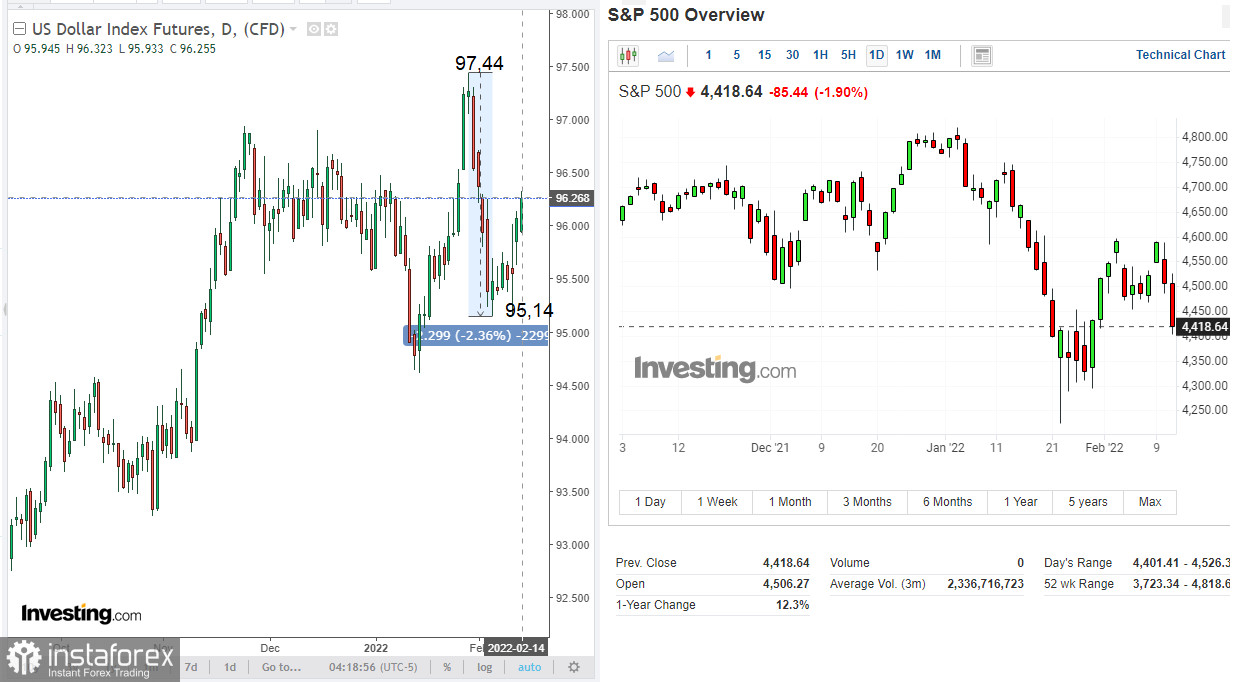

The new week began with the strengthening of the dollar, while futures for major U.S. and European stock indices resumed their decline. The latter are falling, including because of the threat of an escalation of tension on the Russian-Ukrainian border.

Regarding the dollar, it is worth saying that this week promises to be extremely volatile. On Wednesday (at 19:00 GMT) the minutes from the January meeting of the Federal Reserve ("FOMC minutes") will be published.

The publication of the minutes is extremely important for determining the course of the current policy of the Fed and the prospects for raising interest rates in the U.S. It often contains either changes or clarifying details regarding the outcome of the last Fed FOMC meeting.

At the end of the January meeting, Fed leaders confirmed the decision to accelerate the reduction in asset purchases in order to complete the QE program in March 2022 and begin raising interest rates. Fed officials plan to raise interest rates three times in 2022.

However, there was information that an emergency meeting of the Fed is scheduled for today, at which the issue of the need to raise interest rates ahead of schedule may be discussed. As you know, last week the U.S. Department of Labor reported another increase in consumer inflation in the country. Thus, the consumer price index (CPI) in January rose by 0.6% (+7.5% in annual terms). The data beat forecasts that had expected CPI to rise 7.2% YoY after rising 7.0% in December. This is the 8th month in a row that the annual inflation rate has exceeded 5%, nearly 4 times the Fed's target of 2%. With this acceleration, there is a growing threat that the Fed may not be able to cope with rising inflation, and this threatens hyperinflation, which could be disastrous for both the dollar and the prospects of the entire American economy.

If during this emergency meeting, Fed leaders do decide to raise interest rates earlier than planned (in March), then the dollar could strengthen sharply.

Meanwhile, tomorrow at 00:30 (GMT) the minutes from the February meeting of the Reserve Bank of Australia (RBA) will be published. As a result of this meeting, RBA leaders kept the key interest rate at 0.10%, but radically revised their forecasts, acknowledging that the economy is doing much better than they expected. At the same time, the RBA does not intend to raise interest rates until inflation stabilizes within the target range of 2%-3%. The bank also announced the end of its quantitative easing program, signaling that the end of government bond purchases does not mean that interest rates will be raised immediately.

