On Friday, equities and crypto assets went down due to geopolitical tensions. Cryptocurrencies extended their decline during the weekend.

The United States reiterated their warnings that Russia could invade Ukraine in the upcoming days, stating that the chances of preventing war are very uncertain. Russia has rejected American statements, labeling them as "hysteria".

Earlier, Coinbase reported that the inflow into stablecoins reached $3.5 billion over the period of November 2021-January 2022, as traders shifted their investments from the Coinbase exchange into more secure assets. However, the repeat of the bear market of 2018 was unlikely, the exchange said.

The yield of 10-year US treasury bonds has declined recently, which could serve as a positive factor for speculative assets such as equities and crypto in the short term.

Bitcoin's correlation with stocks is likely to continue in the near future, meaning that macroeconomic and geopolitical issues could trigger price spikes.

The volume of BTC trading at major spot exchanges remains low this month compared to previous peak periods.

The correlation between cryptocurrencies and other assets is likely to end in the next 3-7 years. The price charts of the NASDAQ and BTC have been somewhat similar over the past 2 years.

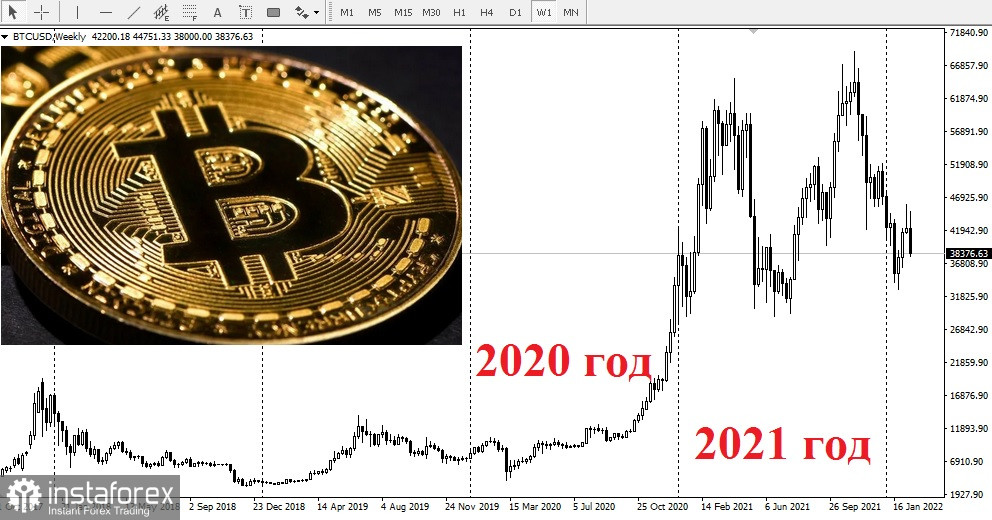

Here is the BTC price chart for the same period.

Here is the BTC price chart for the same period.

Bitcoin is only 13 years old and is still in its infancy. Investing into BTC is currently considered to be an investment into an emerging technology. Nevertheless, bitcoin is digital gold – an international savings asset.

Bitcoin is only 13 years old and is still in its infancy. Investing into BTC is currently considered to be an investment into an emerging technology. Nevertheless, bitcoin is digital gold – an international savings asset.

Amid the current high inflation, BTC is the definite anti-inflationary asset, independent from monetary policy by central banks and their fiat money. Its value is determined by its limited supply and demand and rising user base. Only 150-200 million people use bitcoin at the moment out of the world's population of 8 billion.