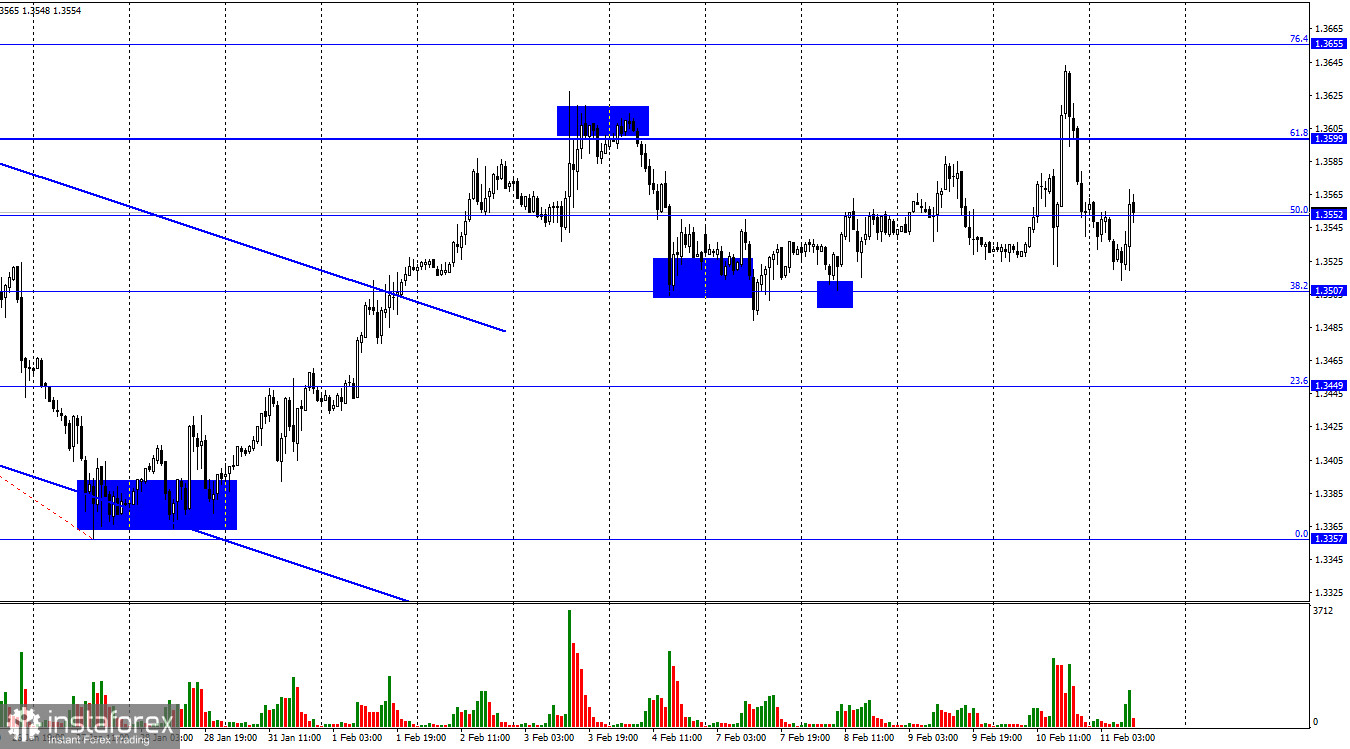

Good afternoon, dear traders! On the 1H chart, the GBP/USD pair is rather volatile. Yesterday, it was clearly visible on the chart. After the release of the US inflation report, the pair tumbled. Shortly after, it rose but lather fell again significantly. This morning, the price made an upward reversal thanks to the pound sterling, So, it is climbing again. Traders tend to ignore all correction levels presented on the H1 chart. Thus, it is better to use the 4H chart to monitor signals. Yesterday, the market was volatile ahead of the publication of US inflation data. Today, the UK unveiled its GDP report for December. The reading turned out to be better than expected. Traders also studied industrial production figures, which were slightly stronger than forecasts.

