Investors may now relax after a busy Monday and the end of the closed FOMC meeting. The massive risk hedging campaign has ended, and investment in risky assets has resumed. Consequently, the altcoins market showed spectacular growth and the total capitalization of the cryptocurrency market soared 6%, approaching the psychological mark of $2 trillion.

The Federal Reserve released the results of the closed meeting. The regulator kept interest rates unchanged at least until the next meeting scheduled for March 16. The main topic for consideration at the closed meeting was risk associated with leveraged loans in 2021 that remained at the high level although the situation somewhat improved from the first six months of 2021. The Federal Reserve also touched on the change in the percentage of non-pass loans. The figure decreased but remain at an acceptable level.

On the one hand, the US central bank may seem to continue summing up the results of 2021. On the other hand, the regulator is definitely preparing for the upcoming changes in monetary policy this year. According to Goldman Sachs, there could be 7 rate hikes in 2022. Monetary policy tightening is expected to harm the equity and cryptocurrency markets. However, CEO Fundstrat Global Advisors Tomas Lee suggests that in the long term, digital assets will benefit from it.

He believes that rate hikes will cause a crisis in the bond market. Over the next decade, investors could lose about $60 trillion. At the same time, Lee assumes there will be a massive shift of large capital towards cryptocurrency assets and products as investors will be willing to find an effective alternative to bonds, albeit more volatile. Lee says investors will remain in the stock market, but the cryptocurrency industry will become the main investment haven for market participants.

The cryptocurrency market may expand by 60 trillion over the next decade, the analyst estimated. At the same time, bitcoin will account for the bulk of such investments as it is considered the safest financial instrument. So, the future of the entire industry will depend on the safety of the flagship cryptocurrency.

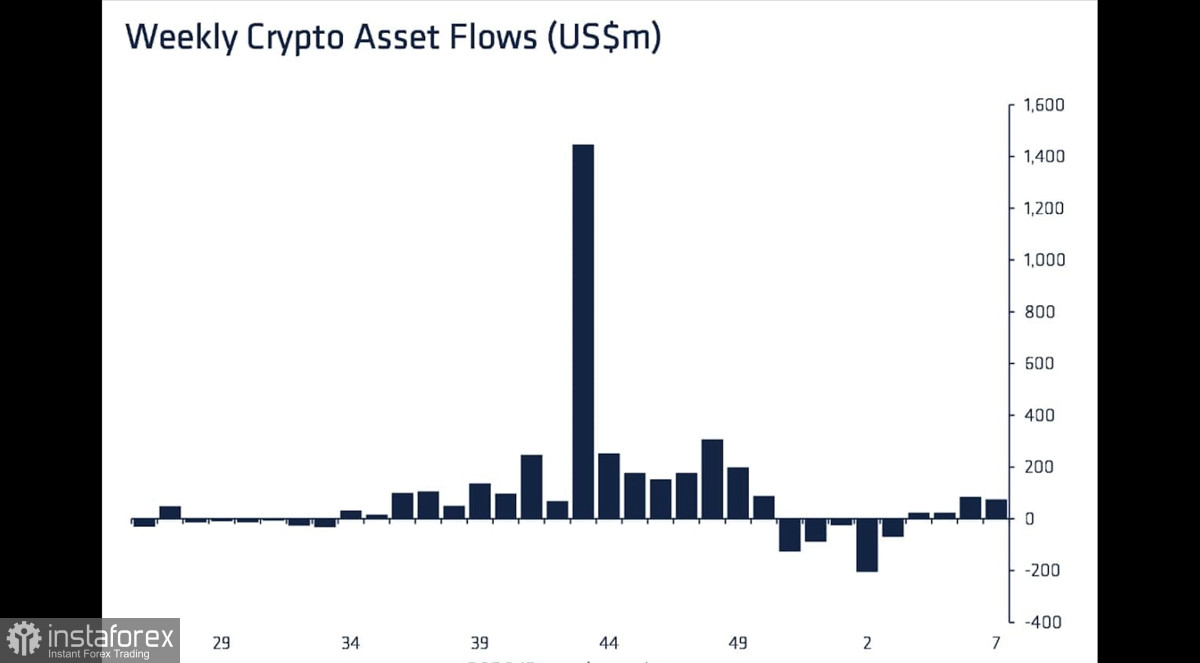

Meanwhile, Bloomberg suggests the adoption of BTC will continue and the asset will be used as collateral for loan transactions in the near future. This will be beneficial to the mass adoption of the coin. Crypto funds keep showing positive dynamics despite the upcoming FOMC meeting. Weekly crypto asset flows totaled $75 million last week, indicating a great growth potential of most digital assets.

Technically, BTC may retest the $45K mark and head towards $46K. BTC added gains after the closed FOMC meeting. The key support zone of $45K was not broken, which means the coin may head towards $46 soon. The line of the head and shoulders pattern is passing there. Technical indicators are signaling a breakout. So, the MACD has crossed the zero line and a bearish crossover is now forming. Meanwhile, the Stochastic and the RSI are moving up, indicating the increased activity of buyers and their readiness to consolidate above $45K.