What is needed to open long positions on GBP/USD:

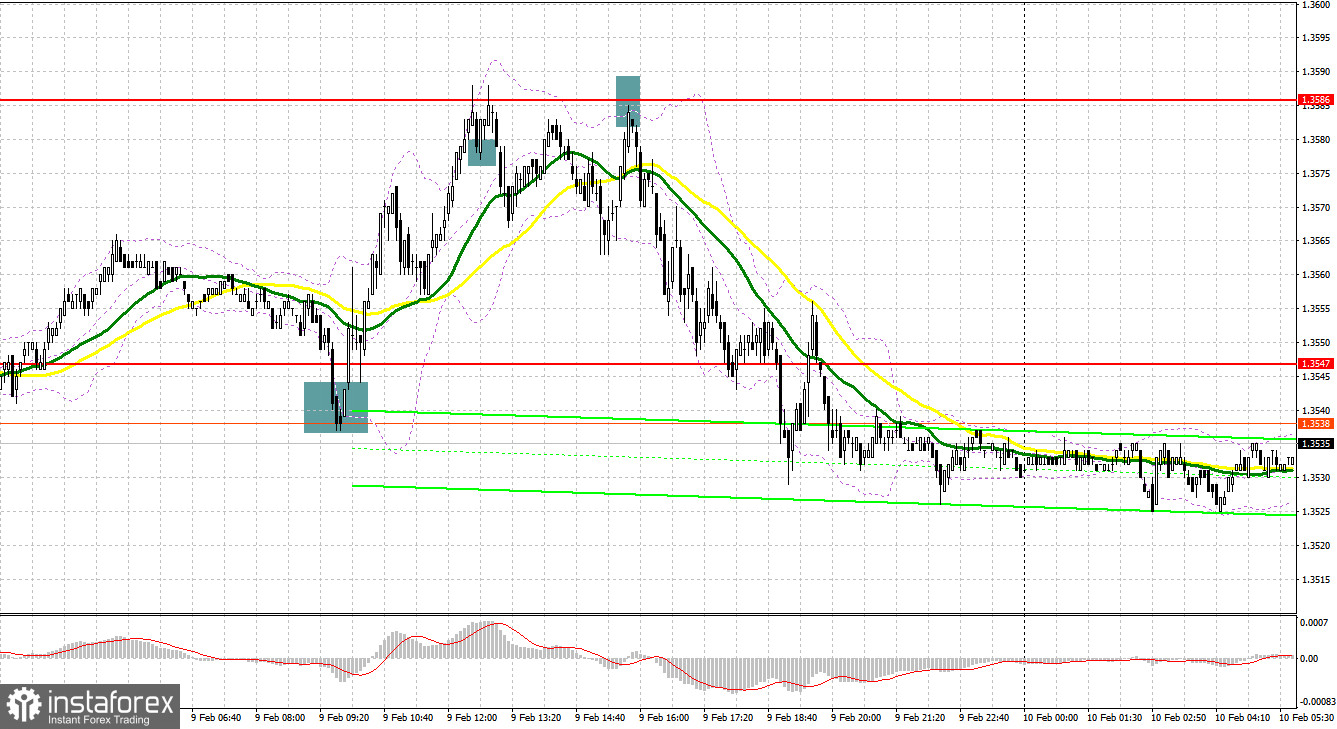

Yesterday, there were a lot of signals for market entries. Let's look at the 5-minute chart and try to figure out what actually happened. In my afternoon article, I highlighted the level of 1.3542 and recommended making trading decisions with this level in focus. I mentioned that the lack of fundamental statistics would be positive for the pound sterling. Bears failed to push the pair below 1.3542. It created an entry point into long positions as part of the upward movement that started yesterday. The British currency added 45 pips after a breakout and consolidation above 1.3577. An upward test of this level led to the formation of entry points into long positions. However, in the second half of the day, technical indicators had changed. Therefore, it was necessary to focus on new levels. After an unsuccessful attempt to break through 1.3586 in the afternoon, bears asserted strength. There were entry points into short positions. As a result, the pair dropped by more than 40 pips, closing the trading day below the opening level.

