Gold dropped yesterday for the first time in four sessions. The price dropped below $1,800 due to high volatility. However, later the quotes managed to consolidate above this target level.

As a result, gold rose to $1,804.10 on the COMEX Exchange. In comparison with the previous close on Thursday, gold fell by $6.20 or 0.3%.

Analysts highlight 3 main factors that adversely affected gold:

– growth of US Treasury yields after the release of economic reports;

–ECB President Christine Lagarde's statements; she no longer rules out the possibility of raising interest rates this year);

– The BoE's decision to hike the benchmark rate for the second time to curb growing inflation.

At the same time, there are positive factors as well that yesterday helped gold to recoup its early losses. Today, they may serve as drivers for an increase.

The list of the main bullish factors includes:

- the steepest ever drop in the shares of Meta Platforms Inc. (on Thursday, the shares of Facebook's subsidiary company, crashed by 26% due to weak earnings report. Its market capitalization decreased by more than $ 250 billion);

- high volatility of shares of other companies on the US stock market;

- the decline in the US dollar index, which may experience the biggest weekly drop since March 2020 (the greenback lost momentum following weak ADP data for January);

- signs of rising inflation in the US: in January, the ISM Services PMI Index fell to a 16-month low, or 59.9%;

– expectations of the US NonFarm Payrolls report (the majority of analysts believe that the reading turns out to be weak);

– the aggravation of the geopolitical situation in the world (reportedly, Russia plans to fabricate a pretext for an invasion of Ukraine).

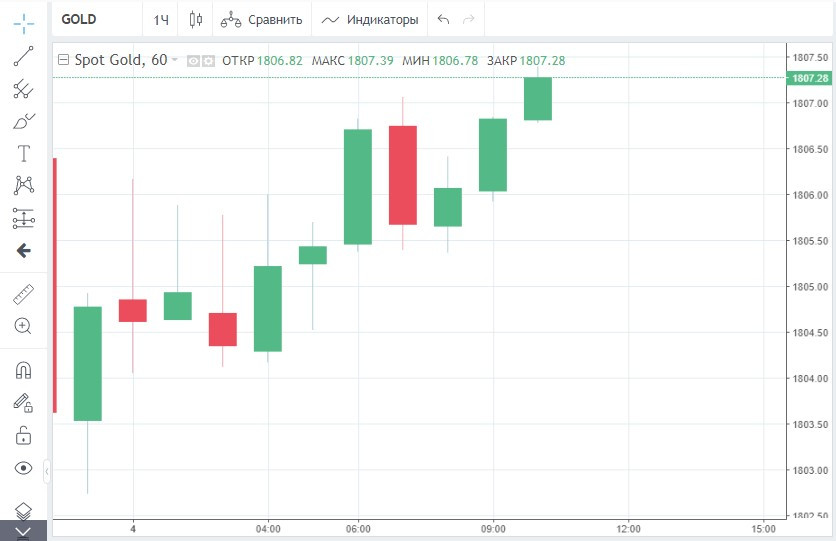

All these factors are sure to contribute to an increase in demand for gold. This morning, gold futures rose by 0.2% to $ 1,807.50. Since the beginning of the week, its price has climbed by almost 0.9%.

Analysts believe that gold may resume a strong rally following the NFP report. If the data turns out to be weak, this will lead to a sharp decline in the US dollar. Gold is sure to take advantage of its weakness.

It is already obvious that the number of people employed in the US non-agricultural sector will not be large. Traders need to pay close attention to the reaction of the stock market. If investors begin to get rid of some shares, gold may rise, analyst Naeem Aslam outlined.