Thus, the British currency advanced in the morning amid positive economic reports. However, macroeconomic data released on Friday are not so upbeat. This is why the pound sterling is unlikely to grow all day. Judging by the 1H chart, in the last eight days the pair has been hovering between the levels of 1.3507 and 1.3618. This is not a sideways corridor but bulls and bears are still tussling. There are no winners yet. Today, the macroeconomic calendar is uneventful in the second half of the day. So, there are no drivers for both parties. Trading volumes are also likely to be low. Specuator5s shod wait for the next week. The pair may need some time to escape from the range of 1.3507-1.3618. Apart from that, political tensions are not easing. Boris Johnson is still being widely discussed in the media, namely scandals that may hurt his political profile. There are rumors that the Conservative Party is trying to find a way to force Johnson to resign.

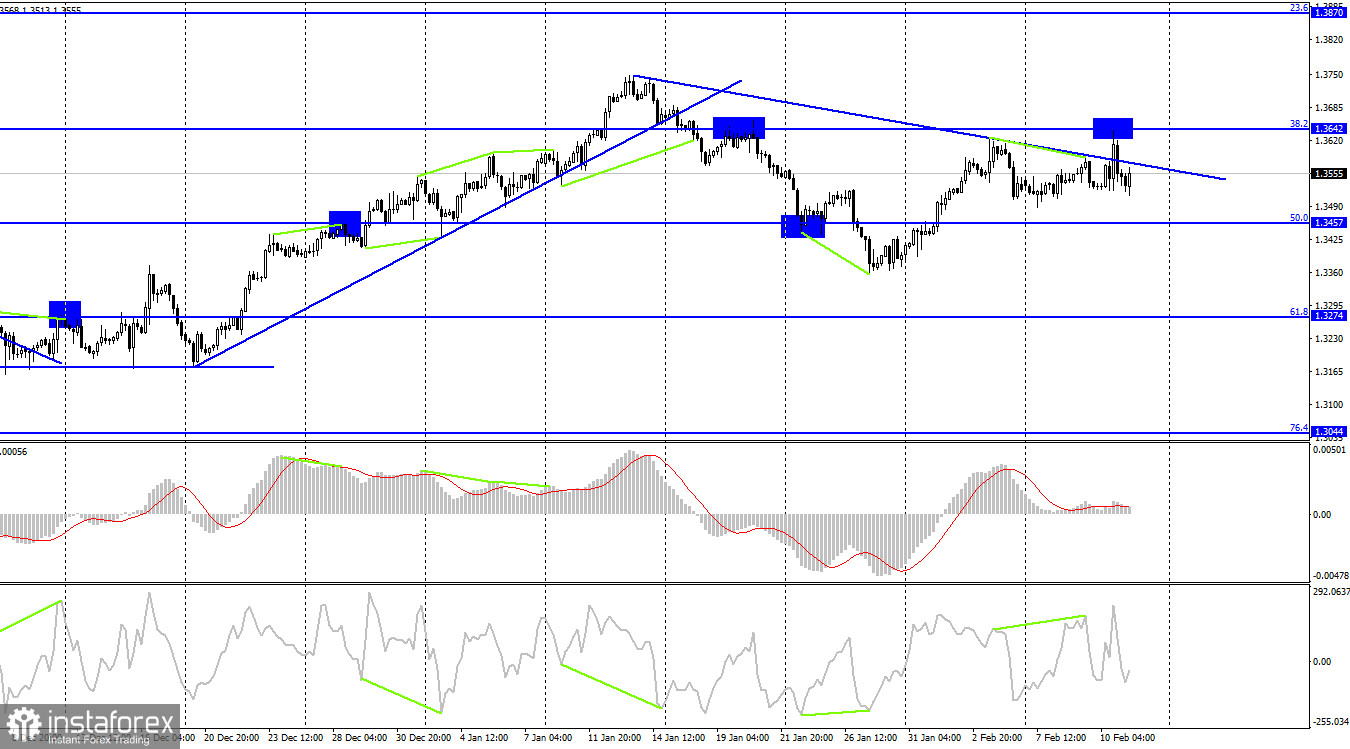

On the 4H chart, the pair performed a rebound from the correction level of 38.2% - 1.3642. After that, it dropped to the Fibonacci level of 50.0% - 1.3457. Yesterday, there was a breakout of the descending trend line, which indicated a bearish market. However, this breakout may be false. I believe that the bearish sentiment persists among traders.

