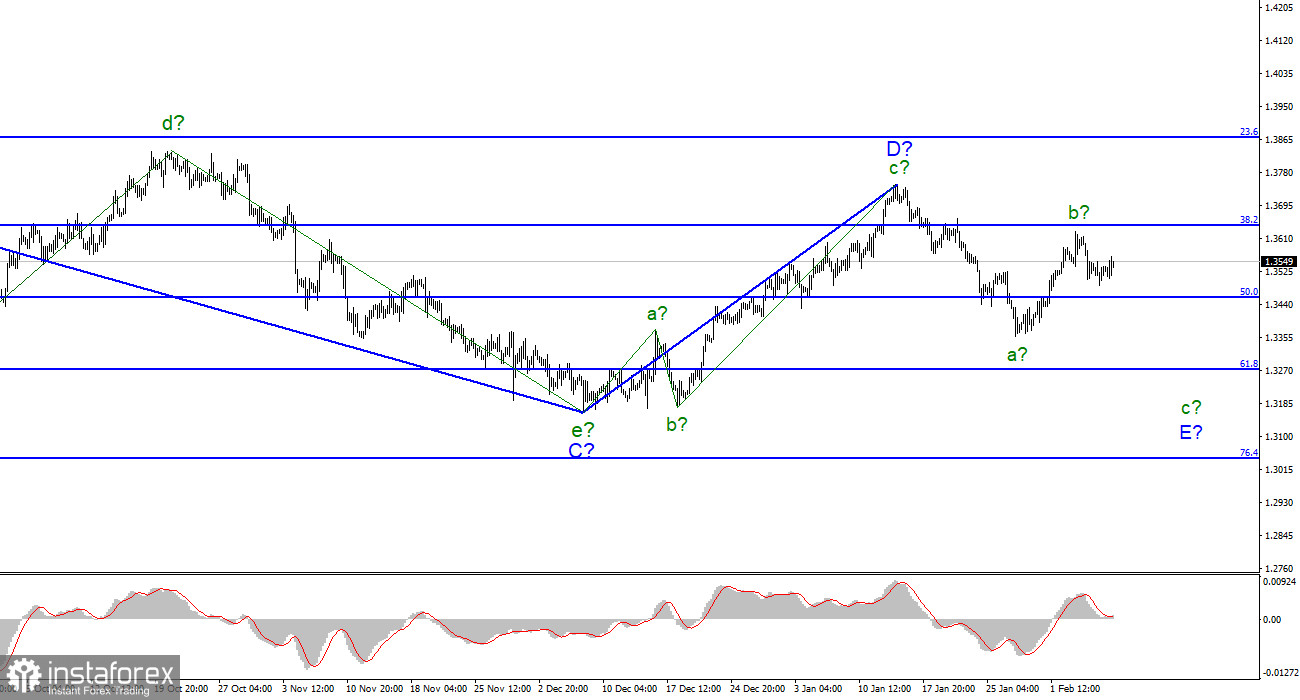

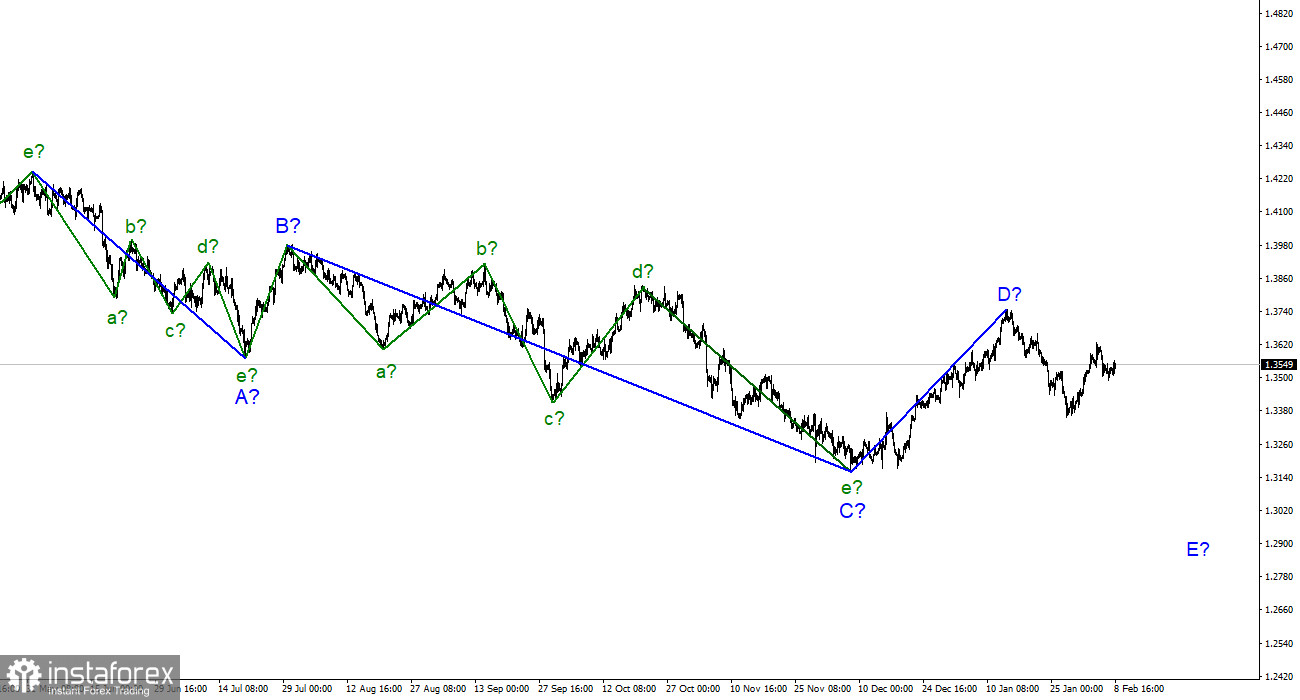

For the pound/dollar instrument, the wave markup continues to look very convincing. In the last few weeks, the instrument has been at the stage of building a new downward wave, which is currently interpreted as wave E of the downward trend segment. All last week, the increase continued, which can be interpreted as a wave b-E. If the current wave marking is correct, then the decline of the instrument has already resumed last Friday and the construction of wave c-E has begun. The instrument did not reach the level of 1.3643 just a little, so there was no signal to sell. Nevertheless, the wave marking is now quite eloquent. The proposed wave E can turn out to be very long, also five-wave, like the previous descending waves. If this is indeed the case, then the instrument can drop much lower than the 30 figure. As you can see, the increase in the interest rate by the Bank of England last week did not help the British to move to the construction of a new upward trend section.

Andrew Bailey: It hurts, but we need to get through it as quickly as possible.

The exchange rate of the pound/dollar instrument increased by 10 basis points during February 8, but in general, it has been trading almost horizontally for the last two days. The construction of a new downward wave has begun, but now the wave marking is such that it may require adjustments if something goes wrong. This week, hardly anything can go wrong, but there may be surprises. The most important report on inflation in the US should cause an increase in demand for the dollar, therefore, the downward wave should continue its construction. British statistics on Friday are unlikely to be able to reverse the trend. All the political twists and turns that Boris Johnson found himself in and which may lead to his resignation, it's interesting, but no more.