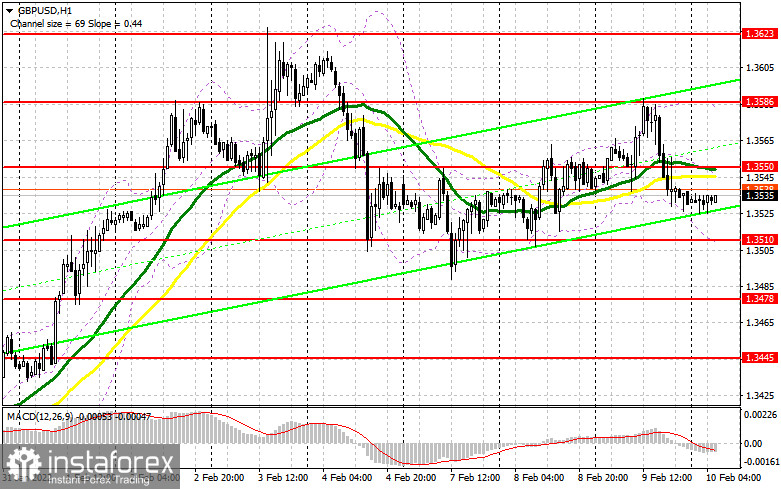

Bears took the upper hand in the second half of the day. I reckon that the further trajectory of the pair will mainly depend on US inflation data. The economic calendar for the UK will remain uneventful in the first half of the day. So, the pair may return to 1.3550 where moving averages are located in the negative territory. Bulls and bears will try to gain control over this level as it determines the future moment of the pair. Of course, the equally important task for today is to protect the support level of 1.3510. If bulls push the pair to this level, it will resume an upward movement as it did last week. However, it is crucial for the price to form a false breakout there. This will give the first entry point into long positions. Apart from that, the pair needs to break through and perform an upward test of 1.3550. It will give an additional buy signal as the price may rise to 1.3586 and the February highs of 1.3623 and 1.3683. I recommend locking in profits at this level. It will act as a more distant target level. The price is likely to hit these levels only in the case of weak US inflation data, which is due in the afternoon. In case of a decline in GBP/USD during the European session and a lack of activity at 1.3510, it is better not to rush to buy risky assets. I would advise you to wait for the test of the next major level of 1.3478. Only the formation of a false breakout there will give an entry point into long positions. You can buy the pound sterling immediately at a drop from 1.3445 or even a lower low of 1.3407, bearing in mind a 20-25 pip intraday correction.

What is needed to open short positions on GBP/USD:

Bears managed to interfere. However, now, only US inflation data and statements of the Governor of the Bank of England, Andrew Bailey, will determine its future trajectory. There are no other objective reasons for the sell-off of the British currency yet. Today, bulls need to defend the 1.3550 level. If the price fails to hold above this level, the first entry point into short positions will appear. Traders will be betting on a downward correction to the lower boundary of the 1.3510 sideways channel formed yesterday. A breakout and a test of 1.3510 in the first half of the day is unlikely to lead to a major drop in the pound sterling. Yet, if it happens, it will give an additional entry point into short positions with the target levels of 1.3478 and 1.3445. I recommend locking in profits at this level. If the pair grows during the European session and bears show no energy at 1.3555, it would be better to cancel selling until the next major resistance level of 1.3586. I would also advise you to open short positions there only after a false breakout. It is possible to sell GBP/USD immediately on a rebound from a high of 1.3623 or even a higher high of 1.3683, bearing in mind a 20-25 pip intraday correction.

.

