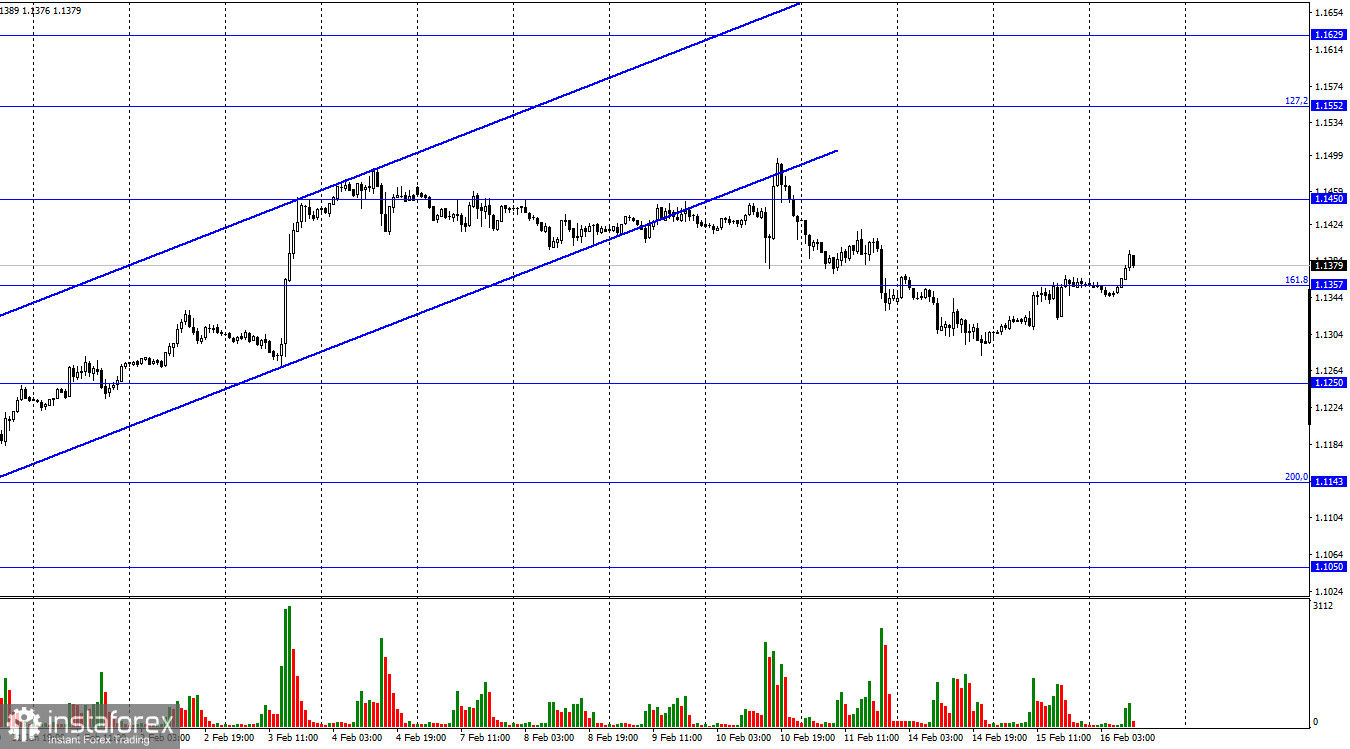

The EUR/USD pair performed a reversal in favor of the European currency on Tuesday and began the growth process. Today, a close was made above the corrective level of 161.8% (1.1357), after which the growth process continues towards the next level of 1.1450. The information background of yesterday was rather weak, but this is from which side to look at. There was little economic news. Traders did not wait for the results of the unscheduled meeting of the Fed, which was declared closed. Everyday economic statistics did not arouse any interest among traders at all and were frankly weak. The GDP report for the fourth quarter in the European Union was the same as a month ago. The producer price index in the US rose to 9.7% y/y. But who is surprised by the rising inflation in America now? There was no more economic news. But, as usual, in recent weeks, there was a huge amount of news related to geopolitics.

Here are press conferences with Olaf Scholz and Vladimir Putin, here is Joe Biden's speech, here is a message about the withdrawal of part of the Russian troops from the border with Ukraine, here is the "date of the beginning of the war", called by the Western media. However, traders have not reacted to all this news for many days in a row, because in practice it turns out that Scholz, Putin, and Biden have not reported anything new. The West continues to threaten Moscow with sanctions in the event of an attack on Ukraine, and Moscow responds by not allowing Ukraine to join NATO because of its security concerns. As a result, there is no progress in the negotiations, and the crisis persists. The Fed minutes will be published tonight and this may be the most interesting event of Wednesday. However, the contents of the document will become known only late in the evening, and during the day traders will continue to "cook" in geopolitics, not understanding in which direction the situation is developing and what to do with this information at all.

