S&P500

Today, the Asian stock indices also showed growth. Japan's stock indices rose by 1.8%.

As for the commodity market, oil prices are holding near multi-year highs. Brent Crude is worth $89.50 per barrel.

The S&P 500 index is trading at 4,546. It is likely to stay in the range of 4,510 - 4,560. Its futures advanced by 0.5% this morning.

Microsoft and Tesla shares declined yesterday. However, the index closed in the black.

The US ISM Manufacturing index fell in January to 57.6% from 58.8%. Analysts had expected a stronger decline. It helped the index to regain ground.

The stock market is also extending gains amid a drop in Omicron cases.

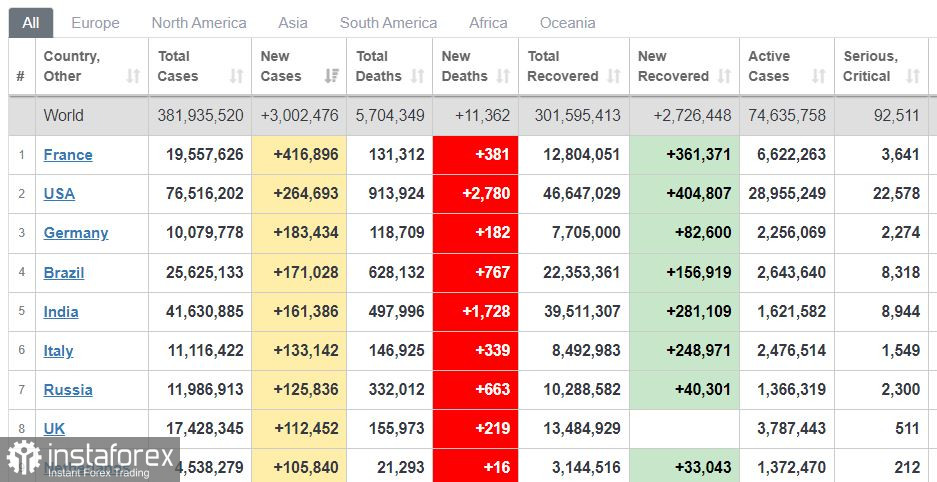

Yesterday, Omicron cases hit a new high of 3 million. The US recorded only 264,000 new cases. Last week, the figure was 700,000 per day. In Europe, there was the highest number of new cases. France reported 416,000 cases yesterday, while Germany posted 183,000. The Netherlands reported 100,000 cases per day. In Russia, there were 125,000 cases yesterday.

Alphabet, Google's parent company, unveiled an upbeat earnings report for the year. Sales increased by 32% to $ 75 billion. The company announced a 20-for-1 stock split in the form of a one-time special stock dividend.

The US labor market is steadily improving. Wage growth, staff turnover, and the number of vacancies in December were at multi-year highs. Nevertheless, there are signs of a slowdown in January. The number of vacancies showed a modest rise to 10.9 million from 10.8. The number of Americans who quit their jobs in December approached 4.3 million, a slight decrease from November's high of 4.5 million

Today, the US will publish the ADP employment change report. The reading is expected to show an increase of 100-200,000 new jobs. Last month, the figure totaled 800,000. The US Department of Labor has already warned traders that employment data for January may be weak due to the Omicron outbreak.

The US dollar index is trading at 96.25. It is likely to stay in the range of 95.90 - 96.50.

The US dollar index fell noticeably in two days. It lost 1.5%. Perhaps one of the reasons for its decline is the growth of the EUR/USD pair. The euro resumed an upward movement amid buoyant demand before the ECB meeting. The ECB is expected to clarify whether it will hike the key rate or not. Investors are betting on such a possibility because of soaring inflation in the eurozone.

The USD/CAD pair is trading at 1.2685. It is likely to remain in the range of 1.2600 - 1.2760. The pair is stuck at 1.2600 - 1.2800. To break out of this range, the pair needs strong fundamentals drivers. It can be news on the US dollar or oil prices.

Conclusion: on Tuesday, the US stock market sustained its bullish run. Analysts warn of a corrective decline in the coming days. However, the market may reach the highs of early January.