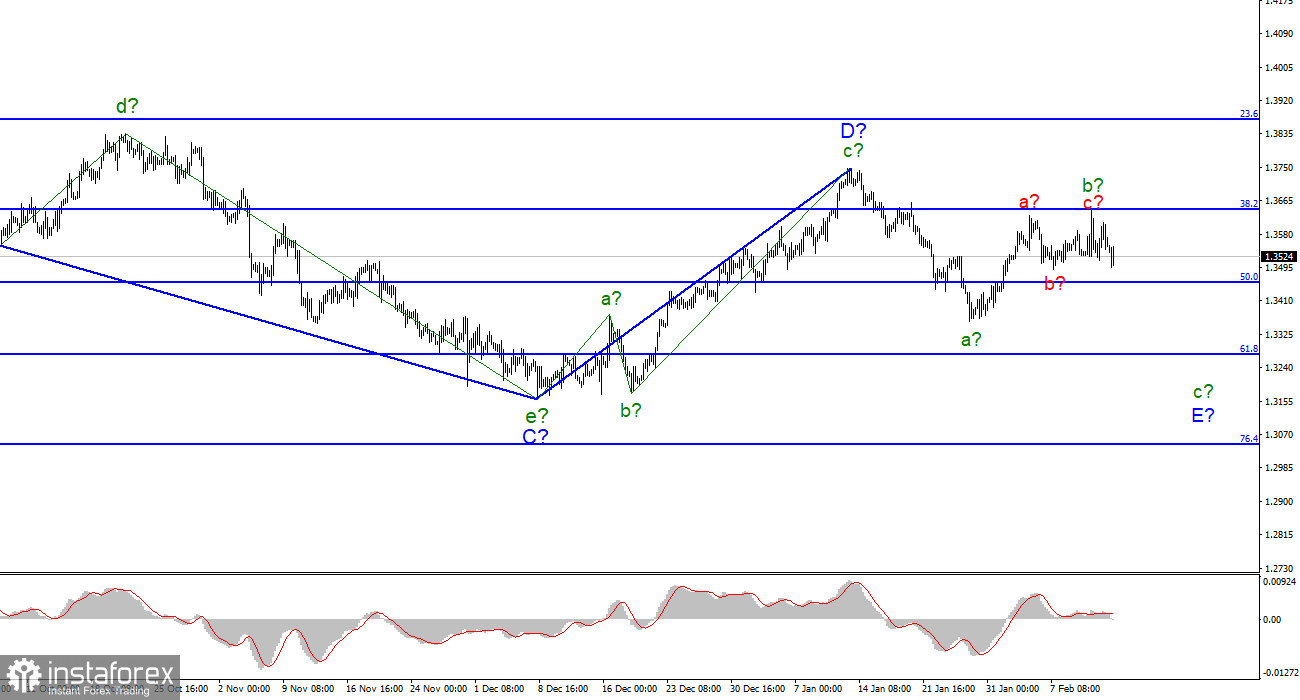

For the pound/dollar instrument, the wave markup continues to look very convincing, but in the near future, it may require changes. The increase in quotes last week complicates the expected wave b and it turns out to be longer than wave a. This conclusion suggests that the instrument is still trying to build a new upward section of the trend, and not to continue building a downward correction. In this case, the assumed wave D will be interpreted as the first wave of the correction section of trend A, since it is still three-wave, therefore, it cannot be wave 1. A successful attempt to break through the 1.3642 mark will indicate the readiness of the market to buy the instrument, which may lead to the exit of quotes beyond the peak of the assumed wave D, which will lead to the need to clarify the wave markup. At the same time, while this has not happened, the current wave marking retains its integrity and assumes a decrease within the wave c-E.

The holiday is overshadowed

The exchange rate of the pound/dollar instrument decreased by 30 basis points during February 14. It may seem that today is an ordinary Monday when the instrument often stands still - there is no information about the background of the economic plan today. However, this is not the case. Even at night, the quotes of the instrument decreased by 70 basis points, and before and after lunch increased by 50. Thus, the instrument today does not stand in one place. I would like to write something today about the UK, the USA, and their economic indicators, but the entire information space is now occupied only by the topic of the Ukrainian-Russian conflict. Even the morning news that the Fed is going to hold an unscheduled meeting, which begins this evening, was perceived by the market as an ordinary event. Although many analysts believe that today the Fed may raise the interest rate for the first time in a long time.

