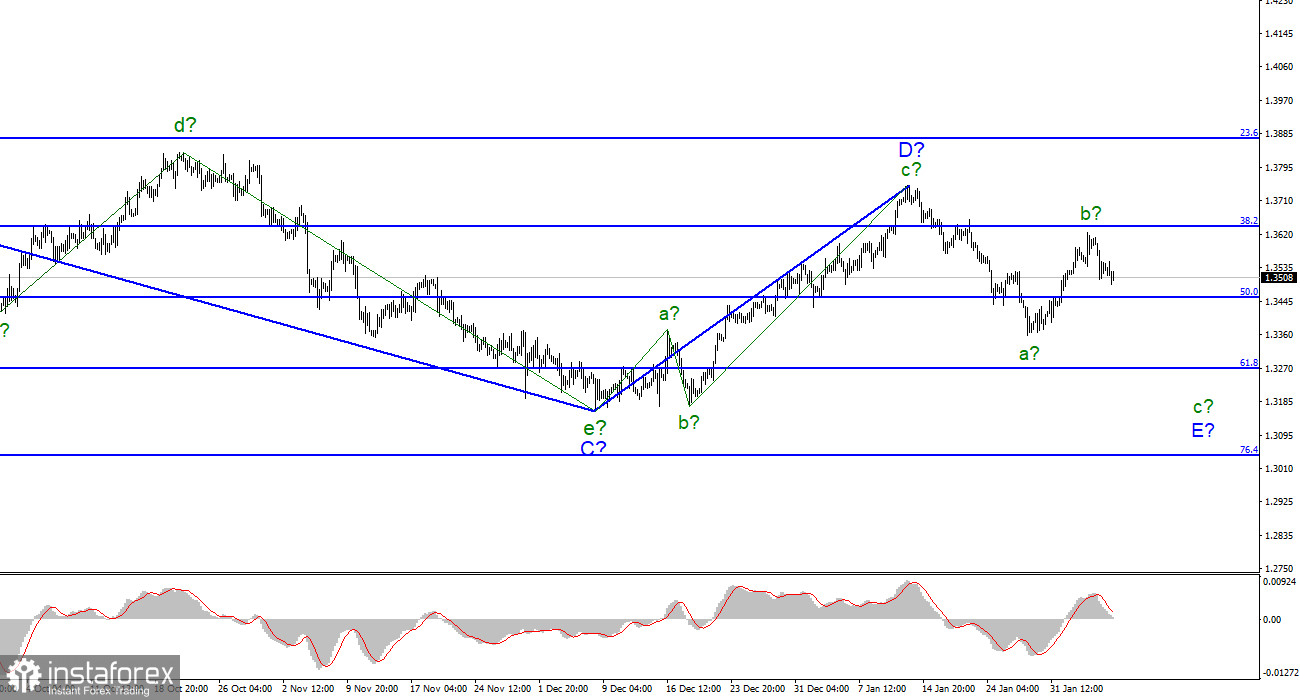

For the pound/dollar instrument, the wave markup continues to look very convincing. In the last few weeks, the instrument has been at the stage of building a new downward wave, which is currently interpreted as wave E of the downward trend segment. However, the increase continued all last week, which can be interpreted as a wave b-E. If this is indeed the case, then the decline of the instrument has already resumed last Friday and the construction of wave c-E has begun. The instrument did not reach the level of 1.3643 just a little, so there was no signal to sell. Nevertheless, the wave marking is now quite eloquent. If it is correct, then the assumed wave E may turn out to be very long, also five-wave, like the previous descending waves. If this is indeed the case, then the instrument can drop much lower than the 30th figure. As you can see, the increase in the interest rate by the Bank of England last week did not help the British to move to the construction of a new upward trend section.

The Bank of England raised the interest rate but could have made a more "hawkish" decision.

