In today's review of the AUD/USD currency pair, we will summarize the results of January trading, try to predict the dynamics of this trading instrument this month, and also try to find the most acceptable options for positioning on the "Aussie". However, first let's pay attention to the decision of the Reserve Bank of Australia (RBA) and the rhetoric of its head, Philip Lowe. So, yesterday, the Australian regulator, following the results of its regular meeting, decided to keep the main interest rate at 0.1%. However, at the same time, the RBA considers it appropriate to complete the quantitative easing (QE) program more quickly than previously expected. The RBA explains such a decision in its monetary policy with good economic indicators. First of all, it concerns the labor market. Nevertheless, according to the statements of the head of the RBA, Lowe, the completion of the QE program does not at all imply a mandatory and imminent increase in rates.

These formulations are rather vague and ambiguous. If everything is as good in the economy as the RBA believes, and the curtailment of the quantitative easing program needs to be completed at an earlier date, then, according to all the logic of monetary policy, the process of raising rates should start after that. However, the Australian Central Bank is cautious about this and does not intend to rush. At least these are the comments of the head of the RBA at this point. Naturally, such an ambiguous tone did not fully satisfy market participants, and the Australian dollar is still if it is correct to say so, in limbo. Well, let's move on to the AUD/USD price charts and after that, we will make conclusions, if possible.

Monthly

So, the January trading ended for the "Aussie" with a decline against the US dollar. However, here you can find several positive and negative points for each of the opposing sides. During the January decline, the pair gained strong support at the significant technical level of 0.6970 and closed last month above the psychological level of 0.7000. This factor can be put into the piggy bank of bulls by "Aussie". At the same time, as can be seen on the monthly chart, the pair fell from the Ichimoku indicator cloud and closed the first month of the current year under its lower limit. But this is already a plus for players on the downgrade.

It is also worth noting the closing of monthly trading under the blue 50 simple moving average, and this is also the merit of the bears. At the moment of writing this article, the pair has rolled back to the broken lower border of the cloud and is trying to return to it. Although there are so many strong resistances at the top, represented primarily by the same 50 MA, and above the upper boundary of the cloud directly on which the red Tenkan line is located, that it will be possible to assume a medium-term, and maybe a long-term upward scenario only after the true exit up from the Ichimoku cloud and the breakdown of the Tenkan. In case of a breakdown of support at 0.6970, the next target of the bears for the "Australian" will be the blue Kijun line, which runs at 0.6759.

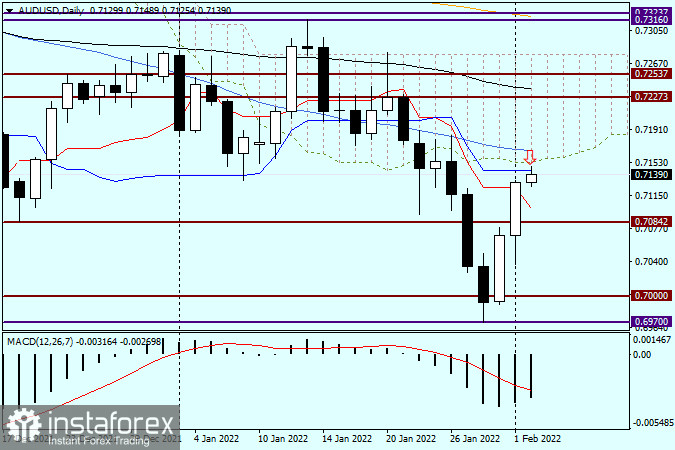

Daily

Despite the not quite intelligible signals given by the Australian Central Bank, in the previous two days, the AUD/USD pair showed pretty good growth. As a result, yesterday's trading closed above the red Tenkan line, and today the bulls on AUD/USD are trying to go up the blue Kijun line, but so far without success. Considering that the lower boundary of the Ichimoku Cloud passes a little higher than Kijun, as well as 50 MA, this may become an insurmountable obstacle for players to increase the course. I suggest waiting for the appearance of bearish reversal patterns of Japanese candlesticks at this or smaller time intervals, which may appear in the 0.7150-0.7170 price zone or near current prices. If we see the appearance of such models, I recommend selling the pair with the nearest targets near 0.7100.