Gold prices have risen for three of five trading days last week, declining slightly only on Tuesday, February 15. The biggest gain was recorded on Thursday, February 17. Gold added nearly $30 for the first time since June 1, breaking the psychological level of $1,900 per ounce.

Will gold be able to hold that level? Everyone is curious about the outcome of negotiations over rising geopolitical tensions when US Secretary of State Anthony Blinken meets Russian Foreign Minister Sergey Lavrov this week.

The weekly gold review shows that the vast majority of market analysts and retail investors are optimistic about the precious metal in the near term. However, if tensions between the US and Russia ease, demand for safe-haven assets could decline.

Apart from geopolitics, fears for economic growth due to central banks' aggressive policy tightening are a big driver for gold's rise.

The Federal Reserve's four-decade revision of interest rates to fight high inflation have forced investors to abandon risky assets and use safe-haven assets such as gold.

This argument makes gold very attractive to investors who are fleeing risky stocks and cryptocurrencies.

Many commodities analysts believe a financial crisis is ahead as rising interest rates will add volatility to stock markets, forcing investors to reduce their risks.

With low interest rates bond yields do not provide the necessary protection.

Many investors express concern about the future of the economy in 12 to 24 months as Wall Street experts signal a recession.

According to chief investment strategist at Bank of America Michael Hartnett, "the rate shock turns into a recession shock" over the next six months.

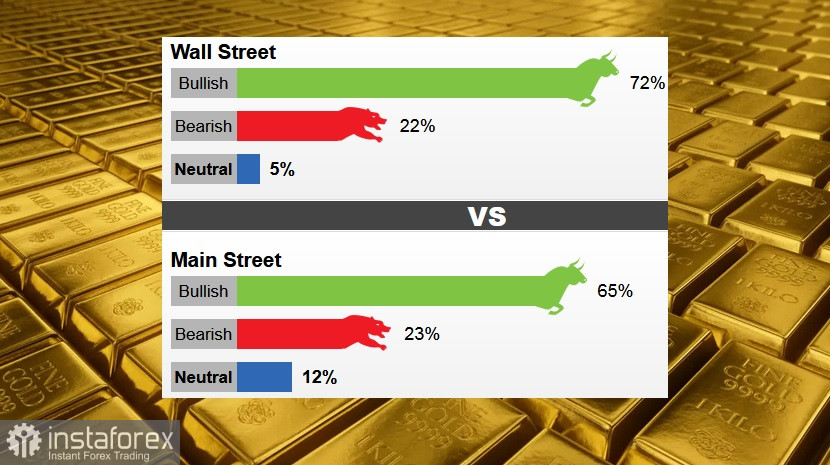

Last week, 18 Wall Street analysts participated in Kitco News' gold Survey. Among the participants, 13 analysts or 72%, expected gold prices to rise. Three analysts or 22%, voted for lower prices this week. Besides, only one analyst or 5% was neutral.

A total of 864 votes were cast in online MainStreet polls. Of these, 564 respondents or 65% looked for gold to rise this week. Another 196 voters or 23% said lower, while 104 voters or 12% were neutral.