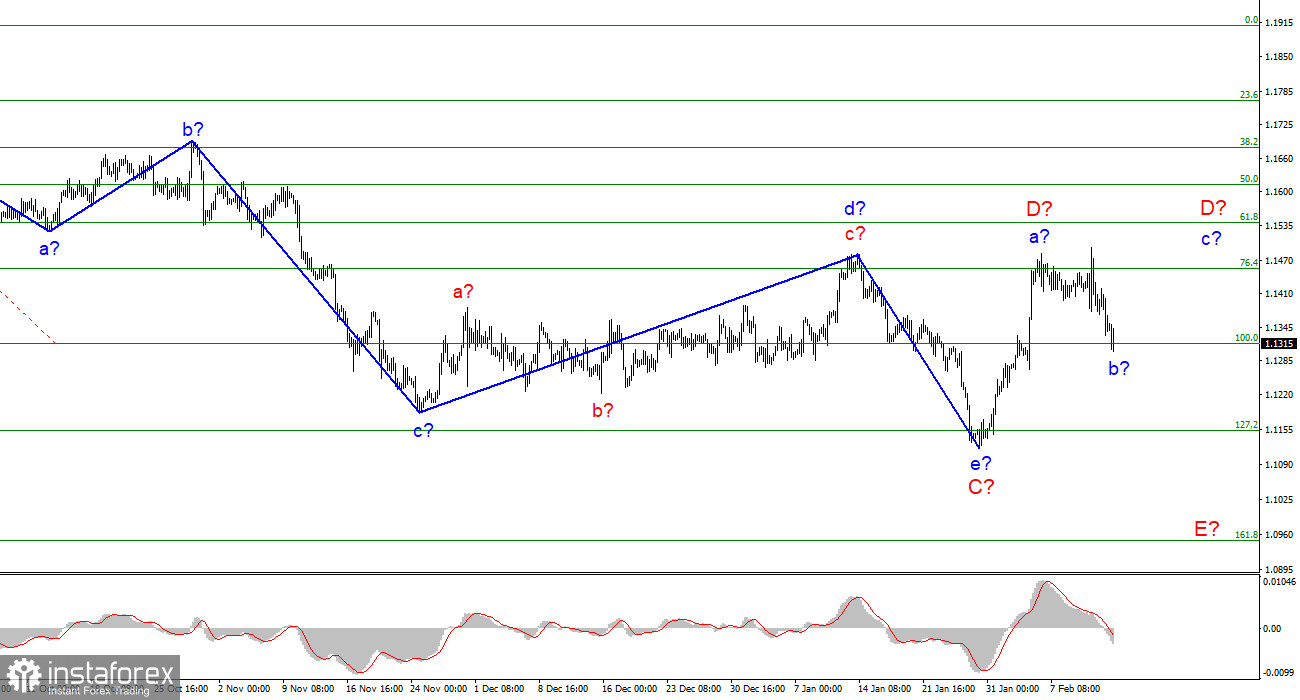

The wave marking of the 4-hour chart for the euro/dollar instrument has undergone certain changes and now it no longer looks as unambiguous as before. Last week, there was a decline in quotes, which may be a wave E, or it may be a wave b-D. I believe that wave D is complete, as the news background openly supports the rise of the US currency. Moreover, there are no clear internal waves inside wave C. Thus, they may not be inside wave D either. Based on this, I think that the probability that the instrument has moved to the construction of wave E is 80 percent. I give 20% of the probability that wave D will take a more complex form, three-wave. There is also a backup option with the completion of the construction of a downward trend section. In this case, on January 28, the construction of a new upward trend section began. But the same news background now does not give any reason to expect that an upward section of the trend will be built. A successful attempt to break through the 1.1314 mark, which corresponds to 100.0% Fibonacci, will indicate that the market is ready for new sales of the European.