The exchange rate of the pound/dollar instrument decreased by a couple of dozen points during February 7, but in general, the instrument was in horizontal movement during the day. The amplitude was low, the market showed no desire to trade actively. However, this behavior of the market does not surprise me. After all, last week there were a large number of important events and reports and the market was trading very actively. But no news is expected in the first three days of the new week. However, even in the absence of a news background, the pound is gradually sliding down, which fully corresponds to the current wave markup. At this rate, it can continue building the proposed wave c-E. After all, this wave does not necessarily have to be built in a few days. For example, wave e-C was built for a month and a half. The main thing now is to correctly identify the wave itself. And I think it's done right. Nothing should spoil the mood of sellers this week. Only on Thursday, an inflation report for January will be released in America, to which the reaction may be unpredictable. If inflation continues to rise, then the demand for the dollar may grow, which will be just fine. On Friday, reports on GDP and industrial production will be released in the UK, but their markets may work superficially. I believe that this week the news background will be generally weak and as long as the instrument has not successfully attempted to break through the 1.3640 mark, we should count on building a new downward wave as part of E. There is no other news from the UK now, although, with such an iconic figure as Boris Johnson, news can always be found. Another thing is that the markets are not yet very interested in whether the British Prime Minister will resign prematurely?

General conclusions.

The wave pattern of the pound/dollar instrument assumes the construction of an assumed wave E. At the moment, the construction of a downward wave has begun, because the sales of the British now look more promising. The wave marking now does not allow for the double interpretation. The instrument may once again return to the 1.3640 mark to build three waves inside b-E, but this is unlikely. As well as a successful breakout attempt of 1.3640. Therefore, I advise selling now with targets located around the 1.3272 mark, which corresponds to 61.8% Fibonacci.

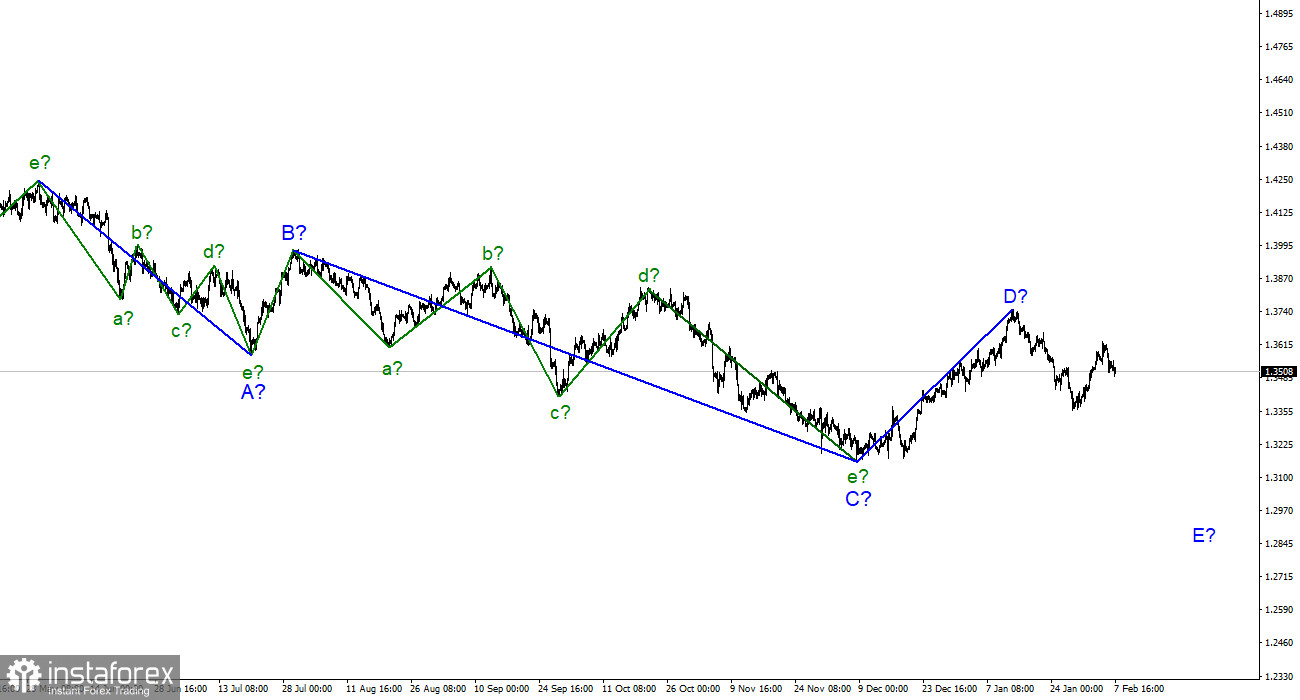

On the higher scale, wave D also looks complete, but the entire downward section of the trend does not. Therefore, in the coming weeks, I expect the instrument to continue to decline with targets below the low of wave C. Wave D turned out to be a three-wave one, so I cannot interpret it as wave 1 of a new upward trend segment.