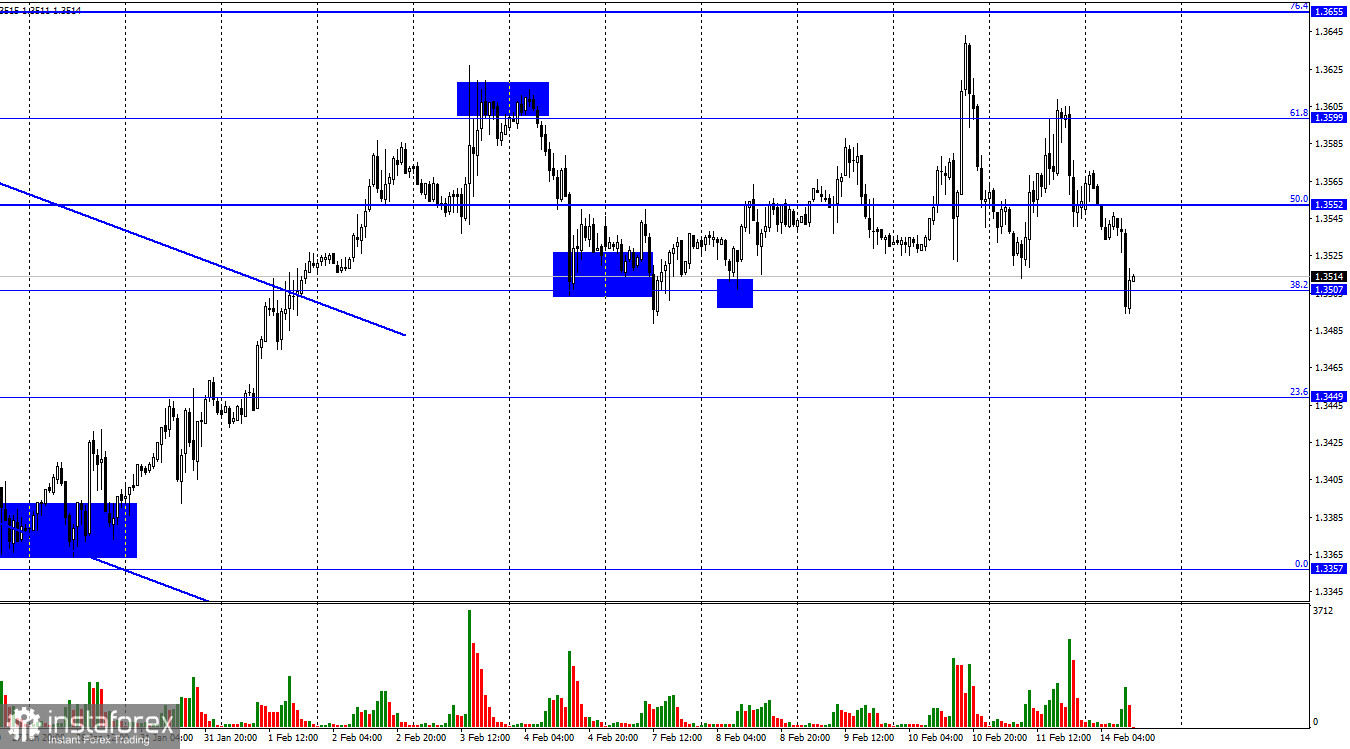

Hello, dear traders! On the hourly chart, the GBP/USD pair made two reversals on Friday. First, it supported the British currency, then the US dollar. Traders demonstrated their highest activity as on Thursday. Today, the pair's quotes consolidated under the correction level of 50.0% at 1.3552, so the decline may continue towards the next correction level of 38.2% at 1.3507. However, taking into account these movements, I believe that the pair can further change its direction very often and quickly. Unfortunately, now the economy has taken a back seat. I have already mentioned in my article on EUR/USD that the Fed emergency meeting will be held today. However, it is not clear what the outcome of the meeting will be, what statements Jerome Powell will make. There are only assumptions that the hawkish sentiment will probably be intensified. However, this is not the only topic for discussion among traders.

Tensions between the US and Russia have become escalating during the past week over the issue of NATO troop deployment on Ukraine's territory. According to EU and US media reports, there are currently 140,000 Russian regular troops on Ukraine's border. Moscow is demanding a written guarantee that Ukraine will not be offered NATO membership. Ukraine and the US refused to provide them. Many reporters believe a war between Ukraine and Russia is likely. This news will definitely affect traders' sentiment. However, it is impossible to predict traders' reaction if the conflict escalates further. Many experts think that the dollar in this case can continue to grow as the demand for it as a safe haven asset will increase significantly. Moreover, the US is also involved in the conflict and it is not quite clear how it will be resolved. Overall, it could be a very turbulent week for all global markets.

