According to US CPI data for January, which was released by the US Department of Labor on Thursday, inflation rose by 0.6% month-over-month, up from 0.5% in December. Economists predicted an increase of 0.4%.

Year-over-year, inflation jumped by 7.5%, reaching a 40-year high and beating the forecasted increase of 7.3%.

The report noted an increase in food and energy prices, as well as rents. Food prices went up by 0.9% last month, while the energy index gained 0.9%. Falling fuel prices were counterbalanced by rising electricity prices.

The core CPI, which strips out volatile food and energy prices, advanced by 0.6% last month, matching December's increase.

January's core CPI rise was the seventh in the past 10 months that exceeded 0.5%.

The core index gained 6.0% year-over-year.

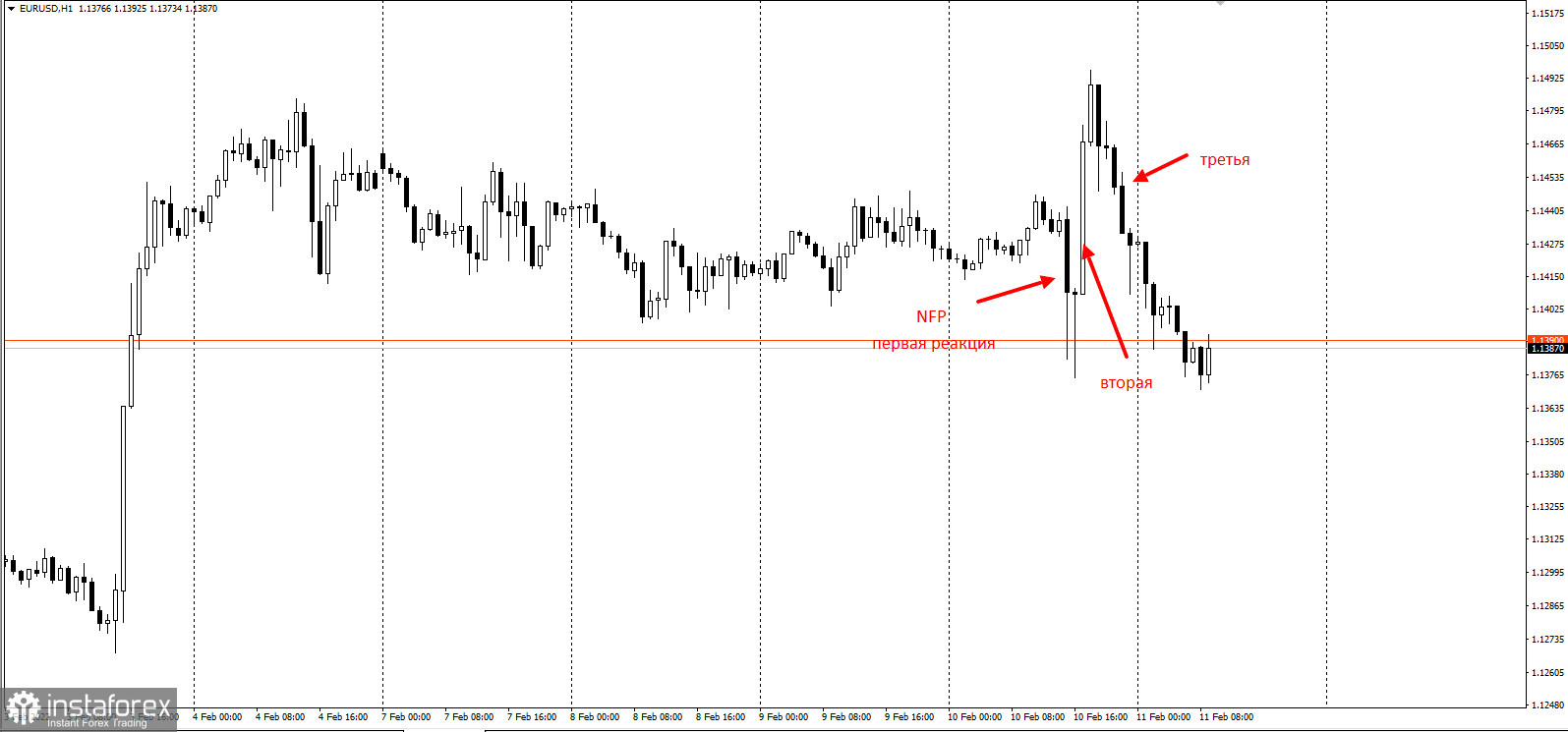

Despite bullish signals for the US dollar, trader reaction to the data was mixed. EUR/USD changed direction three times during Thursday's New York session.

Amid continuing calls for a 50 basis points interest rate hike in March, economists now expect six rate increases this year.

According to Katherine Judge, senior economist at CIBC, soaring prices are reinforcing the hawkish position of the Federal Reserve, confirming the need to hike interest rates.

"While we still expect more favorable base effects and a partial easing of supply shortages to push core inflation lower this year, this suggests it will remain well above the Fed's target for some time", Andrew Hunter, senior U.S. economist at Capital Economics commented. He expects inflation to peak in January.