Of course, if this happens, the market reaction will not take long. But the topic of the Ukrainian-Russian conflict is a longer-running topic. The issue of Ukraine's accession or non-accession to NATO cannot be resolved in a couple of days. Consequently, it will hang in the air for a long time. And since Moscow wants guarantees of Ukraine's non-entry into NATO, it is unlikely that it will begin withdrawing troops from the Ukrainian borders until it receives guarantees. In general, the market potentially gets the topic that can influence its mood for a very long time. Price changes are visible on charts with a smaller scale. This is certainly not panic, but still, the market may start to panic if the conflict in Ukraine escalates. The situation is tense, and the spring I talked about in the article on the euro/dollar may loosen at any moment.

General conclusions

The wave pattern of the pound/dollar instrument assumes the construction of a wave E. The construction of the proposed wave b is completed, or this wave is not b. The instrument made an unsuccessful attempt to break through the 1.3645 mark, and wave b acquired a three-wave appearance. But there was no continuation of the increase in quotes, so now I believe that a wave c-E will be built. Therefore, I advise selling now with targets located around the 1.3272 mark, which corresponds to 61.8% Fibonacci.

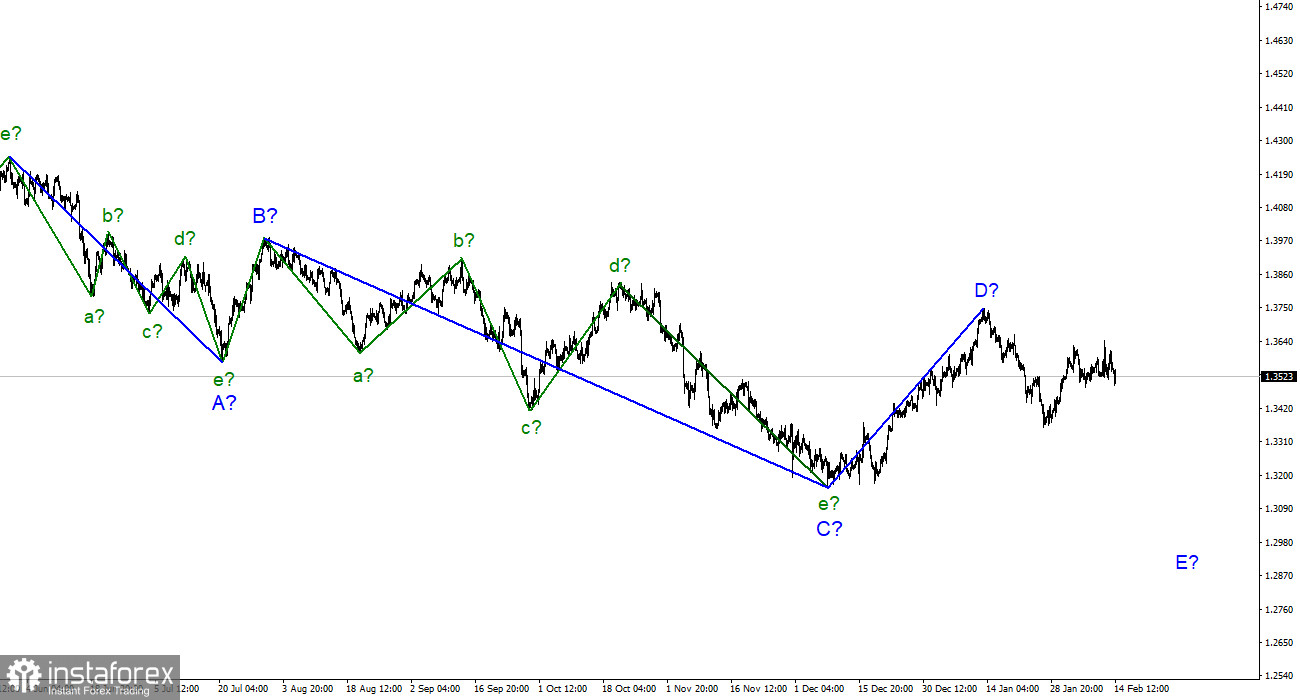

On the higher scale, wave D also looks complete, but the entire downward trend section does not. Therefore, in the coming weeks, I expect a resumption of the decline of the instrument with targets below the low of wave C. Wave D turned out to be three-wave, so I cannot interpret it as wave 1 of a new upward trend segment.