S&P500

Omicron updates on January 4

The main US stock indices dropped significantly. The NASDAQ Composite lost 3.7%, the Dow Jones dived by 1.4%, and the S&P 500 declined by 2.4%.

In the morning, Japan's stock indices closed the week with a gain of 0.7%.

As for the commodity market, oil prices grew by 2% yesterday despite a strong fall in the US stock market. Brent Crude is estimated at $91.40 per barrel.

The S&P 500 is trading at 4,477. It is expected to stay in the range of 4,765 – 4,520.

Futures for the S&P 500 climbed higher by 1.2% after the market opening, So, the likelihood of a further ruse is quite high.

Shares of IT companies incurred the largest losses on Thursday. Meta Platforms Inc, the owner of social media network Facebook, suffered the biggest losses as the company's capitalization plunged by $230 billion in a day. Spotify shares were down by 17%, while PayPal dropped by 6%.

The stock market experienced a steep decline. However, analysts note that that was the equity market needed after 4-day growth. Perhaps the sell-off was due to the fact that traders closed their short-term positions.

The ISM Services PMI totaled 59.9% in January. The figure turned out to be better than the forecast. Initial jobless claims rose by 238,000 for the week, which was in line with the forecast. The number of long-term unemployed amounted to 1.62 million. the reading coincided with the forecast. Industrial production dropped by 0.4% in January.

Today, traders are anticipating the NonFarm Payrolls report. Economists expect the economy to add 150,000 new jobs. However, this data may have little impact on the market. The Department of Labor has already warned traders that the reading is likely to be weak due to the Omicron outbreak.

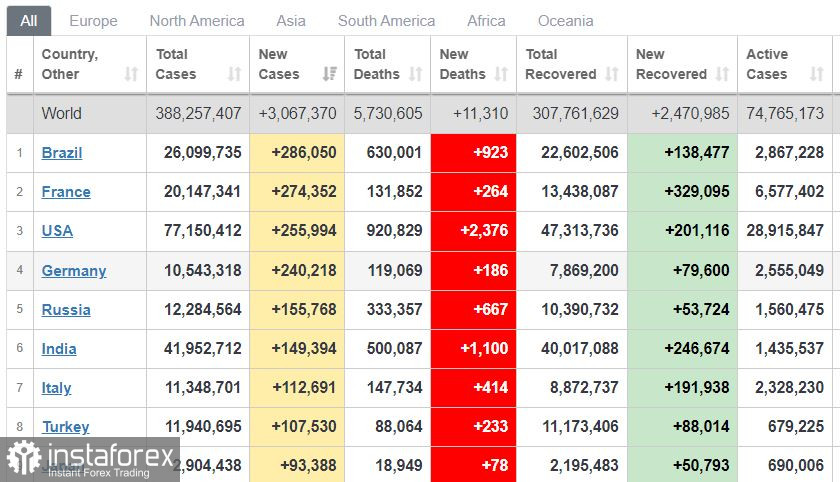

Omicron is raging across the globe. The number of new cases has already hit a high of 3.1 billion. Brazil reported the highest number of new cases- +286,000 yesterdays. There were 276,000 cases in France and 255,000 cases in the US. Germany recorded 240,000 cases. Russia is still unable to curb the Omicron spread. The country registered 155,000 new cases yesterday. Experts forecast a surge to 200,000. However, it will be the highest level. After that, the virus spread will ease. The Swedish government will lift most Covid restrictions next week. Denmark and Finland may follow suit. These countries have a high vaccination rate (80%) and a small number of Omicron cases.

The US dollar index is trading at 95.20. It is likely to stay in the range of 94.90 - 95.50.

The US dollar index has been declining for four consecutive days. It has already lost 2%. Now, the US dollar index is closer to the January lows than to highs. On Thursday, the US dollar index fell due to a strong rise of the EUR/USD pair following the ECB's meeting. The regulator confirmed that it would complete one of two asset-purchase programs in March. Apart from that, the Bank of England decided to hike the interest rate yesterday to raise the pound rate for the second time in a row. Now, the key rate is 0.5%. The reason for the rate increase is rising inflation. Like many central banks across the world, UK inflation is hovering above the target level. In the country, the target level is 4%.

The euro/dollar pair grew to 1.1460 from 1.1280 yesterday before the announcement of the ECB's decision. It gained 180 pips in a day, which was quite unusual given the movements of the euro in recent years.

The USD/CAD is trading at 1.2680. It is expected to remain in the range of 1.2600 - 1.2740. The pressure on the pair increased due to a fall in the US dollar and growing oil prices. So, it may decrease lower.

Conclusion: the US market is likely to grow after a strong fall on Thursday.