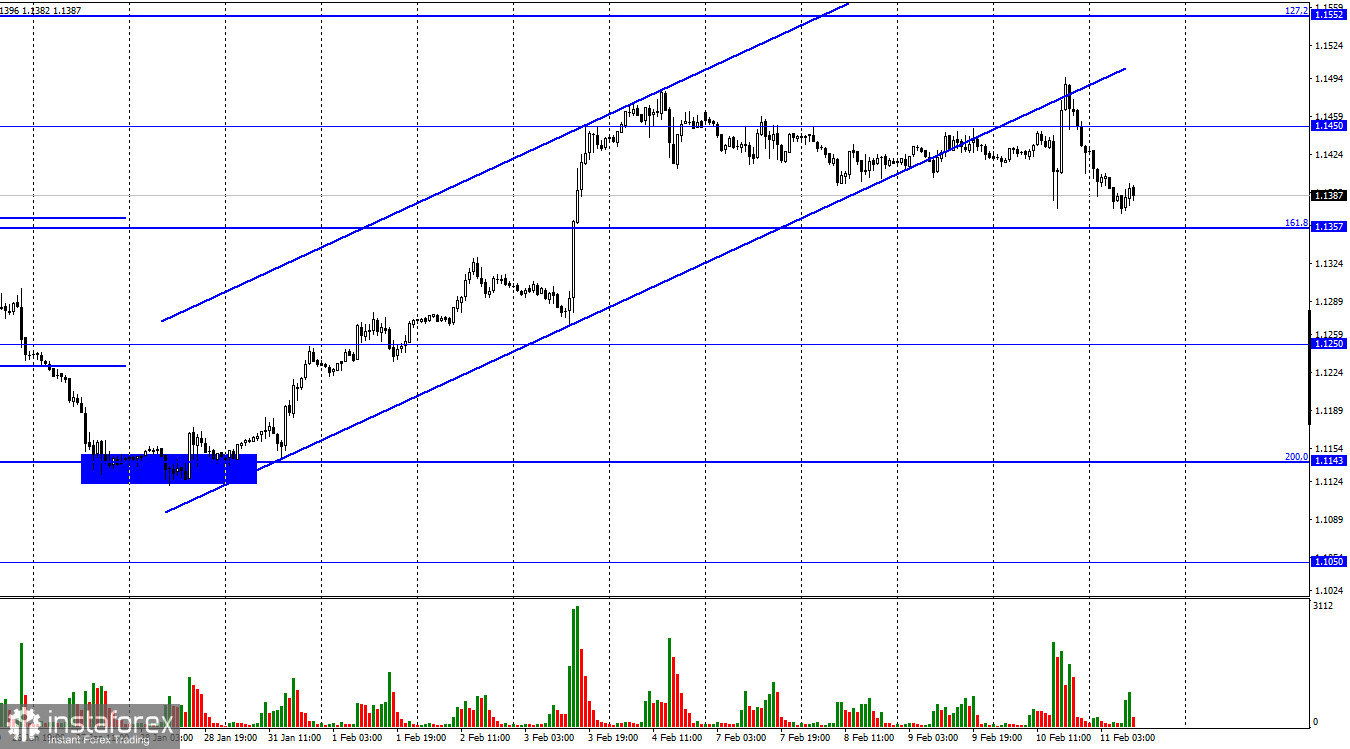

Hello, dear traders! On Thursday, the euro/dollar pair jumped to 1.1450 and then tumbled to the 161.8% correctional level of 1.1357. Such a movement was caused by the US inflation report for January. According to the data, inflation surged to 7.5% on a yearly basis. Core inflation totaled 6.0%. In fact, the figures are very high, and traders did not expect them. That is why their reaction was mixed, thus causing the price swings.

