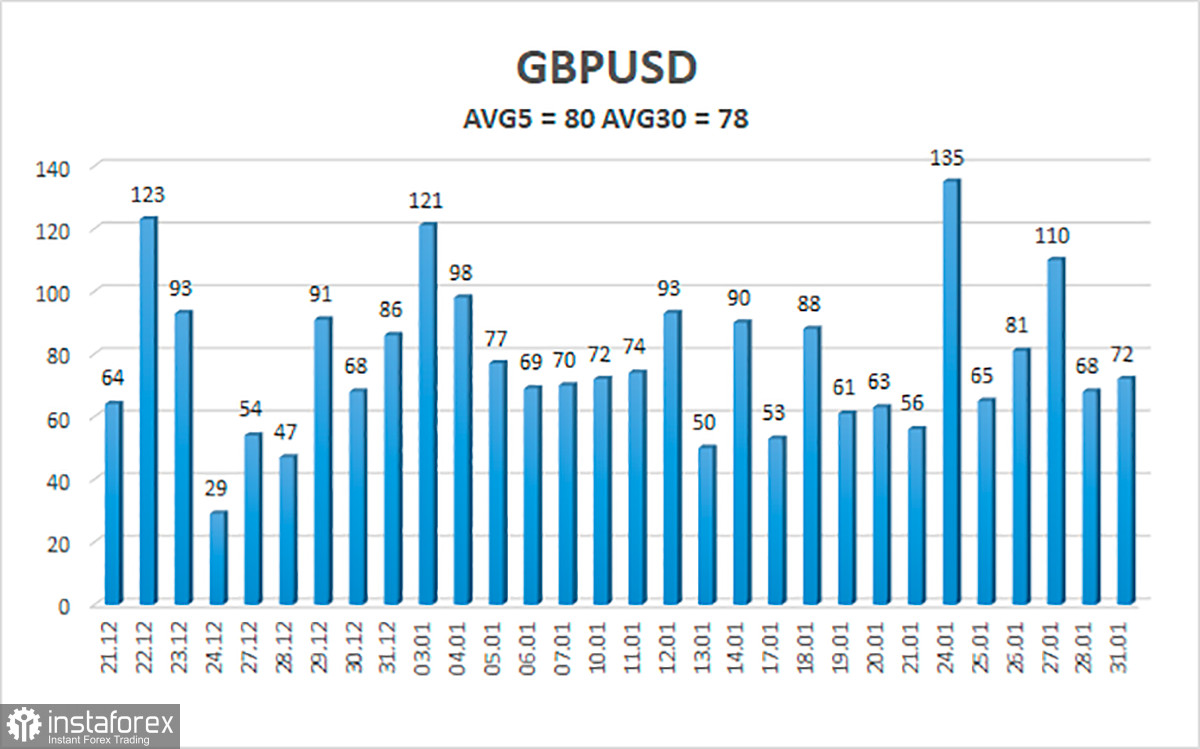

The average volatility of the GBP/USD pair is currently 80 points per day. For the pound/dollar pair, this value is "average". On Tuesday, February 1, thus, we expect movement inside the channel, limited by the levels of 1.3371 and 1.3531. The reversal of the Heiken Ashi indicator downwards signals a possible resumption of the downward trend.

Nearest support levels:

S1 – 1.3428

S2 – 1.3367

S3 – 1.3306

Nearest resistance levels:

R1 – 1.3489

R2 – 1.3550

R3 – 1.3611

Trading recommendations:

The GBP/USD pair began to adjust in the 4-hour timeframe. Thus, at this time it is recommended to open new short positions with targets of 1.3371 and 1.3306 in the event of a price rebound from the moving average line. It is recommended to consider long positions if the pair gains a foothold above the moving average, with targets of 1.3531 and 1.3550, and keep them open until the Heiken Ashi indicator turns down.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.