On the 4-hour chart, the pair consolidated twice over the descending trendline on Friday. However, it did not lead to the further growth of the British pound. Thus, the trend line is no longer in action, the GBP/USD exchange rate is exactly in the middle between the levels of 1.3457 and 1.3642. The last bearish divergence in the CCI indicator has already been canceled.

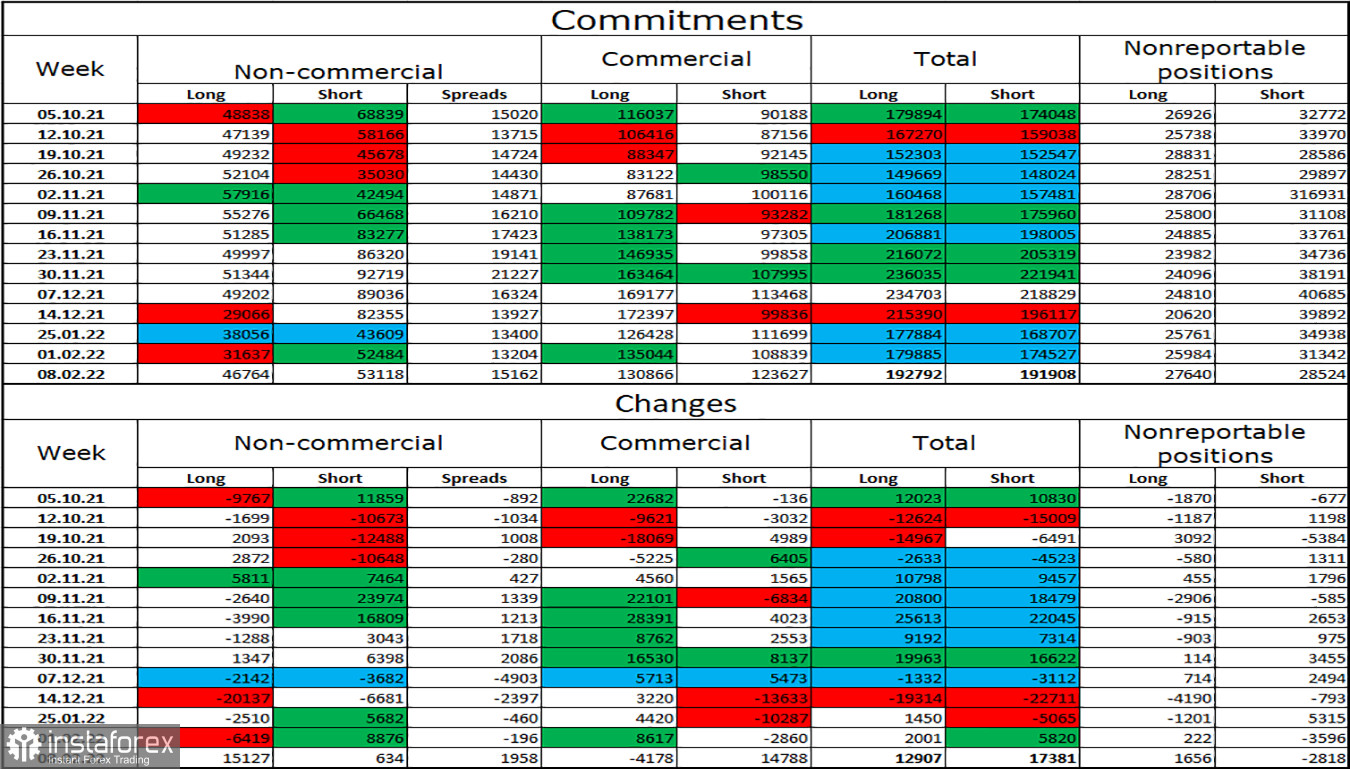

COT report:

The sentiment of "non-commercial" traders has changed dramatically again during the last reporting week. The week before, speculators were increasing the number of short contracts. Now, they try to increase the number of long contracts, which rose by 15127. This is a perfect example of quick change of major players' sentiment and, accordingly, the whole market. The overall sentiment of speculators can be currently considered bearish as they held more short contracts. However, as mentioned above, traders' sentiment is changing very quickly. Besides, this week's news background can be the reason for its faster change.

US and UK economic news calendar:

US - Emergency Fed Meeting

The UK economic calendar is completely empty on Monday. It should be the same in the US. However, the Fed announced at the weekend that it would hold an unscheduled meeting on February 14. It is not clear when its outcome will be announced. Besides, today's news background can be strong. Traders are evidently nervous.

GBP/USD outlook and recommendations for traders:

Currently, I would recommend selling the British pound. However, there are no sell signals on the 4-hour chart, compared with a great number of both sell and buy signals on the hourly chart. Traders are nervous, so movements can be very sharp and strong.