Only today, traders calmed down, and the US dollar advanced against the euro. It seems that the US Fed had not foreseen such figures. However, inflation rises every month, thus forcing monetary authorities to take radical measures. Notably, there are only eight meetings in 2022, when the regulator may take this or that decision. Very seldom, the regulator organizes emergency meetings. Thus, only on March 15-16, the Fed will have a chance to make a decision on monetary policy. Experts suppose that the regulator will raise the key interest rate by 0.5% at once. This, in turn, explains the US dollar appreciation. In fact, the Fed does not have any other methods to cap the surging inflation. The stimulus program is almost closed. In March, there will be no asset purchases. However, the QE tapering has no influence on inflation. The key interest rate hike is the only way out. Thus, the US dollar may continue gaining in value in the next few weeks. If the pair closes below the uptrend channel, it is likely to fall in the following days. If it fixes below the 161.8% correctional level of 1.1375, it is highly likely to drop to 1.1250.

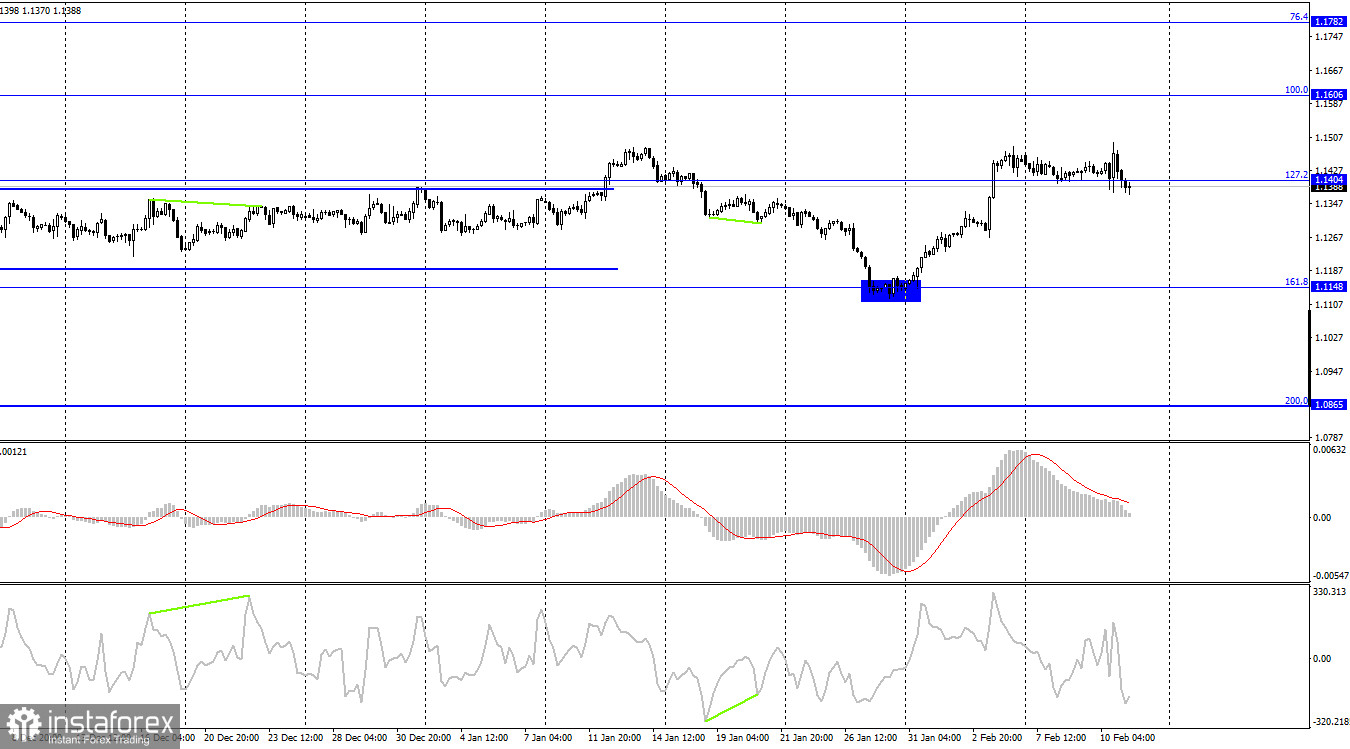

On the four-hour chart, the euro/dollar pair reversed in favor of the US dollar and closed below the 127.2% correctional level of 1.1404. Thus, the quote may continue falling towards the 161.8% Fibonacci level of 1.1148.

