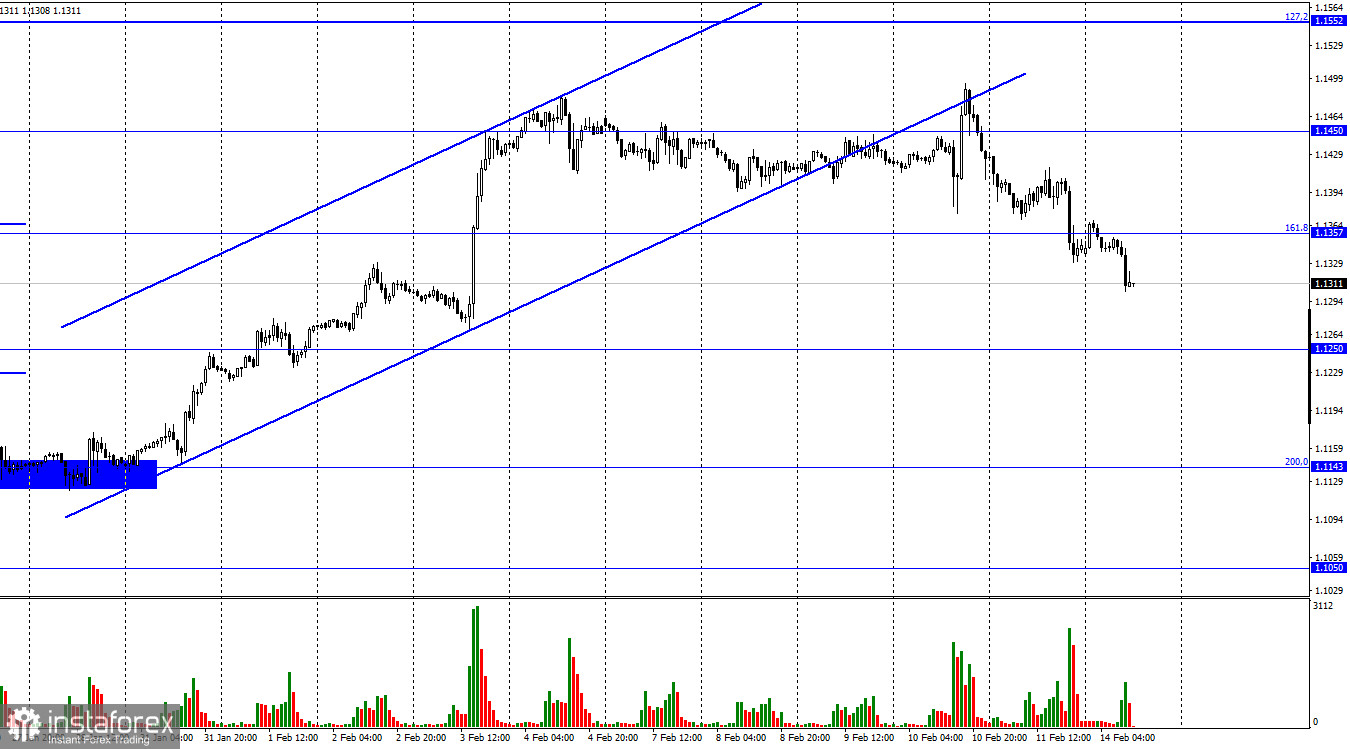

Hello, dear traders! The EUR/USD pair continued to decline on Friday and consolidated under the correction level of 161.8% at 1.1357. Therefore, the decline may continue towards the next level 1.1250. However, the chart analysis is not highly significant for traders. Many important events occurred over the last few days that can significantly affect traders' sentiment. Notably, the Fed is holding an emergency meeting today. The regulator noted that interest rate issues would not be raised. However, emergency meetings are not held without any reason. The last meeting occurred 7 years ago. Therefore, the interest rate may not be raised, however it will definitely be discussed. Inflation in the US continues to rise and requires a clear and quick response from the Fed. Thus, the probability of a 0.50% rate hike at the March meeting (and maybe even earlier) is now about 100%.

