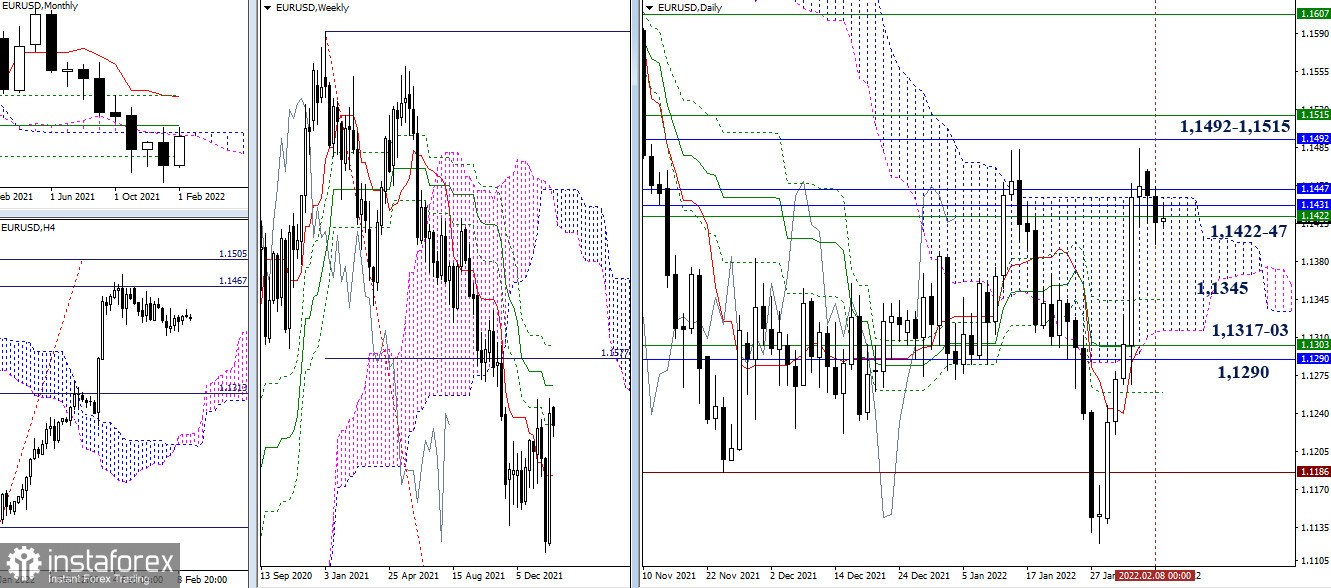

EUR/USD

As previously expected, the current inhibition led to a delay in the development of the situation. The accumulation of levels in different timeframes in the area of 1.1422-47 continues to exert its attraction and influence on current processes. The next important level for the bulls is the combination of medium-term trend resistances (1.1492 monthly + 1.1515 weekly). As for the bears, the support levels of 1.1345 (daily Fibo Kijun) and 1.1317 - 1.1303 - 1.1290 (lower limit of the daily cloud + weekly short-term trend + monthly Fibo Kijun) can be considered.

The pair is getting closer to the key level of the smaller timeframes – a weekly long-term trend during the long downward correction. Now, the trend is at 1.1402. A consolidation below it and reversal of the moving average can change the current balance of forces, but as long as the pair stays above the level (1.1402), the advantage remains on the bullish side. Today, the upward targets can be noted at 1.1445 - 1.1473 - 1.1498 (classic Pivot levels). If priorities change, the strengthening of the bearish mood will take place along the supports of the classic pivot levels (1.1392 - 1.1367 - 1.1339).

