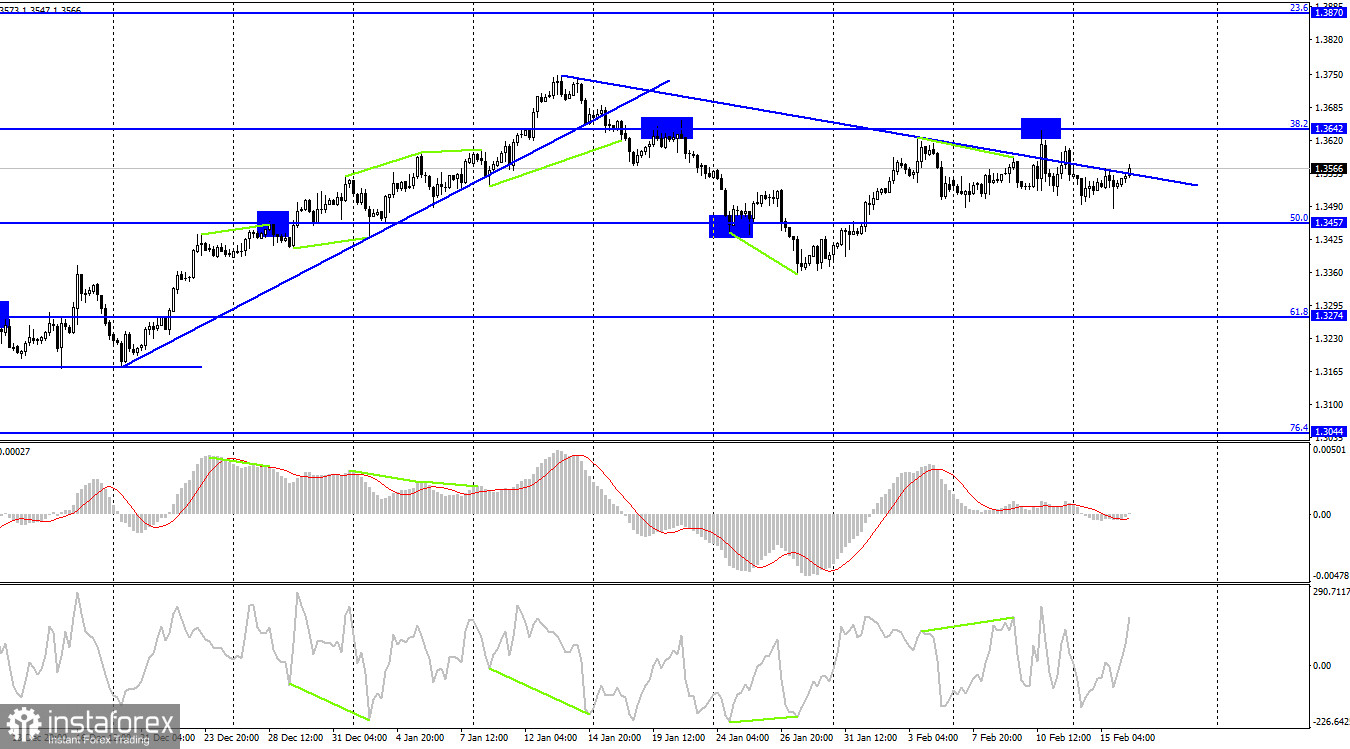

On Tuesday, GBP/USD fell to the Fibonacci retracement level of 38.2% - 1.3507 on the 1-hour chart. A pullback from this level supported the British pound and limited the bearish pressure. Today's consolidation above 50.0% - 1.3552 may facilitate further growth towards the next Fibonacci retracement level of 61.8% - 1.3599. This morning, the UK released the data on inflation. The consumer price index was expected to accelerate to 5.4% y/y, but instead, it went up to 5.5%. So, we can conclude that prices in the UK continue to rise just like in the EU and the US. Apparently, measures taken by central banks have had no impact on the inflation rate. This is a clear example of how a rate hike can influence the consumer price index. As we already know, the Fed is going to raise the rate 4-7 times this year. The purpose of the monetary policy tightening is to bring inflation back to the target level of 2%.

However, the Bank of England has already raised the interest rate twice. Still, inflation continues to accelerate. Let us assume that the effect of the latest rate hike is not yet obvious, but the rate increase in December was supposed to slow down the pace of inflation growth. However, we see that prices keep rising even faster than a month earlier. From my point of view, this leads us to an important conclusion: a rate hike does not necessarily mean that inflation will slow down, which implies tougher measures by central banks. At the same time, raising the rate may halt economic growth. So, this step cannot be taken based on inflation alone. Sooner or later, central banks will face the maximum level above which no more rate hikes will be possible as this may lead to a recession. Until then, inflation may fail to return to the target level of 2%. In this case, it may stay elevated for quite a long time.