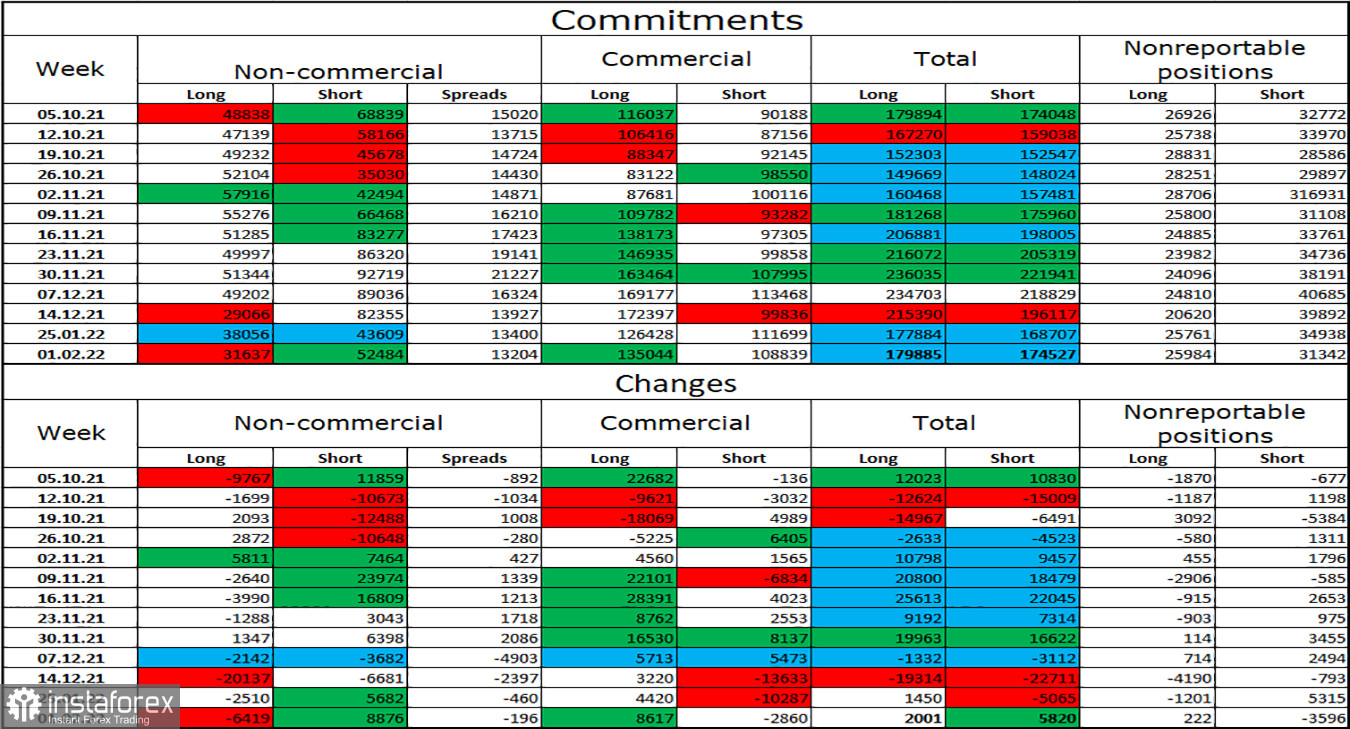

COT report (Commitments of Traders):

The sentiment of the "Non-commercial" traders has changed dramatically over the reporting week. During this week, speculators opened 8,876 Short contracts and closed 6,419 Long contracts. Thus, if a week ago the total number of Long and Short contracts in the hands of the "Non-commercial" traders was almost the same, the gap is almost twice as big: 52,484 – 31,637. It means that the market is now bearish, which corresponds to technical indicators on the daily chart. In the last few months, the mood of major players has changed quite often. You can see it by studying the figures of the first two columns of the table. Perhaps, it is better to refrain from making a long-term forecast.

Macroeconomic calendar for the US and the UK:

UK- GDP data (07:00 UTC).

UK- Industrial Production (07:00 UTC).

US - University of Michigan Consumer Sentiment Index survey (15:00 UTC).

On Friday, all economic reports for the UK have already been released. Traders are now anticipating the University of Michigan Consumer Sentiment Index survey, which will be unveiled later. However, trading activity is likely to remain low until the end of the day.

Outlook for GBP/USD and trading recommendations:

It is recommended to open short positions on the pound sterling on a rebound from the trend line on the 4H chart with the target level of 1.3457. The price dropped from the level of 1.3642. It is better to open long positions if the price rises above the trend line on the 4H chart with the target levels of 1.3642 and 1.3655.