At the same time, the governor of the Bank of England, Andrew Bailey, urged Britons to put up with the fall in real incomes and said that this is necessary to reduce inflation. He said that UK workers should not ask for a wage increase, but at the same time noted that the Bank of England understands that the real incomes of Britons may decrease by 2% in 2022. This could be the country's worst drop in living standards since 1990. Wages are now growing by an average of 5%, while inflation this year may reach 7%. Andrew Bailey said he understands the pain of British workers but calls for "help to survive this problem." According to Bailey, inflation will not be stopped only by raising the interest rate. The demand must decrease slightly, which can be achieved due to a lower rate of wage growth compared to price growth. I would also like to note that the Bank of England has already raised the rate twice and intends to do it two more times at least this year.

General conclusions.

The wave pattern of the pound/dollar instrument assumes the construction of an assumed E wave. At the moment, the construction of a downward wave has begun, because the sales of the British now look more promising. The wave marking does not allow for double interpretation yet. The instrument may once again return to the 1.3640 mark to build three waves inside b-E, but this is unlikely. As well as a successful breakout attempt of 1.3640. Therefore, I advise selling now with targets located around the 1.3272 mark, which corresponds to 61.8% Fibonacci, for each MACD signal "down".

On the higher scale, wave D also looks complete, but the entire downward section of the trend does not. Therefore, in the coming weeks, I expect the instrument to continue to decline with targets below the low of wave C. Wave D turned out to be a three-wave one, so I cannot interpret it as wave 1 of a new upward trend segment.