The US Fed called for an emergency meeting today to discuss issues on interest rates. The announcement was published on the official website of the Fed.

This is a bit alarming because the last time the central bank organised an emergency meeting was during the beginning of the pandemic.

This sort of hints that problems with inflation are more serious than expected.

Supposedly, the next Fed meeting is in March, and only by that time will the members decide if they will raise the interest rate.

Goldman Sachs forecast the Fed to conduct 7 rate hikes this year.

News of the unscheduled Fed meeting emerged over the weekend, and today US stock indices are already actively declining, without waiting for the meeting of the Board of Governors.

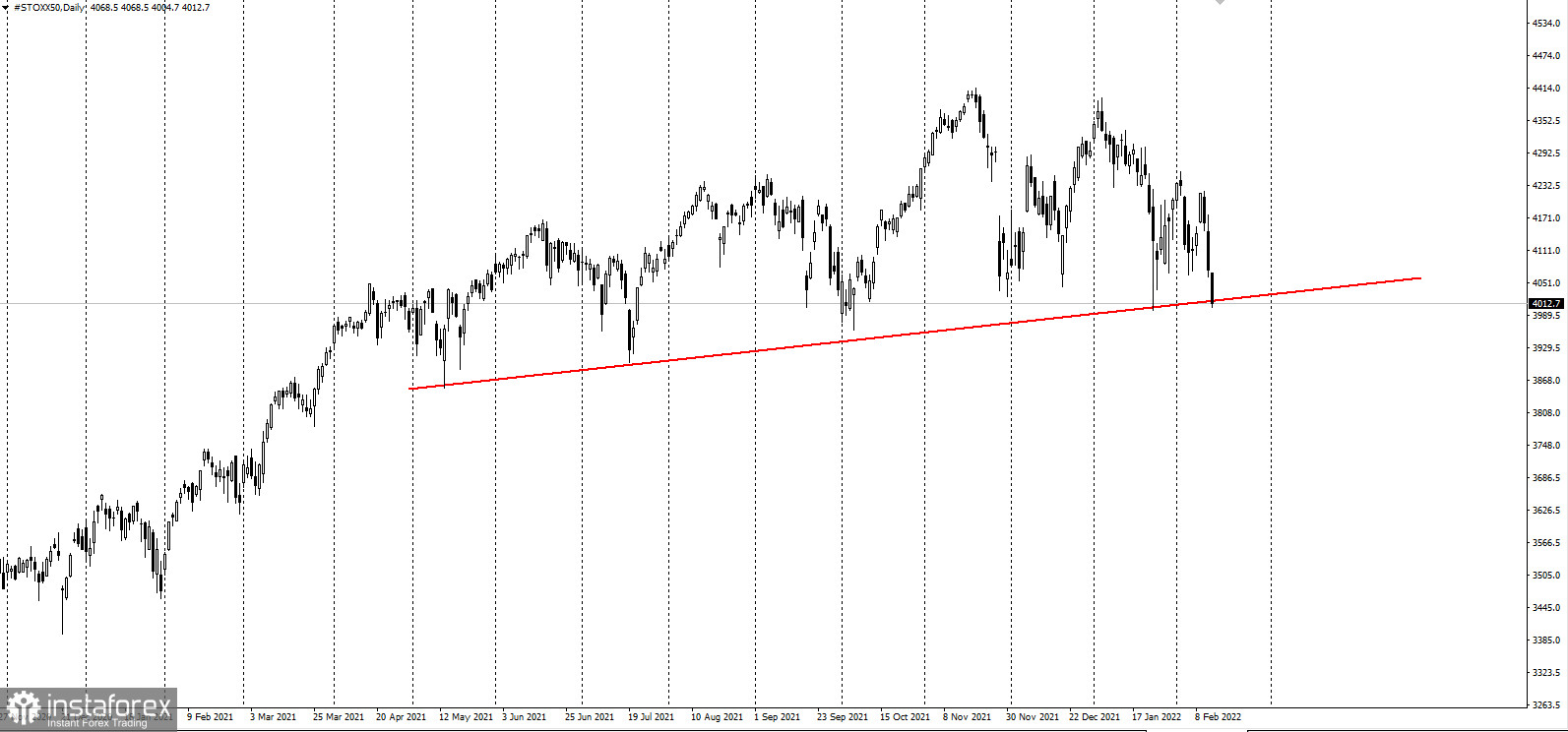

Indices in Europe are also declining:

This scenario makes long positions ideal as such could end with a rise to all time highs.

Good luck!