On the 4-hour chart, the pair closed under the corrective level of 127.2% (1.1404) and may continue to drop quotes in the direction of the Fibo level of 161.8% (1.1148). Brewing divergences are not observed in any indicator today, but they are not required with the information background that exists now. The new side corridor characterizes the mood of traders as neutral. Now neither bulls nor bears have an advantage.

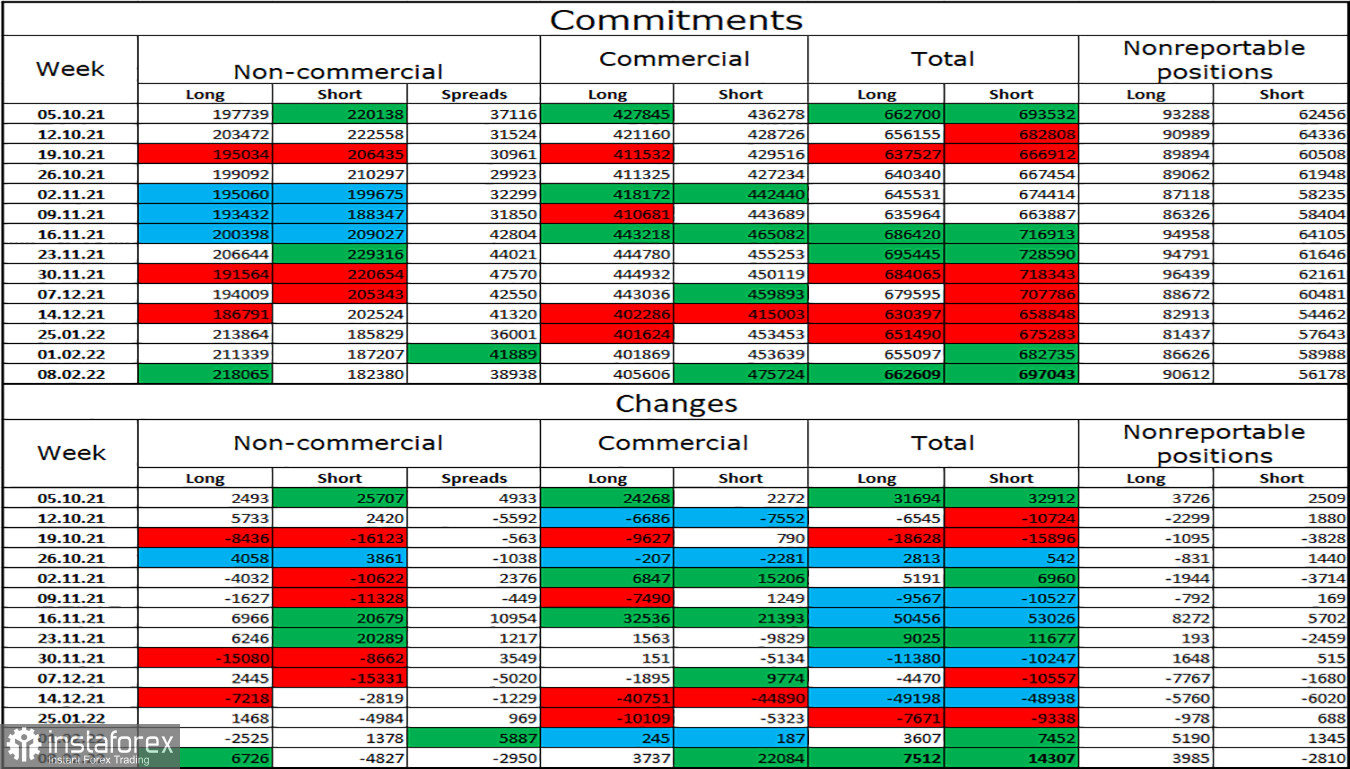

Commitments of Traders (COT) Report:

Last reporting week, speculators opened 6,726 long contracts and closed 4,827 short contracts. This means that their mood has become more "bullish". The total number of long contracts concentrated on their hands is now 218 thousand, and short contracts - 182 thousand. Thus, in general, the mood of the "Non-commercial" category of traders is characterized as "bullish". This would allow the European currency to count on growth, if not for the information background, which now fully supports the American currency. I believe that this week the data from the COT reports can be ignored since the situation in the world is tense and the mood of major players can change rapidly.

News calendar for the USA and the European Union:

EU - change in industrial production (10:00 UTC).

US - change in retail trade volume (13:30 UTC).

US - change in industrial production (14:15 UTC).

US - publication of the minutes of the Fed meeting (19:00 UTC).

On February 16, the calendars of the European Union and the United States contain several entries that may arouse the interest of traders. In particular, I recommend paying attention to the report on retail trade in the United States and the Fed minutes. The information background today may be average in strength.

EUR/USD forecast and recommendations to traders:

I recommended new sales of the pair with targets of 1.1357 and 1.1250 if a close is made below the level of 1.1404 on the 4-hour chart. Now, these deals can be kept open. I do not recommend buying a pair right now, as the probability of continuing the fall is too high.