Moreover, ECB president Christine Lagarde delivered a speech at the end of last week. She again failed to encourage traders-buyers who are deeply pessimistic now. Lagarde said that raising the interest rate was out of the question, taking into account the current state of the EU economy. Therefore, the most-likely scenario is the following: the Fed will definitely raise the interest rate by 0.50% at the next meeting, while the ECB will most likely not raise the rate during 2022. So, in this cae traders have to buy the dollar. As mentioned above, an unscheduled Fed meeting is held today. Its results will be summed up and announced afterwards. Therefore, updated data will be provided during the day or tomorrow at the latest. Besides, it can significantly affect traders' sentiment. As the majority of traders anticipate the Fed's more hawkish rhetoric, I expect a new decline of the EUR/USD pair.

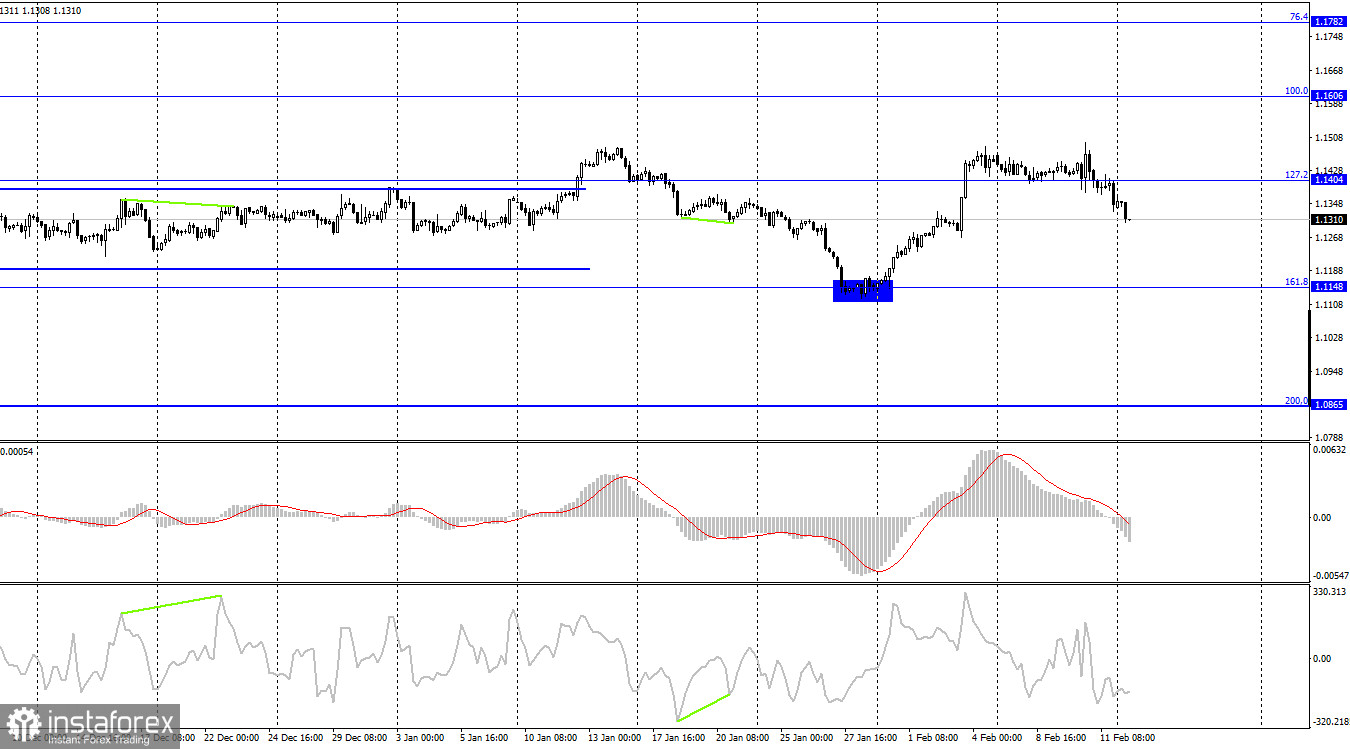

On the 4-hour chart, the pair made a new reversal in favor of the US currency and closed under the correction level of 127.2% at 1.1404. Therefore, the fall of the quotes may continue towards the Fibo level of 161.8% at 1.1148. There are no emerging divergences in any of the indicators today, however they are not necessary with such a strong news background.

