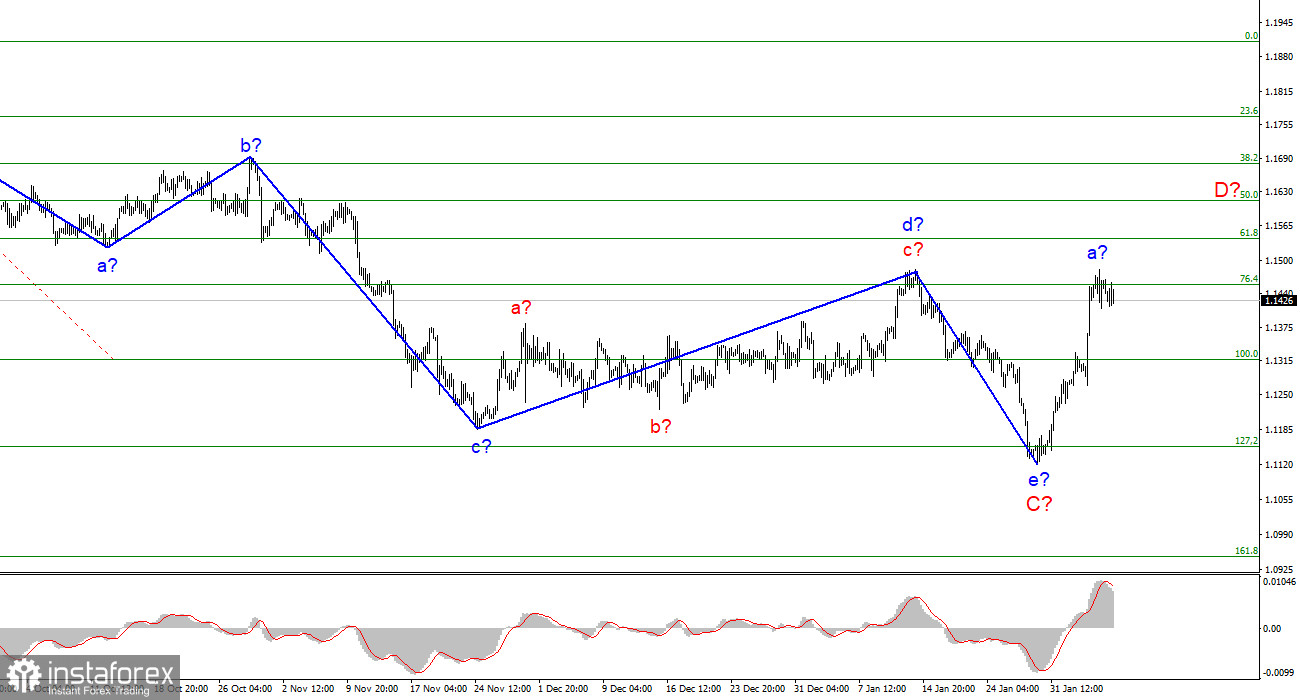

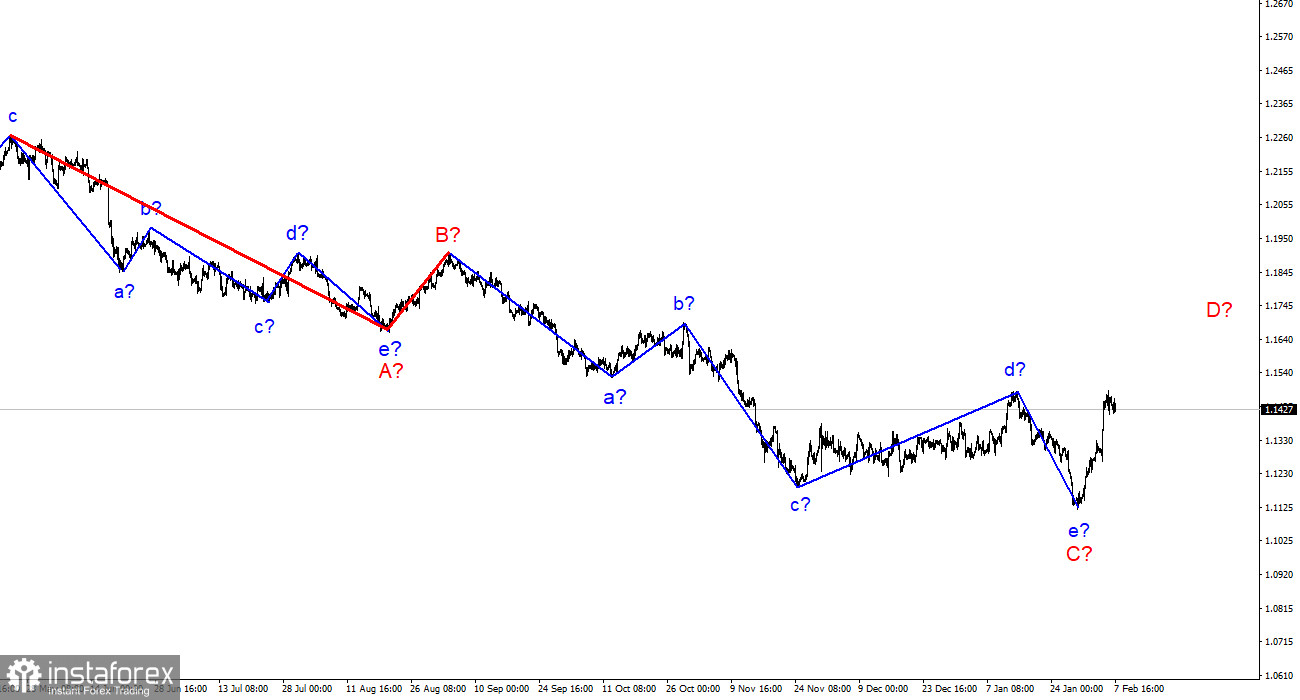

The wave marking of the 4-hour chart for the euro/dollar instrument has undergone certain changes, but nothing drastic. In the last week, a fairly strong increase in quotes continued. Thus, wave e-C is recognized as completed, since it turned out to be about the same size as the previous wave d-C. Therefore, the current upward wave is either D or 1. In the first case, the increase in the euro currency may already be completed. The picture below clearly shows that the correction wave B turned out to be shortened. The same can happen with wave D. An unsuccessful attempt to break through the 1.1455 mark, which corresponds to 76.4% Fibonacci, may become the second in recent weeks and lead to a departure of quotes from the reached highs, as well as the completion of the current wave. Thus, the wave marking now indicates a decline in quotes. And depending on how strong this decline will be, it will be possible to talk about which wave is being built now.

The Nonfarm Payrolls report in the USA had a double force.

The euro/dollar instrument fell by 40 basis points on Monday. Market activity is very weak today. However, what could you expect from Monday, when there was not a single interesting event or economic report during the day? Last week was extremely rich in interesting events. Partly due to these events, the European currency has increased by 360 basis points, and now it also has a good chance of continuing this movement. However, there were also Friday's reports in the US, among which were the most important Nonfarm Payrolls. Let me remind you that this report has been weaker than market expectations for the last two months. But at the end of January, it significantly exceeded expectations, amounting to 467 thousand with forecasts of 30-150 thousand. In addition, the previous report was also revised, from which it followed that 199 thousand new jobs outside agriculture