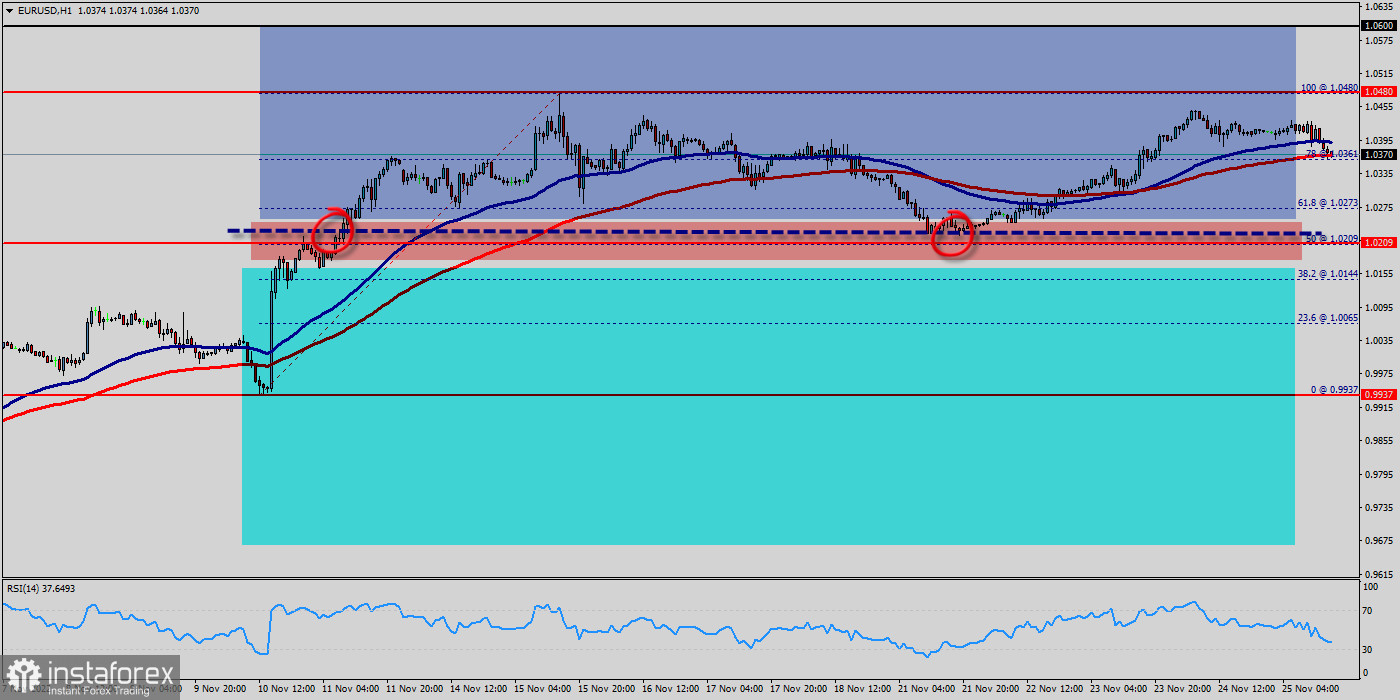

The trend of EUR/USD pair movement was controversial as it took place in the downtrend channel. Due to the previous events, the price is still set between the levels of 1.0480 and 1.0209, so it is recommended to be careful while making deals in these levels because the prices of 1.0480 and 1.0209 are representing the resistance and support respectively.

The pair is moving between the levels of 1.0480 and 1.0209. As the trend is still below the 100 EMA, a bearish outlook remains the same as long as the 100 EMA is headed to the downside. Consequently, the level of 1.0480 remains a key resistance zone.

Consequently, the first resistance is set at the level of 1.0480. Moreover, the RSI starts signaling a downward trend, and the trend is still showing strength below the moving average (100). Hence, the market is indicating a bullish opportunity below the area of 1.0480. So, the market is likely to show signs of a bearish trend around 1.0480 - 1.0400.

Therefore, it is necessary to wait till the downtrend channel is passed through. Then the market will probably show the signs of a bearish market. In other words, sell deals are recommended below the price of 1.0480 with the first target at the level of 1.0350. From this point, the pair is likely to begin a descending movement to the price of 1.0300 with a view to test the daily support at 1.0209.

Forecast

If the pair fails to pass through the level of 1.0480, the market will indicate a bearish opportunity below the strong resistance level of 1.0480. In this regard, sell deals are recommended lower than the 1.0480 level with the first target at 1.0350. It is possible that the pair will turn downwards continuing the development of the bearish trend to the level 1.0300, then next target 1.0209. However, stop loss has always been in consideration thus it will be useful to set it above the last double top at the level of 1.0480 (notice that the major resistance today has set at 1.0480).