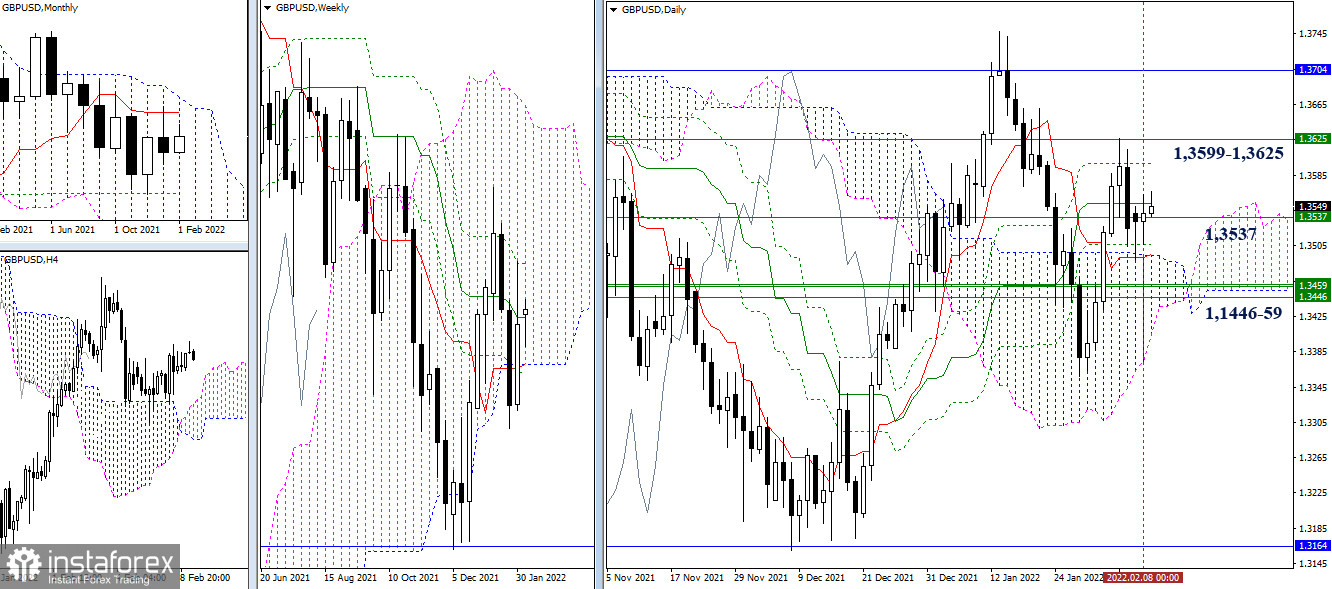

GBP/USD

The pound keeps trading in the attraction zone of daily levels, while the center of gravity is currently in the weekly medium-term trend (1.3537). As a result of slowdown and pause, the main conclusions and expectations about the development of the movement remain the same. The support and resistance levels of this area also retain their value and location.

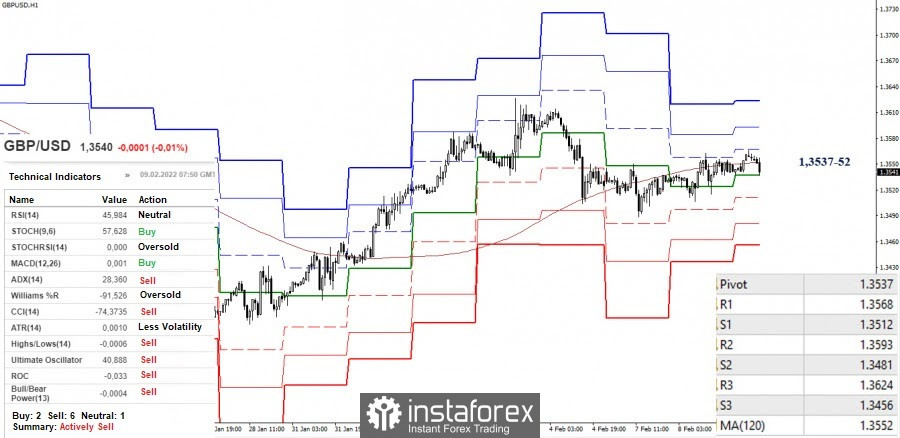

There is uncertainty in the smaller timeframes. The pair remains in the attraction zone of key levels, which are currently uniting their efforts in the area of 1.3537-52 (central pivot level + weekly long-term trend). Trading below or above the levels, without interacting with them, will form the preponderance of the forces of one side or the other. The upward pivot points to resume growth are at the resistance of the classic pivot levels 1.3568 - 1.3593 - 1.3624, while the downward pivot points for the decline are at the support of the classic pivot levels 1.3512 - 1.3481 - 1.3456.

***

Ichimoku Kinko Hyo (9.26.52) and Kijun-sen levels in the higher time frames, as well as classic Pivot Points and Moving Average (120) on the H1 chart, are used in the technical analysis of the trading instruments.