Markets start Wednesday in a positive mood – stock indexes are growing, as yields of 10-year UST have gone above 2% again, reacting to the approaching Fed's March meeting. Oil and gold have become a little cheaper. There are no objective reasons for such movements, except for one – the US financial authorities need to ensure the flow of funds into treasuries, and the best tool that has been invented historically is to provoke capital flight from the "danger zone" to the "reliable", that is, from Europe to the US. This strategy is quite doubtful, but surprisingly, it continues to act on gullible investors.

Positive mood is expected to increase today since there are no objective reasons to escalate tension, COVID-19 restrictions are being lifted, and supply chains are expected to gradually recover. On the contrary, the US dollar will be under pressure.

USD/CAD

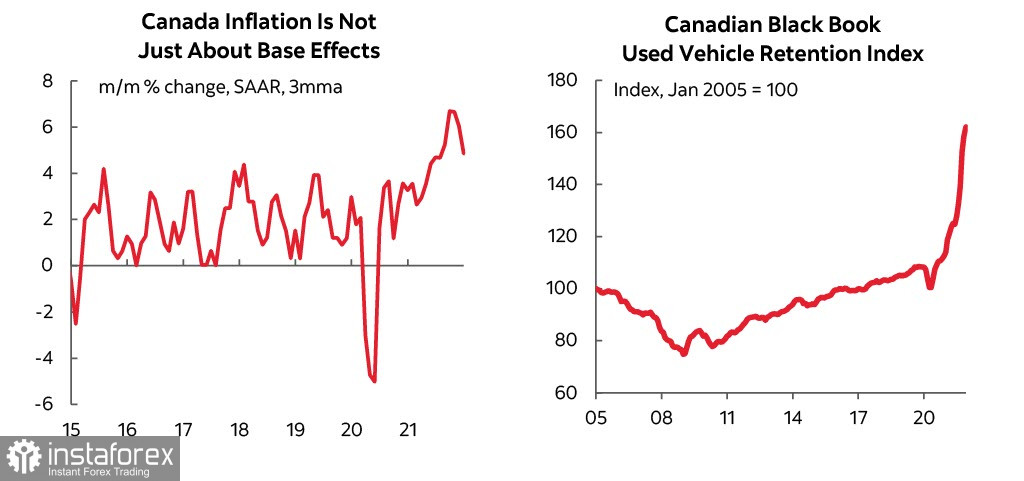

Canada's January consumer inflation report will be published today. Bloomberg forecasts 4.8%, as Scotiabank sees inflation a little deeper a month earlier, at 5%. This is a lower inflation rate than in the US, and it is logical to assume that the Bank of Canada can afford to operate somewhat behind the Fed, but in reality, it is not so simple.

The formula for calculating Canada's inflation does not include the dynamics of prices for used cars, unlike in the United States. It has grown by 2.3%, and if we use the same weight coefficients as in the US, then we need to add about 1.8% to the inflation rate, that is, inflation in Canada will no longer be 5%, but 6.8%, which is practically the same as in the US. This means that the pressure on the Bank of Canada is as strong as on the Fed, and the Bank of Canada needs to raise the rate no less aggressively than the Fed.

BoC Governor, Macklem, expressed his opinion last week that the restoration of the supply chain will help return inflation to 3% by the end of the year. But in any case, this is above the target, and, as Macklem warned, "significant changes in monetary policy are coming."