were created. According to updated data, 510 thousand were created in December. Thus, two of the strongest reports at once should have increased demand for the US currency. And it was at the time when the construction of a descending wave was brewing, and the instrument made an unsuccessful attempt to break 1.1455. That is, a great opportunity was missed, but the current wave layout has not changed. Therefore, I still expect a decrease in the instrument. ECB President Christine Lagarde is due to speak today. Her speech last week was very meager and the market hopes that Lagarde will be more eloquent today. Everyone is still interested in information about when the ECB is going to start raising interest rates and how it is going to act if inflation in the EU continues to rise. Let me remind you that so far the European Regulator plans only the completion of the PEPP program in March and the completion of the APP program by the end of the year.

General conclusions.

Based on the analysis, I conclude that the construction of the ascending wave C is completed. If this assumption is correct, then in the near future the construction of a corrective downward wave b in D or 2-1 of a new upward trend section may begin. However, an option is also possible with the construction of a shortened wave D and the transition to the construction of a wave E of a downward trend section with targets located below the 11th figure. But from the 1.1455 mark, I still advise selling the instrument: at least some kind of downward wave should be built.

On a larger scale, it can be seen that the construction of the proposed wave D has now begun. This wave can be shortened or three-wave. Considering that all the previous waves were not too large and were approximately the same size, the same can be expected from the current wave. There are reasons to assume that wave D has already been completed, but a further increase in quotes will force us to reconsider this assumption.