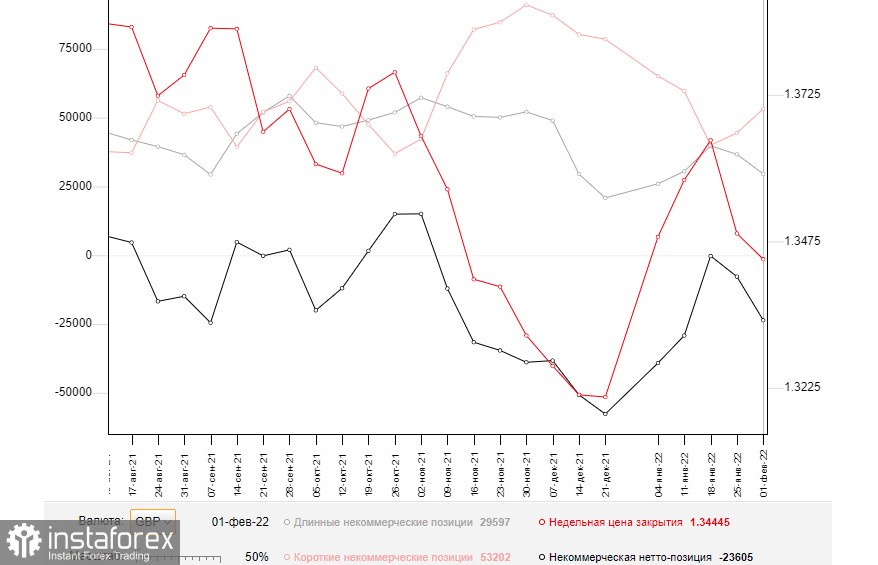

COT report

The COT report (Commitment of Traders) from February 1 showed a sharp increase in short positions and a drop in long ones. This enabled a modest contraction of the positive delta. However, we should understand that the data does not take into account the BoE policy meeting where the regulator hiked the key rate. Nevertheless, it did not help the pound to develop a rally. Traders are well aware that the regulator took a tougher stance on monetary policy to curb rising inflation. Given that the UK economy is going through hard times and at any moment the pace of economic growth may slow down, the British currency did not advance considerably following the interest rate hike. On top of that, the Fed is also expected to raise the benchmark rate in March this year, which will be bearish for GBP/USD. Some analysts believe that the central bank may resort to a more aggressive stance and raise the key rate by 0.5% at once, rather than by 0.25%. The US dollar is sure to take advantage of it. The COT report from February 1 revealed that the number of long non-commercial positions decreased to 29,597 from 36,666, while the number of short non-commercial positions rose to 53,202 from 44,429. This led to an even greater increase in the negative non-commercial net position to -23,605 from -7,763. The weekly closing price declined to 1.3444 from 1.3488.

Signals of technical indicators

Moving averages

Trading is carried out at about the 30 and 50 daily moving averages. It indicates market uncertainty before the release of important economic reports.

Remark. The author is analyzing the period and prices of moving averages on the 1-hour chart. So, it differs from the common definition of classic daily moving averages on the daily chart.

Bollinger Bands

A breakout of the upper border at about 1.3575 will trigger a new bullish wave of GBP. Alternatively, a breakout of the lower border at about 1.3510 will escalate pressure on GBP/USD.

Definitions of technical indicators

- Moving average recognizes an ongoing trend through leveling out volatility and market noise. A 50-period moving average is plotted yellow on the chart.

- Moving average identifies an ongoing trend through leveling out volatility and market noise. A 30-period moving average is displayed as the green line.

- MACD indicator represents a relationship between two moving averages that is a ratio of Moving Average Convergence/Divergence. The MACD is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. A 9-day EMA of the MACD called the "signal line".

- Bollinger Bands is a momentum indicator. The upper and lower bands are typically 2 standard deviations +/- from a 20-day simple moving average.

- Non-commercial traders - speculators such as retail traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Non-commercial long positions represent the total long open position of non-commercial traders.

- Non-commercial short positions represent the total short open position of non-commercial traders.

- The overall non-commercial net position balance is the difference between short and long positions of non-commercial traders.