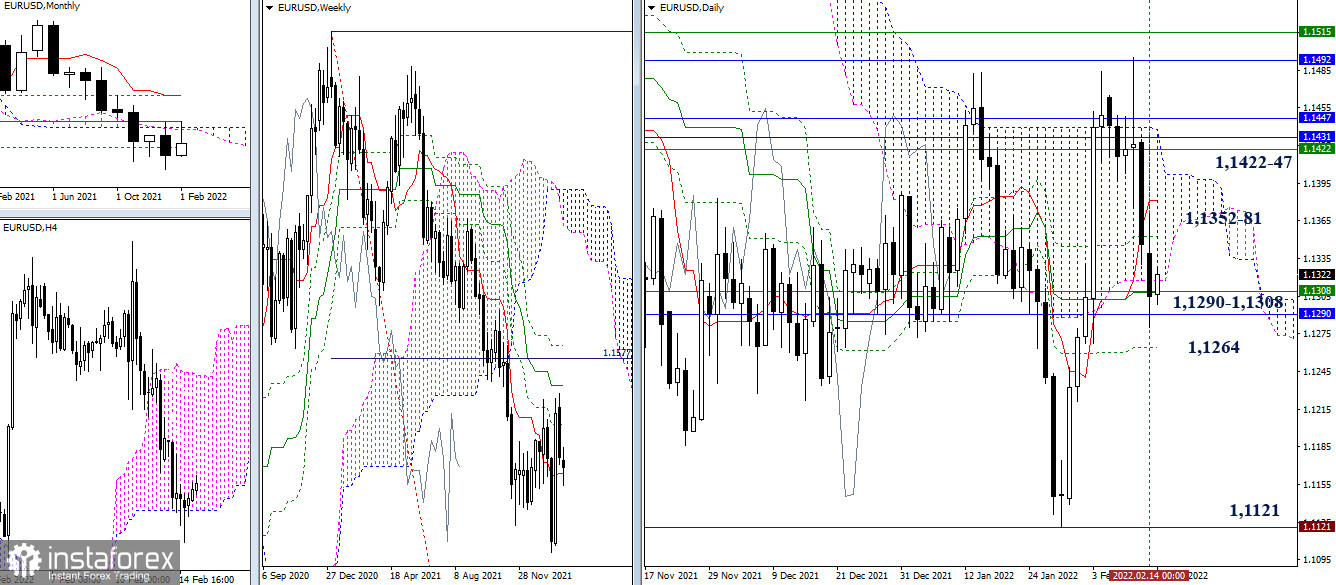

EUR/USD

The advantage yesterday mainly belonged to bears, who updated last week's low and declined to the area of combining strong supports of 1.1308 - 1.1290 (daily levels + weekly short-term trend + monthly Fibo Kijun). The result of the interaction will determine the nearest course of events. On the contrary, the formation of rebound will return the pair first to the daily resistances (1.1352 - 1.1381), and then to the resistances of 1.1422-47. A breakdown and a reliable consolidation below will allow the bears to build plans to further strengthen their sentiments, but to restore the downward trend, it will still be necessary to pass a significant distance and update the low (1.1121).

