Whatever is done in the dark eventually comes to the light.

I will start today's GBP/USD review with the main event of the day, or maybe of this week, which will be the publication of the minutes of the last FOMC meeting. Recently, the US Federal Reserve (Fed) has been acting rather ambiguously, I would even say mysteriously. There is no question about the hawkishness of monetary policy. However, the extraordinary Fed meeting was shrouded in secrecy and for some reason the results and all the details are not publicized. Anyway, whatever is done in the dark eventually comes to the light. Today is an important day for market participants, as the publication of the minutes of the last Fed meeting may clarify the situation regarding the balance of power amongst the FOMC members. It will also give a hint as to how many times this year the Fed intends to raise the key interest rate. It may also become known whether the Fed intends to raise the rate by 25 or 50 basis points for the first time. Furthermore, it is possible that the minutes will not give market participants any new information. In this case, the pressure on the US currency will not only continue but also intensify. As far as today's events are concerned, I would recommend paying attention to the extensive US data that will be published today. Let's have a look at the GBP/USD currency pair charts and start with the daily timeframe.

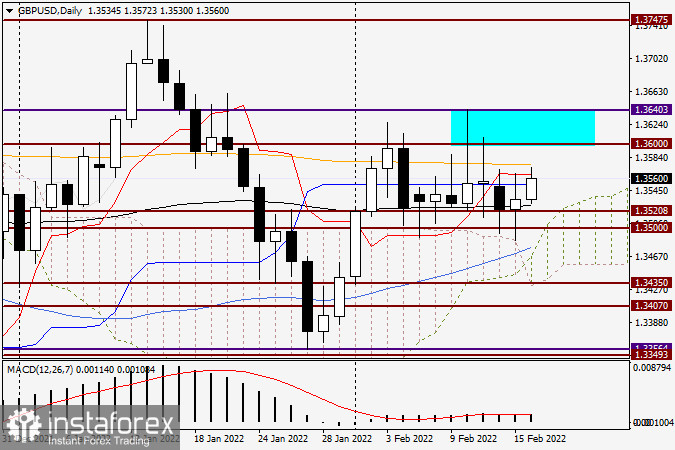

Daily

Yesterday's trading could be described as swinging. The pair has fallen and risen, but neither the bears nor the bulls have been able to consolidate their positions. Support was gained at the upper boundary of the Ichimoku cloud and on the downside attempts of the players to pass the all-important psychological, historical and technical level of 1.3500. However, resistance to the price was provided by the red Tenkan line and blue Kijun line of the Ichimoku indicator. The pound is already overcoming yesterday's barriers, but on the way of the pound is also orange 200 exponential moving average, which runs at 1.3576. A break-up of the 1.3600-1.3640 price zone with a subsequent consolidation above the latter will finally signal a further bullish scenario.

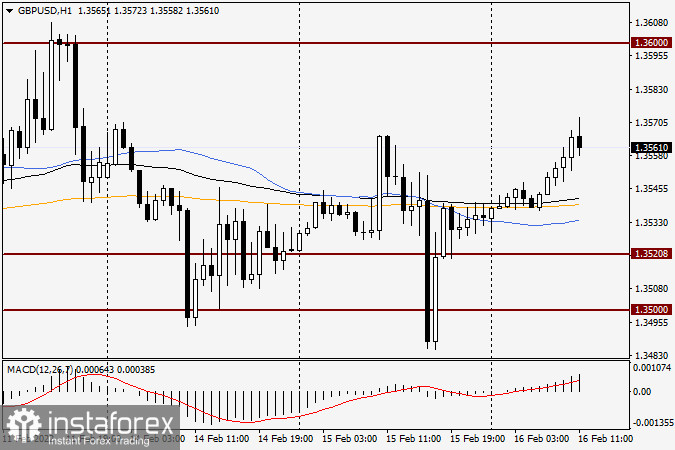

H1