On Friday, the pair consolidated twice above the descending trendline on the 4-hour chart. Today, the quotes have again returned to this line in another attempt to settle above it. If this attempt turns out to be successful, the price may advance towards the retracement level of 38.2% - 1.3642. There are no emerging divergences in any of the indicators today.

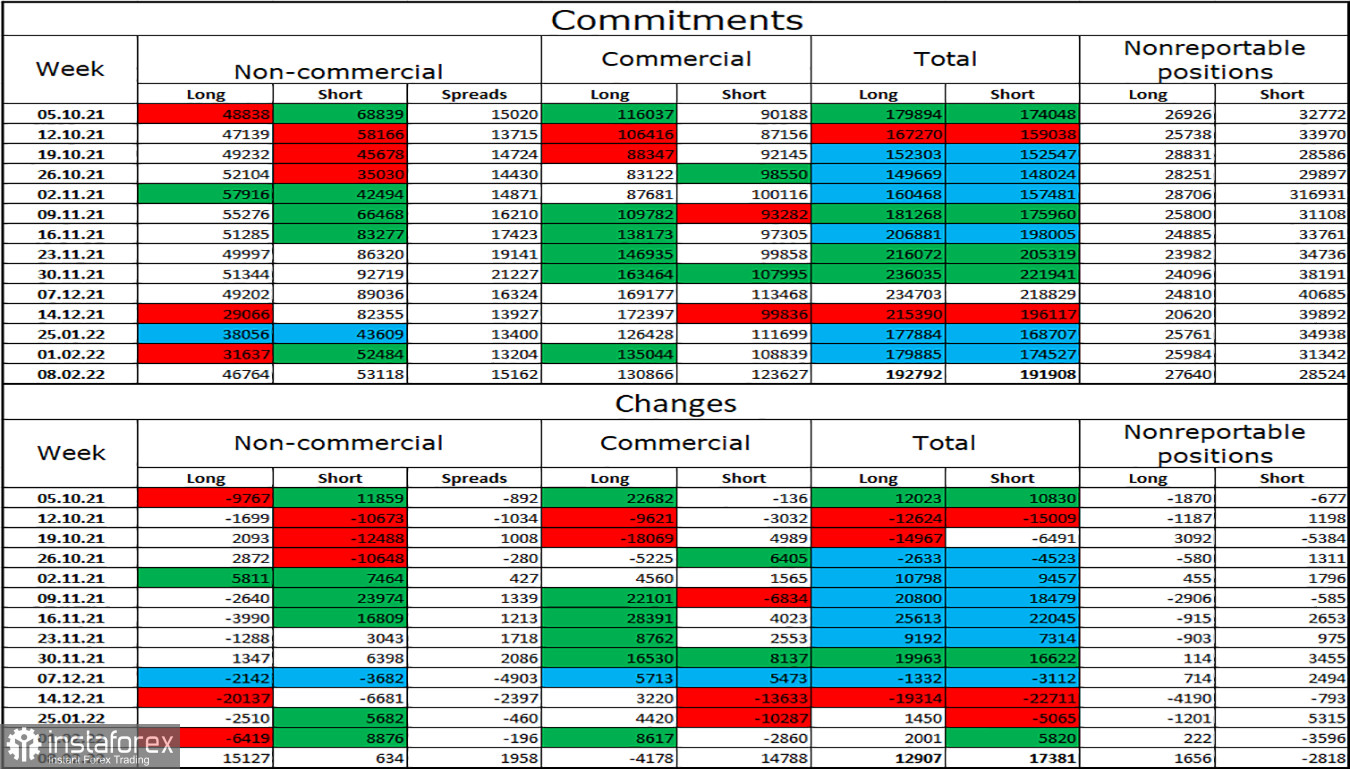

Commitments of Traders (COT) report:

The sentiment of the non-commercial group of traders has changed dramatically over the last reporting week. A week earlier, speculators increased the number of short contracts. Today, on the contrary, they are adding more long positions, the number of which has increased by 15,127. This is a vivid example of how quickly the sentiment of major players can change. The overall market mood can now be called bearish as speculators have more short contracts opened. As I have mentioned above, traders' sentiment is changing too quickly, and the news background this week may contribute to these changes.

Economic calendar for US and UK:

UK – Consumer Price Index (07-00 UTC).

USA – Retail Sales (13-30 UTC).

US – Industrial Production (14-15 UTC).

US – FOMC Meeting Minutes (19-00 UTC).

On Wednesday, all reports scheduled for the day have already been released. The data on inflation has shortly supported the pound. There will be more important events later in the afternoon, including the report on US retails sales and the Fed minutes.

Outlook for GBP/USD and trading tips:

I would recommend selling the pound although there are no sell signals on the 4-hour chart. At the same time, there are a huge number of sell and buy signals on the hourly chart. Traders are still nervous, so the price movements are rapid and accompanied by sharp reversals.