Inflation fears have been driving up gold prices in recent days. But how long will this last? Will the precious metal be able to withstand rising interest rates in the future?

Investors focus on the January US consumer price index to be released on Thursday. Economists expect the annual inflation rate to rise to a 40-year high of 7.3%.

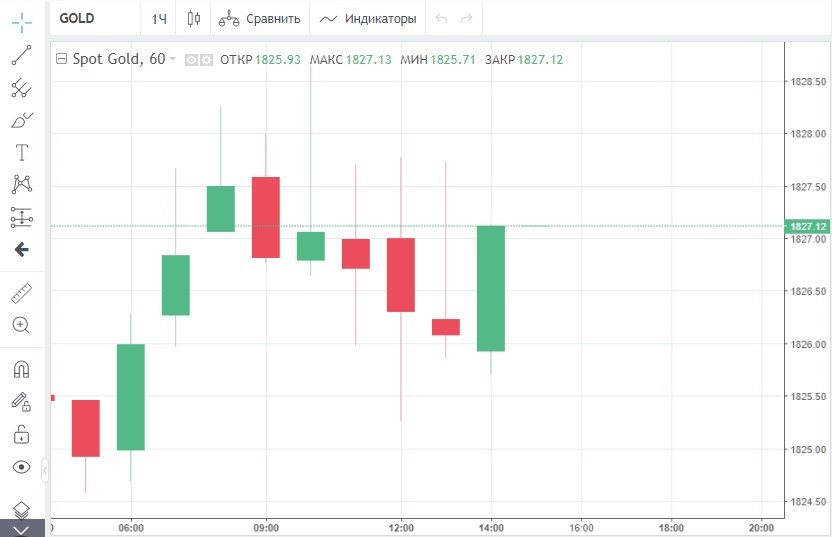

Demand for gold increased on the expectations for the data. The precious metal closed in the black for three sessions in a row. At the previous trading session, on Tuesday, bullion rose by 0.3%. In money terms, the difference with the previous close was $6.10. At the end of the day, the asset was trading at $1,827.9. This is the highest value in 2 weeks.

The price of gold increased despite a 0.2% strengthening of the dollar. The bullion also ignored an increase in the yield on 10-year U.S. government bonds, which reached 1.96% - almost 2020 highs.

For both the dollar and yields, the prospect of a faster Fed interest rate hike is now the main driver.

If Thursday's report meets economists' expectations and US annual inflation actually rises to 7.3%, the US central bank may act more aggressively. Most likely, it will raise interest rates by 50 basis points as early as March to curb the strong inflationary pressure.

Definitely, the prospect of a sooner tightening may lead to a sharp collapse in the gold market next month. However, there is a favorable scenario for the precious metal.

If the US consumer price index turns out to be below forecasts, it will allow the regulator to choose a less aggressive path, while inflation is likely to continue to accelerate.

The Fed's lagging rate amid further price increases is an ideal environment for gold. In such a scenario, investors are likely to prefer gold, which is traditionally considered one of the best hedging instruments against inflation compared with fiat currencies and stocks.

The demand for the safe-haven asset has already grown significantly since the beginning of the year. The investment appeal returned to gold when other financial markets (stock market and cryptocurrency market) were lacking stability.

Analysts at the Swiss bank UBS note that at this stage, gold as a hedge asset is valued higher than other popular instruments, which are also used to diversify portfolios.

Experts believe that the desire of traders to secure their investments in a period of volatility in the markets will help the asset to remain above the important level of $1,800 by the end of the first quarter.

However, in the next quarter, the appetite for gold may gradually begin to fade. As inflationary pressures and coronavirus risks diminish, investors will once again buy risky instruments such as stocks and cryptocurrencies. This will have a negative effect on the value of the precious metal. It may fall as low as $1,700, UBS said.

Bank of America predicts gold will trade at an average of $1,900 in the first quarter and $1,925 for the year as a whole. Analysts at the largest US financial conglomerate believe demand for gold will remain high in 2022. A number of factors may contribute to this:

- continued rise in inflation amid supply problems

- increasing fears of a slowdown in the global economic recovery due to the spread of COVID-19

- tense geopolitical situation in the world.

Another US giant - Wells Fargo - is optimistic about gold. According to its experts, the asset may turn from the loser it was last year into one of the leaders in 2022.

The precious metal may break through to new record highs. If gold can break through the important $1,900 level despite Fed interest rate hikes, it will be priced at $2,000 to $2,100 by the end of 2022.

Wells Fargo analyst Austin Pickle expects higher inflation, stock market volatility, volatile yields on risky assets, and an easing of pressure on gold from the dollar to help prices rise. These macroeconomic developments are likely to boost bullion purchases throughout the year.