According to RBA Governor Philip Lowe, there are still "no serious arguments in favor of tightening monetary policy in the short term." In his opinion, "it will take some time before interest rates rise." During a recent hearing in the House of Representatives Standing Committee, Lowe said that it is likely that if the economy follows the bank's forecasts, a rate hike will be included in the agenda at the end of this year. However, this does not mean that it will be upgraded soon after. Despite the fact that the Australian economy is managing to cope with the coronavirus pandemic, according to Philip Lowe, there is currently no evidence of its excessive stimulation.

Thus, unlike the Fed, the RBA will stick to the soft course of its monetary policy for the time being, which means that the main driver of the AUD/USD dynamics is the strengthening of the U.S. dollar.

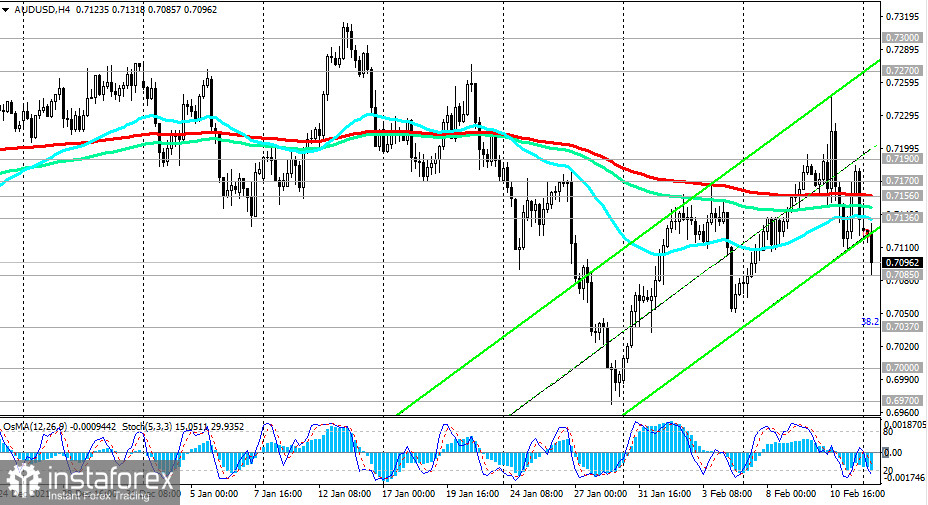

Today's decline in oil and other commodity prices against the backdrop of falling global stock indices also puts pressure on commodity currencies, one of the main of which is the Australian dollar. And as we can see, AUD/USD is actively declining today, reaching an intraday low near the 0.7085 mark. A breakdown of this local support level will cause a further decline with the nearest target at the lower border of the descending channel on the weekly chart passing through the 0.6970 mark.

Technical analysis and trading recommendations

Amid the strengthening of the U.S. dollar today, AUD/USD is declining in the first half of the trading day. At the time of writing, AUD/USD is trading in the bear market zone, below the key long-term resistance level of 0.7300 (200 EMA on the daily and weekly charts).

In case of a breakdown of the local support level of 0.7085, the pair is waiting for a further deeper decline inside the descending channel on the daily chart. Its lower limit is below 0.6800. In this case, intermediate targets will be the support levels of 0.7037 (38.2% Fibonacci correction to the wave of the pair's decline from the level of 0.9500 in July 2014 to the lows of 2020 near the level of 0.5510), 0.7000, 0.6970 (the lower limit of the descending channel on the weekly chart).

In an alternative scenario and after the breakdown of important short-term resistance levels 0.7136 (200 EMA on the 1-hour chart), 0.7156 (200 EMA on the 4-hour chart), the upward correction will continue with targets at the resistance levels of 0.7170 (50 EMA on the daily chart), 0.7190, 0.7270 (144 EMA on the daily chart). A breakdown of the resistance level of 0.7300 may again turn the tide and bring AUD/USD into the bull market zone.

In the meantime, AUD/USD remains in the global bearish trend zone. Therefore, preference should be given to short positions.

Support levels: 0.7085, 0.7037, 0.7000, 0.6970, 0.6900, 0.6800, 0.6455

Resistance levels: 0.7136, 0.7156, 0.7170, 0.7190, 0.7270, 0.7300

Trading Recommendations

Sell Stop 0.7080. Stop-Loss 0.7160. Take-Profit 0.7037, 0.7000, 0.6970, 0.6900, 0.6800, 0.6455

Buy Stop 0.7160. Stop-Loss 0.7080. Take-Profit 0.7170, 0.7190, 0.7270, 0.7300