The Ukrainian-Russian conflict may cause panic in the markets

The euro/dollar instrument fell by 25 basis points on Monday and generally moved very weakly. At the same time, the market now resembles a compressed spring that can shoot at any moment. It happened because of the Ukrainian-Russian conflict, which quite unnoticeably for many has entered the stage when war can happen at any moment. It is this idea that the West is promoting to the masses, although Moscow officially declares that it is not preparing any invasion and is simply conducting exercises on its territory. However, you don't need to be an expert political scientist to understand that something is brewing. And this "something" scares investors, markets, and ordinary people. German Chancellor Olaf Stolz and Ukrainian President Volodymyr Zelensky held talks in Kyiv today. Negotiations between Stolz and Russian President Vladimir Putin will take place tomorrow. However, I would not count on these negotiations too much, since there have been a lot of such talks in the last few days alone. World leaders are, as they say, "in touch" with each other and constantly call up to discuss measures and ways out of the crisis. However, no solutions to the crisis have yet been proposed. Both sides of the conflict continue to stand their ground, so there is a compressed spring here. Everyone understands that Russian troops will not stay near the Ukrainian border forever. Therefore, the "X hour" must come. Either the de-escalation of the conflict will begin, or its escalation will continue. For de-escalation to begin, Kyiv must abandon its intentions to join NATO. But the Ukrainian authorities have so far refused such an option.

General conclusions

Based on the analysis, I conclude that the construction of the descending wave C is completed. However, wave D can already be completed too. If so, now is a good time to sell the European currency with targets located around the 1.1153 mark, which corresponds to 127.2% Fibonacci. Another upward wave may be built inside wave D, but for now, this option is a backup. An unsuccessful attempt to break 1.1314 may lead to a departure of quotes from the reached lows.

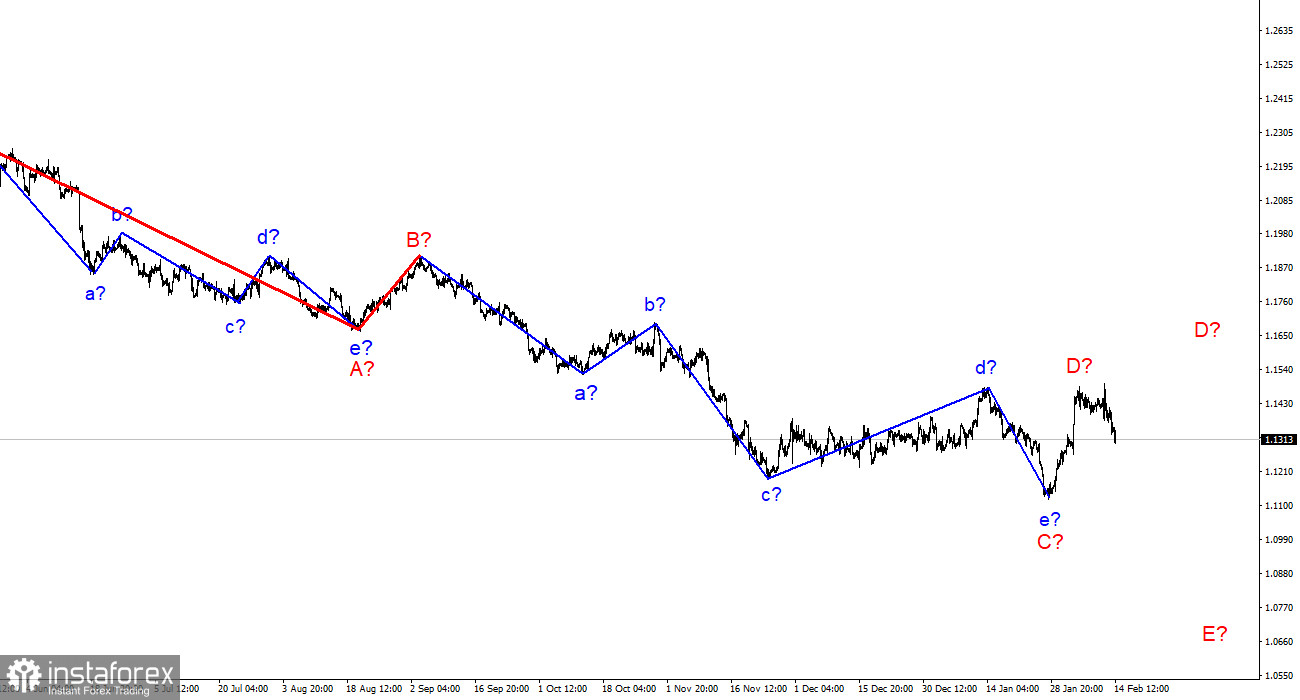

On a larger scale, it can be seen that the construction of the proposed D wave has now begun. This wave can be shortened to three waves. Considering that all the previous waves were not too large and approximately the same in size, the same can be expected from the current wave. There is reason to assume that wave D has already been completed. Then the construction of wave E began.