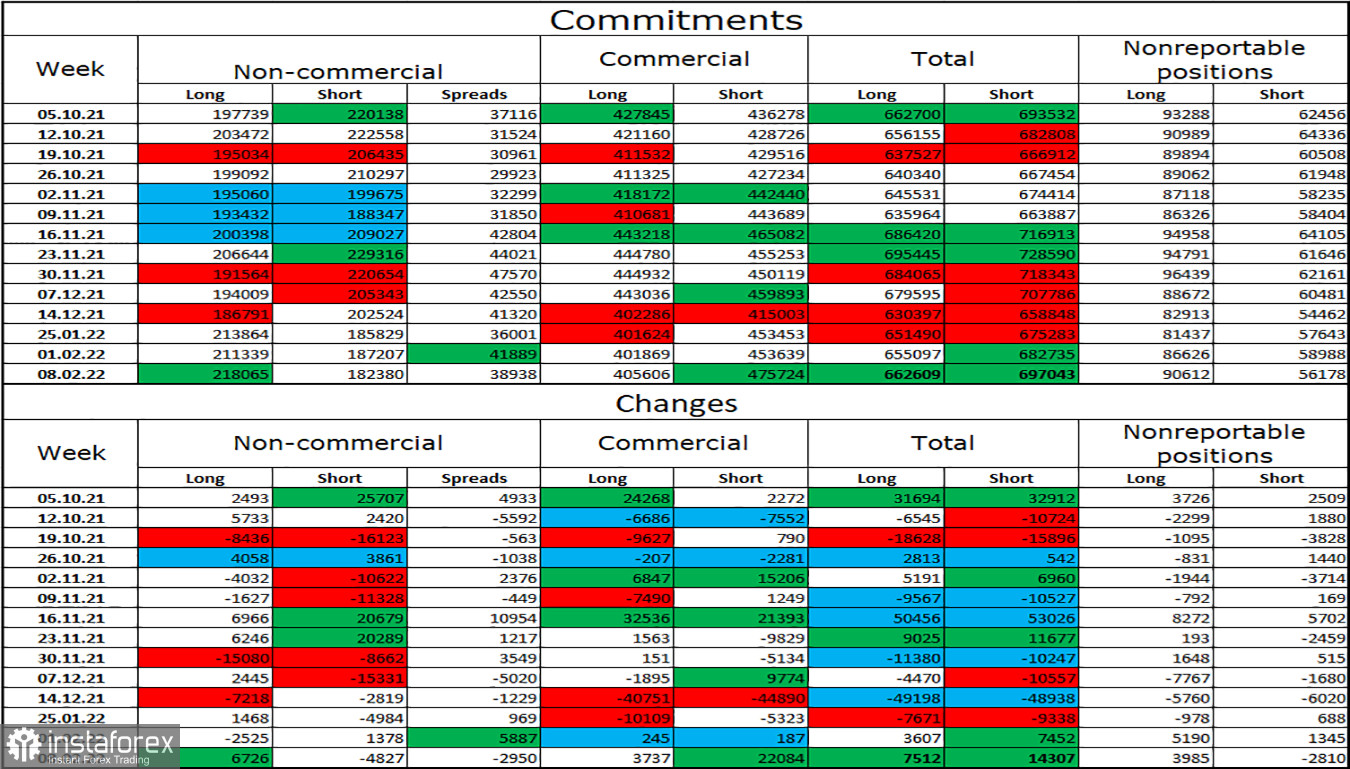

COT report:

Speculators opened 6726 long contracts and closed 4827 short contracts during the last reporting week. That fact indicates that their sentiment has become more bullish. The total number of long contracts held by speculators is now 218,000, while the number of short contracts is 182,000. Therefore, the overall sentiment of non-commercial traders is considered bullish. This aspect could provide a chance to rise for the European currency, except for news background favorable for the US currency now. I think that this week the COT reports data is of negligible importance as the current global situation is tense and the sentiment of major players can change drastically.

US and the EU economic news calendar:

EU - ECB President Christine Lagarde will deliver a speech (16-15 UTC).

US - Fed emergency meeting

On February 14, the EU and US economic calendars contain one important entry each. Each of the above-mentioned events can significantly influence traders' sentiment, so I believe today the news will be strong and unexpected.

EUR/USD outlook and recommendations for traders:

I recommended new sales of the pair with the targets of 1.1357 and 1.1250 if the close below the level of 1.1404 is carried out on the 4-hour chart. These trades can be held now. Currently, I do not recommend buying the pair as the probability of further decline is too high.