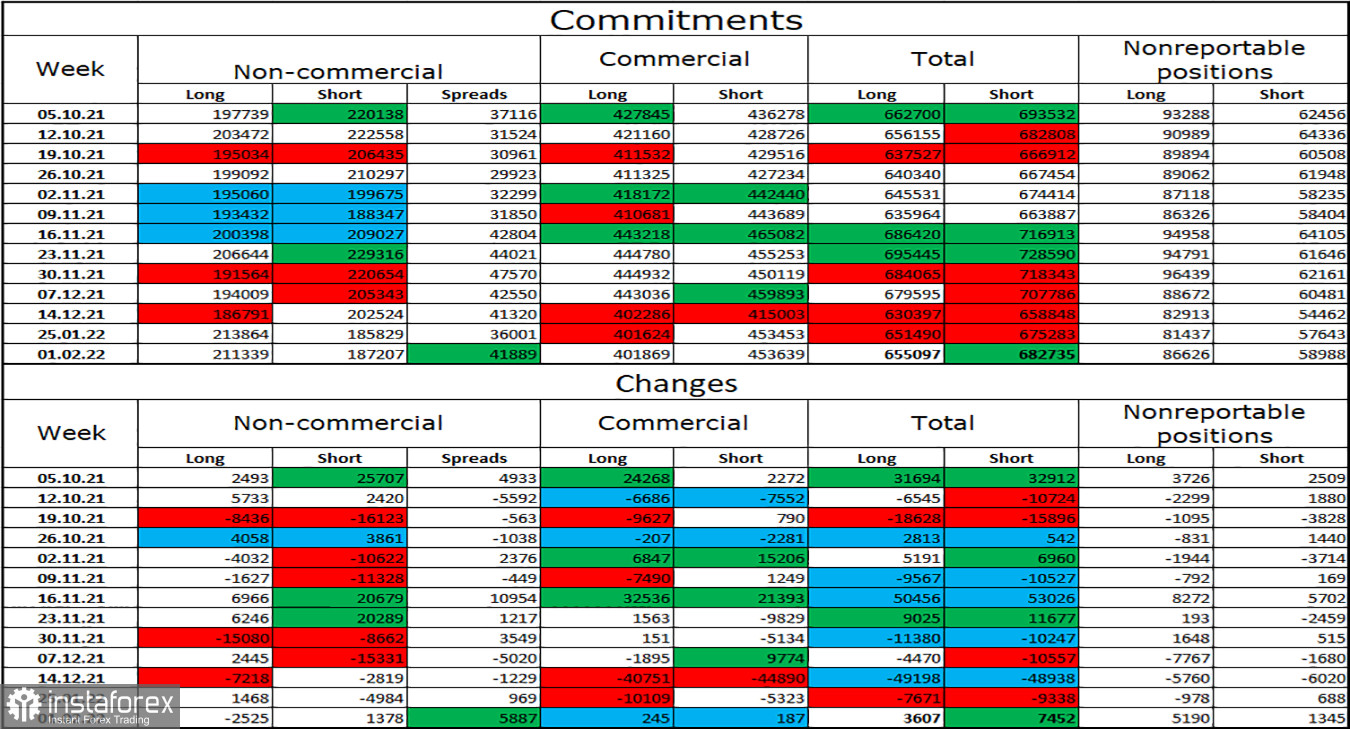

Commitments of Traders Report

Last week, speculators closed 25 long positions and opened 1,378 short positions. This means that their mood has become more bearish. The total number of long positions totaled 211 thousand, and short positions hit 187 thousand. Thus, in general, the mood of the non-commercial traders is characterized as bullish. This means that the euro has a chance to gain in value. In the last few weeks, the number of long positions increased, while the number of short positions dropped. Thus, the mood of major players has changed, which gives reason to expect growth over the next months.

Macroeconomic calendar for the US and the EU:

On February 11, the macroeconomic calendar for both the EU and the US is absolutely empty. Traders may pay attention only to the UoM consumer sentiment report. Meanwhile, the news flow will hardly affect market sentiment.

Outlook for EUR/USD and trading recommendations:

It is possible to sell the pair with the targets of 1.1357 and 1.1250, if the price closes below 1.1401 on the four-hour chart. It is better to avoid buying the pair since it is highly likely to go on falling.