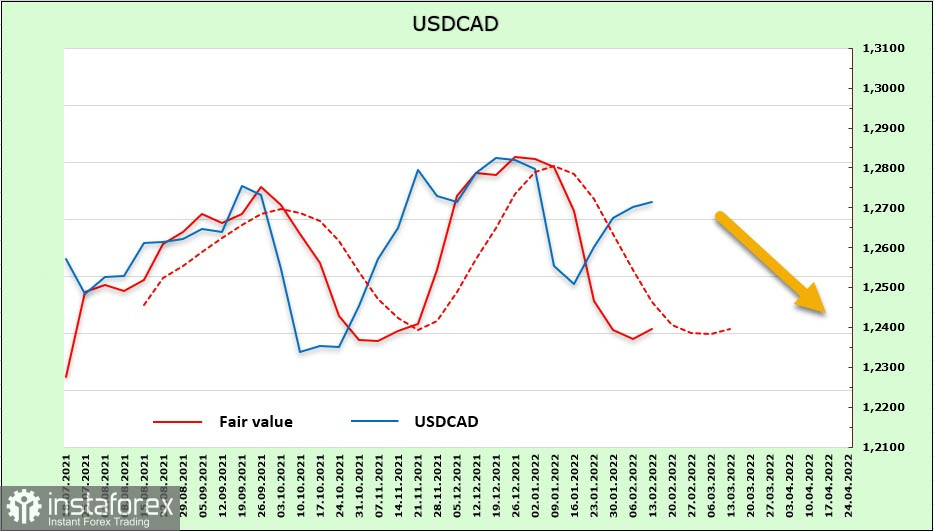

What about investors? Investors maintain a long position in the Canadian dollar, but there is no growth. According to the CFTC report, the long position decreased by 268 million, to 1.17 billion. The settlement price is trying to rise.

Investors expect the BoC to act slightly behind the Fed, giving the US dollar some edge. The USD/CAD pair will leave the converging triangle soon. We indicated a more hawkish Fed a week earlier as a condition for an upward exit, and this factor happened. The chances of rising have become a little higher. The nearest support is set at 1.2540, and sales with the nearest target of 1.2450 are justified in case of breakdown. But if the resistance level of 1.2800 is broken, the estimate will change to the opposite one.

USD/JPY

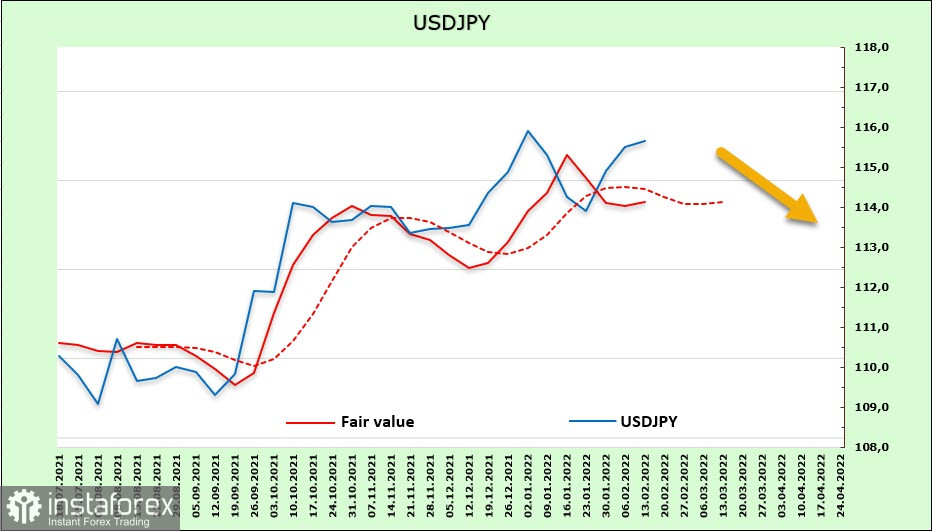

Rumors began to circulate in the Japanese bond market that the Bank of Japan, following the Fed and the ECB, will begin to normalize monetary policy. The arguments include the need to control the yield curve. On February 14, the Bank of Japan made a bond purchase to keep the rate inside the range. If these rumors are substantiated, then an additional bullish factor will appear for the yen.

Meanwhile, GDP data for Q4 show no upward momentum in domestic prices. The deflator of private consumption is down by 0.1%, falling for the fifth quarter in a row. Inflation expectations rose to 2.46%, which is the maximum since the beginning of research in 2014, but at the same time, the Tankan producer index fell to an 11-month low, which means that the threat of recession is returning.

Apparently, the rumors about the normalization of politics have no serious basis. According to the CFTC report, the yen's short position is stable. There is only a weekly decline of 209 million, reporting to -6.399 billion. Even the hysteria about a hypothetical "attack" on Ukraine did not affect the mood of long-term investors.

The target price is still below the long-term average, which is bearish, but there are signs of an upward reversal, which adds uncertainty. What's more likely is an attempt to update the high at 116.36 amid a decrease in tension with the target of 118.60.