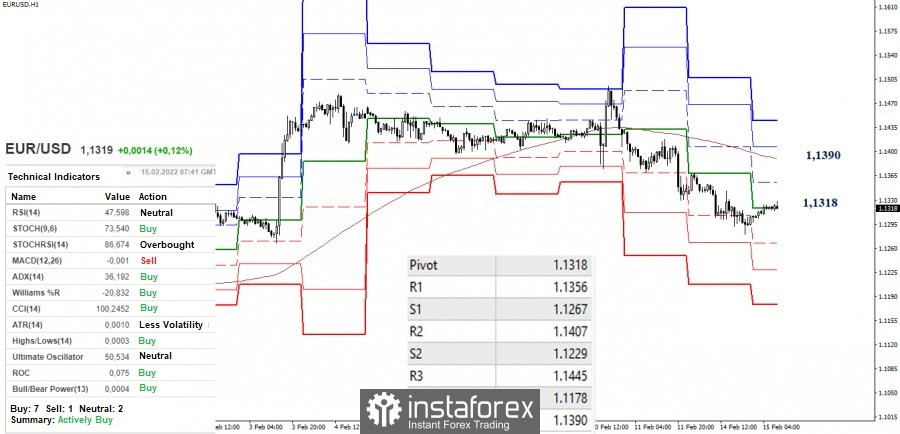

The bears have the main advantage in the smaller timeframes. However, the pair is currently in the upward correction zone. In turn, the bulls are now fighting for the central pivot level (1.1318). A consolidation above which will open the way to the next important level – a weekly long-term trend (1.1390). The nearest resistance on this way today can be noted at 1.1356 (R1). In contrast, the rebound and recovery of the downward trend on the hourly chart will return relevance to the support of the classic pivot levels (1.1267 - 1.1229 - 1.1178).

GBP/USD

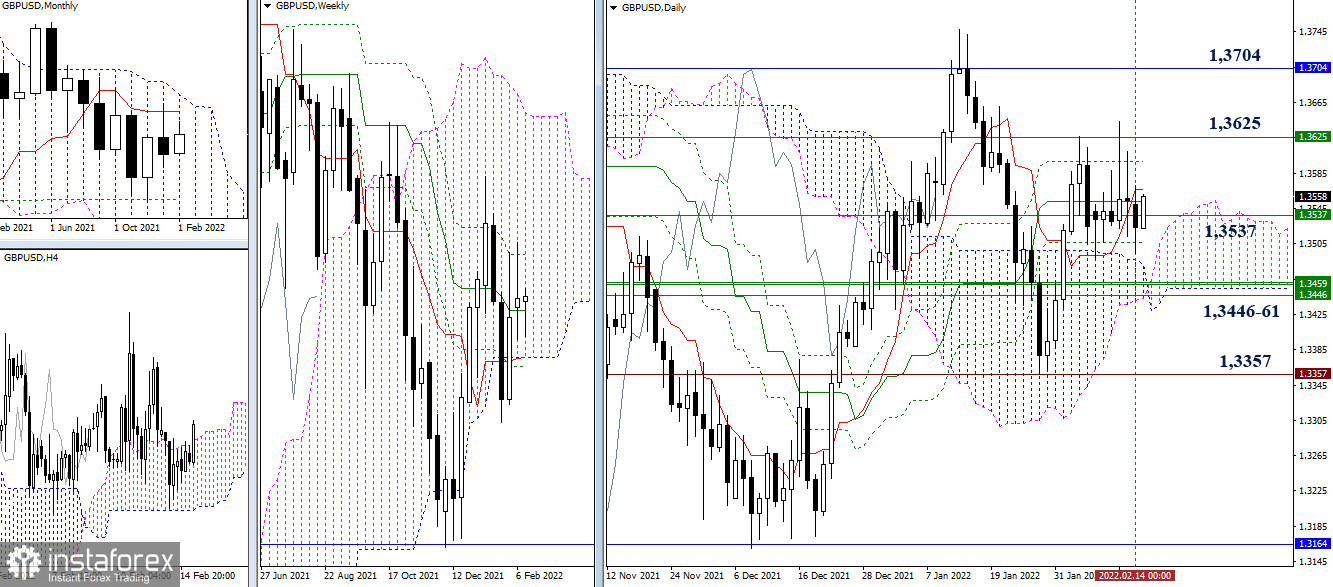

The development of events continues to remain in the attraction zone, led by a weekly medium-term trend (1.3537), so uncertainty dominates in the daily timeframe. The main pivot points continue to remain in the same places, which also contributes to the preservation of the alignment of the situation, already announced earlier.

The uncertainty in the higher timeframes leads to instability in the smaller ones. The opposing sides often lose their advantage, and as a result, they cannot develop an activity for a long time and remain tied to key levels that have been in a horizontal position lately. Today, the key levels in the smaller timeframes are consolidating around 1.3549-29 (central pivot level + weekly long-term trend). The possession of levels determines the current advantage of players in the market. Classic pivot levels act as intraday pivot points. Their resistances are currently set at 1.3565 - 1.3606 - 1.3642, while the supports are at 1.3488 - 1.3452 - 1.3411.

***

Ichimoku Kinko Hyo (9.26.52) and Kijun-sen levels in the higher time frames, as well as classic Pivot Points and Moving Average (120) on the H1 chart, are used in the technical analysis of the trading instruments.